Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

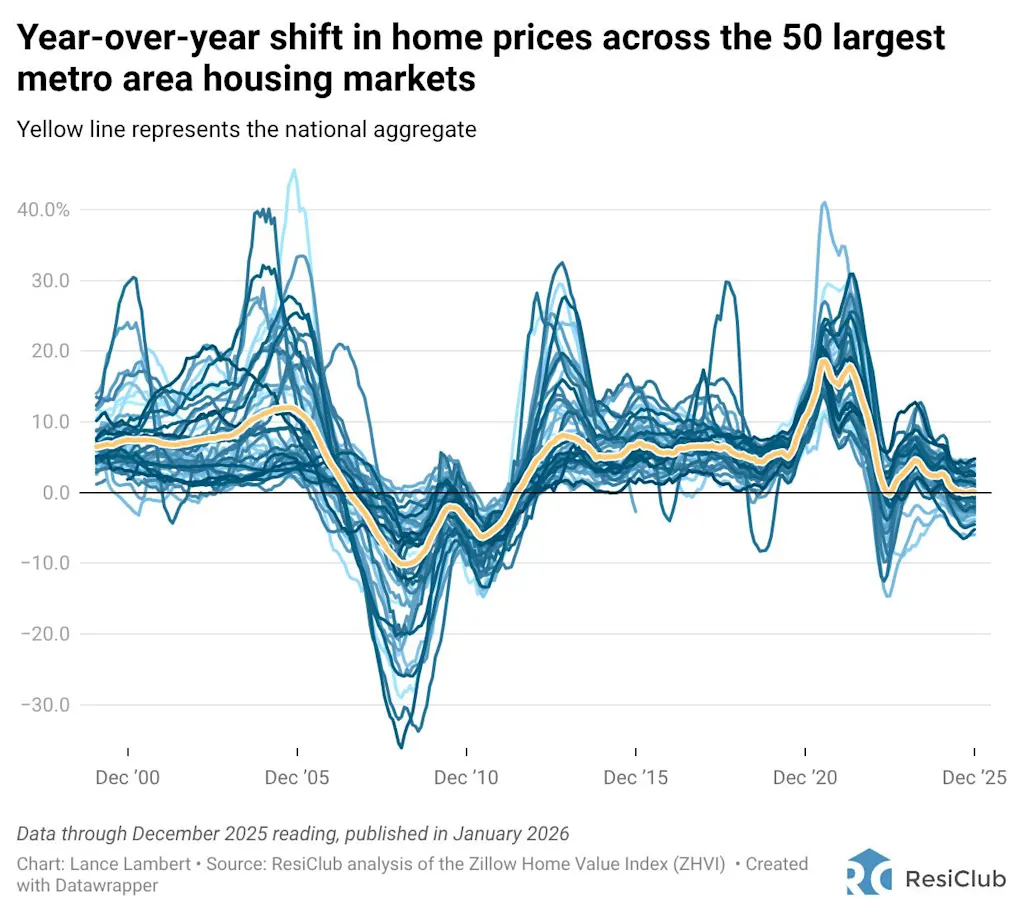

Primarily based on our evaluation of the Zillow House Worth Index, U.S. dwelling costs are up simply 0.1% 12 months over 12 months from December 2024 to December 2025. That marks a deceleration from the +2.6% progress charge a 12 months earlier—although nationwide worth progress has just lately stabilized, ticking barely increased from a low of -0.01% in August 2025.

Within the first half of 2025, the variety of main metro-area housing markets seeing year-over-year declines climbed. That rely has since just about stopped ticking up.

- 31 of the nation’s 300 largest housing markets (10% of markets) had a falling year-over-year studying within the January 2024 to January 2025 window.

- 42 of the nation’s 300 largest housing markets (14% of markets) had a falling year-over-year studying within the February 2024 to February 2025 window.

- 60 of the nation’s 300 largest housing markets (20% of markets) had a falling year-over-year studying within the March 2024 to March 2025 window.

- 80 of the nation’s 300 largest housing markets (27% of markets) had a falling year-over-year studying within the April 2024 to April 2025 window.

- 96 of the nation’s 300 largest housing markets (32% of markets) had a falling year-over-year studying within the Might 2024 to Might 2025 window.

- 110 of the nation’s 300 largest housing markets (36% of markets) had a falling year-over-year studying within the June 2024 to June 2025 window.

- 105 of the nation’s 300 largest housing markets (36% of markets) had a falling year-over-year studying within the July 2024 to July 2025 window.

- 109 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year studying within the August 2024 to August 2025 window.

- 105 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year studying within the September 2024 to September 2025 window.

- 105 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year studying within the October 2024 to October 2025 window.

- 98 of the nation’s 300 largest housing markets (33% of markets) had a falling year-over-year studying within the November 2024 to November 2025 window.

- 106 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year studying within the December 2024 to December 2025 window.

As you possibly can see above, within the first half of 2025, there was a notable improve within the variety of housing markets slipping into year-over-year worth declines as the supply-demand equilibrium (as measured by stock) shifted extra rapidly towards homebuyers. Over the previous seven months, nevertheless, the record of declining markets has begun to stabilize as stock progress has decelerated.

House costs are nonetheless climbing a bit of 12 months over 12 months in lots of areas where active inventory remains well below pre-pandemic 2019 levels, resembling pockets of the Northeast and Midwest. In distinction, some pockets in states like Texas, Florida, and Colorado—the place energetic stock exceeds pre-pandemic 2019 ranges by a stable clip—are seeing modest dwelling worth pullbacks or flat pricing.

Most of the housing markets seeing probably the most softness, the place homebuyers have gained probably the most leverage, are primarily positioned in Sunbelt areas, significantly the Gulf Coast and Mountain West.

Many of these areas saw even greater price surges during the Pandemic Housing Boom, with dwelling worth progress outpacing native revenue ranges. As pandemic-driven home migration slowed and mortgage charges rose in 2022, markets like Tampa and Austin confronted challenges, counting on native revenue ranges to help frothy dwelling costs.

That Sunbelt softening was additional compounded by an abundance of recent dwelling provide within the area. Builders are sometimes prepared to decrease costs or supply affordability incentives to keep up gross sales, which additionally has a cooling impact on the resale market. Consequently, some consumers who might need beforehand opted for current properties are as a substitute selecting new development with extra enticing offers—which added additional upward strain to resale stock progress over the previous few years.

window.addEventListener(“message”,operate(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.type.top=d}}});

After all, whereas 106 of the nation’s 300 largest metro-area housing markets are seeing year-over-year dwelling worth declines, one other 194 are seeing year-over-year dwelling worth will increase.

The place are dwelling costs nonetheless up on a year-over-year foundation? See the map under.

window.addEventListener(“message”,operate(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.type.top=d}}});

Under is a historic chart displaying the year-over-year change in dwelling costs throughout the 50 largest metro housing markets, with the yellow line representing the nationwide combination, courting again to 2000.