On this Monetary Samurai podcast episode, I communicate to Ben Miller, co-founder and CEO of Fundrise about his outlook for residential industrial actual property in 2025. Regardless of excessive mortgage charges, he is taken a optimistic view and he shares the principle explanation why.

Take heed to my dialog with Ben by click on the play button beneath or go to the episode on Apple or Spotify.

Causes To Be Optimistic On Residential Industrial Actual Property In 2025

In my put up, How I’d Invest $250,000 Today, I touched upon why I consider residential industrial actual property presents a compelling funding alternative in 2025. Nonetheless, with stubbornly excessive mortgage charges to start out the yr, some doubt has crept in.

Naturally, I used to be excited to listen to Ben’s optimistic perspective on the subject. Beneath is a abstract of the 4 key causes Ben is bullish on residential industrial actual property in 2025, as mentioned on the podcast.

You’ll discover some skepticism in my voice as I problem sure factors in his arguments. Since there are not any ensures when investing in threat belongings, it is at all times smart to uncover any potential blind spots.

1) Valuation Differential Between Shares and Actual Property Is Too Extensive

The S&P 500 is buying and selling at ~22x ahead earnings, nicely above its historic common ahead P/E of 17x. Traditionally, investing in shares at such elevated valuations has typically led to lackluster returns.

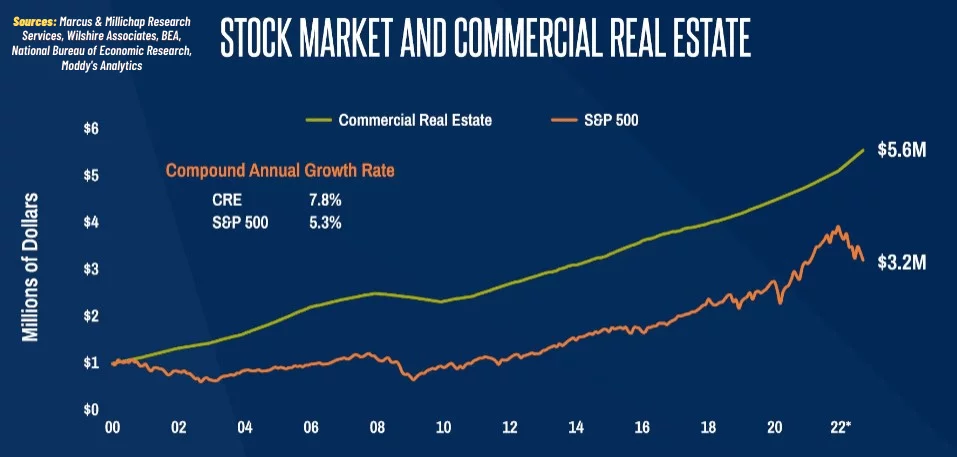

In the meantime, industrial actual property costs have declined by over 20% up to now two years, as shares surged by greater than 50%. This large valuation hole appears unsustainable, significantly if mortgage charges start to edge decrease.

Beneath is a chart that caught my consideration as a result of it highlights how condo values have declined to ranges much like these seen through the global financial crisis. Nonetheless, the financial system and family stability sheets are considerably stronger as we speak. This disconnect makes me optimistic about residential industrial actual property, as costs rebounded sharply following the worldwide monetary disaster.

Again in 2010, I vividly keep in mind wanting to start out a fund to purchase up all of the residential actual property in Vallejo, a metropolis 29 miles north of San Francisco that had declared chapter. Nonetheless, I lacked the funds and connections to make it occur. At this time, I can merely spend money on a residential industrial actual property fund and acquire publicity to properties at vital reductions.

2) Efficiency Correlation Is Out of Alignment

Shares and industrial actual property have traditionally been extremely correlated, as each replicate the broader financial system. From 2012 to 2022, their efficiency moved in tandem. A wholesome financial system advantages each asset courses.

Nonetheless, since 2022, this correlation has damaged down, creating a possibility for many who consider in imply reversion. Furthermore, in a possible recession, actual property may outperform shares as buyers shift towards a extra secure asset.

3) Future Undersupply of Housing

Elevated rates of interest since 2022 have considerably slowed new building, even in builder-friendly cities like Austin and Houston. Costar says that new housing begins in Houston are down 97%. This multi-year pause in growth is setting the stage for a housing undersupply.

Ben, along with his firm’s monumental portfolio of residential industrial actual property, believes the oversupply from the constructing increase by way of 2021 will probably be absorbed by the tip of 2025, if not by the center of 2025, sooner than many estimates. Because of this, he expects rents and residential industrial actual property costs to start rising once more by late 2025 and past. Their portfolio is already seeing lease progress return.

Within the interview, I additionally current my argument that the return to office will bolster industrial actual property in main cities like NYC, San Francisco, Boston, Seattle, and LA, the place constructing new developments is considerably more difficult. Nonetheless, Ben stays skeptical, citing developments in know-how as a counterpoint.

4) Low Danger Of Accelerating Inflation

There’s a widespread concern that Trump’s second term may convey vital inflation. Nonetheless, the financial system in 2015, 2016, and 2017 was a lot stronger than it’s as we speak. But, regardless of strong progress and eventual tax cuts after Trump took workplace on January 20, 2017, inflation remained comparatively low till the pandemic.

Moreover, Trump has pledged to fight inflation throughout his marketing campaign, suggesting it’s unlikely he would pursue insurance policies that might exacerbate it.

Demographics additionally level to a deflationary development over the long run. With America’s start price declining, slower inhabitants progress is more likely to exert downward strain on inflation.

Investing in Industrial Actual Property for the Lengthy Time period

As a worth investor, I’m at all times looking out for disconnects in historic efficiency and valuations. Many private finance lovers doubtless share this mindset, as we are usually extra frugal and cost-conscious.

In 2025, I’d choose to allocate extra new funding {dollars} to undervalued residential industrial actual property relatively than costly shares. After the S&P 500’s robust efficiency in 2023 and 2024, it’s onerous to think about the index delivering outsized returns once more in 2025.

To date, I’ve invested about $300,000 with Fundrise, a trusted associate and long-time sponsor of Monetary Samurai. With a low funding minimal of simply $10, dollar-cost averaging into industrial actual property has by no means been extra accessible.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Financial Samurai newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. All the pieces is written primarily based on firsthand expertise and experience.