Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Most of America’s largest homebuilders have publicly said that the height 2025 housing market noticed softer-than-expected circumstances, significantly in lots of elements of the Solar Belt.

This softer housing market surroundings precipitated unsold stock to tick up. Certainly, because the pandemic housing increase fizzled out, the number of unsold completed U.S. new single-family homes has been rising:

- August 2016 —> 61,000

- August 2017 —> 63,000

- August 2018 —> 69,000

- August 2019 —> 79,000

- August 2020 —> 52,000

- August 2021 —> 34,000

- August 2022 —> 45,000

- August 2023 —> 72,000

- August 2024 —> 105,000

- August 2025 —> 124,000

The August determine (124,000 unsold accomplished new properties) printed final week is the best degree since July 2009 (126,000).

Let’s take a more in-depth have a look at the information to higher perceive what this might imply.

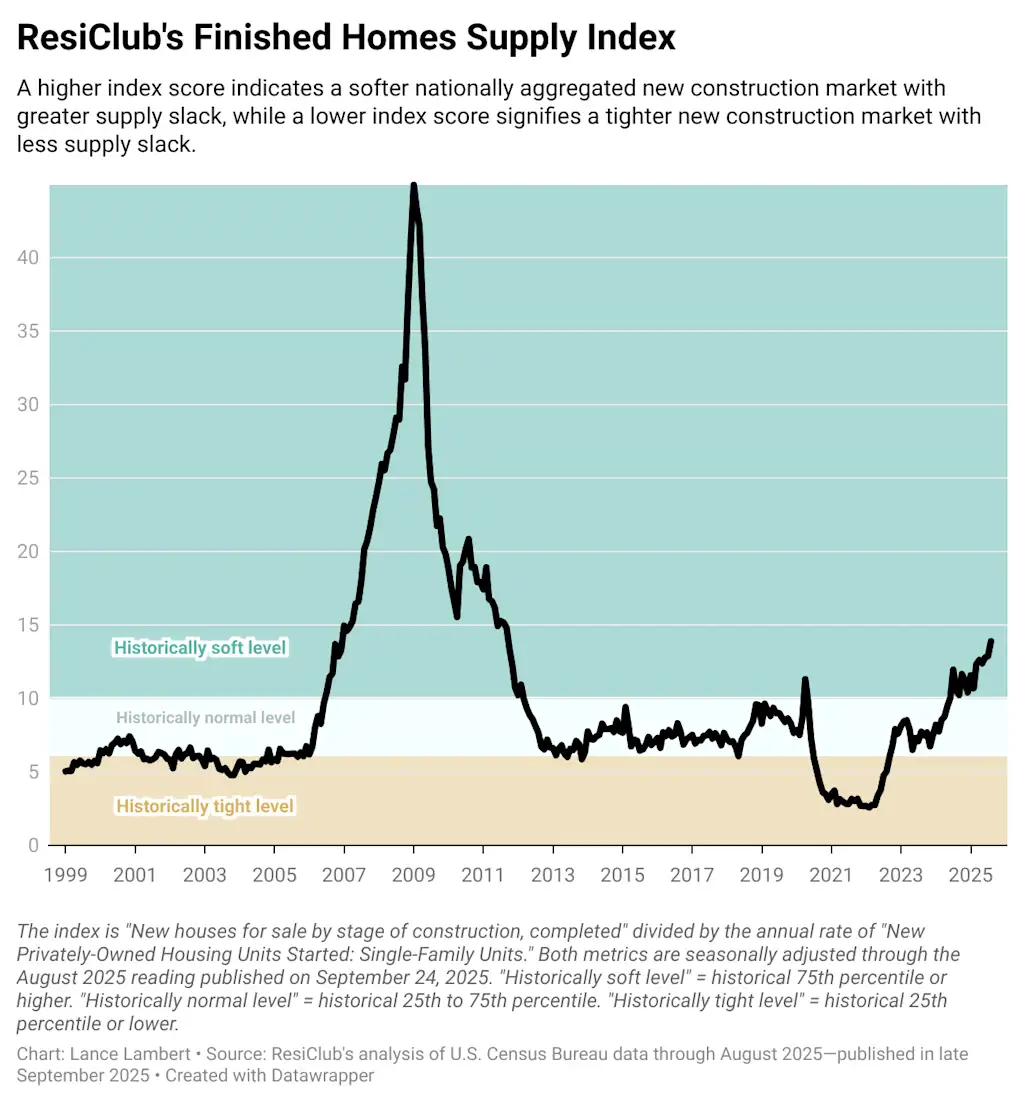

To place the variety of unsold accomplished new single-family properties into historic context, we’ve ResiClub’s Completed Properties Provide Index.

The index is one easy calculation: the variety of unsold accomplished U.S. new single-family properties divided by the annualized charge of U.S. single-family housing begins. The next index rating signifies a softer nationwide new-construction market with higher provide slack, whereas a decrease index rating signifies a tighter new-construction market with much less provide slack.

For those who have a look at unsold accomplished single-family new builds as a share of single-family housing begins (see chart under), it nonetheless exhibits we’ve gained slack (and have extra now than in pre-pandemic 2019); nonetheless, this slack, nationally talking, isn’t something near the 2007-2008 weakening.

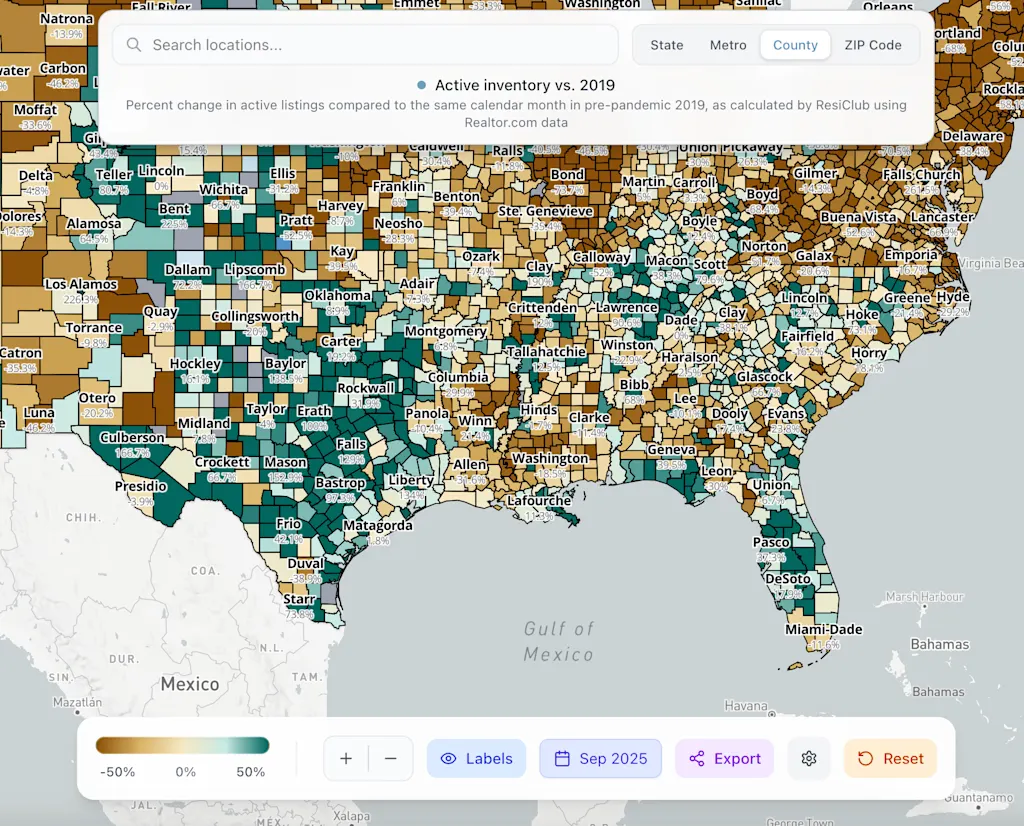

Whereas the U.S. Census Bureau doesn’t give us an excellent market-by-market breakdown on these unsold new builds, we’ve a good suggestion the place they’re, based mostly on whole lively stock properties on the market (together with present). A lot of it’s probably within the Mountain West and Solar Belt, significantly across the Gulf space.

Certainly, some builders are experiencing pricing stress, significantly in pockets of Florida and Texas, the place resale stock is properly above pre-pandemic 2019 ranges. See the screenshot from the ResiClub Terminal under.

To supply bigger incentives and transfer a few of these properties, many major homebuilders in the Sun Belt are compressing their margins.

Whereas homebuilder margins have compressed from the highs of the pandemic housing increase, some look alright in contrast with pre-pandemic 2019 ranges. Nevertheless, if resale stock and unsold accomplished new-build stock proceed to rise subsequent 12 months—and additional margin compression turns into needed—we may attain a degree the place each single-family allow exercise and housing begins exercise pull again extra. We’ll preserve a detailed eye on it.

Huge image: There’s higher slack within the new development market now than just a few years in the past, giving consumers and traders some leverage in sure markets to barter higher offers with homebuilders.