Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

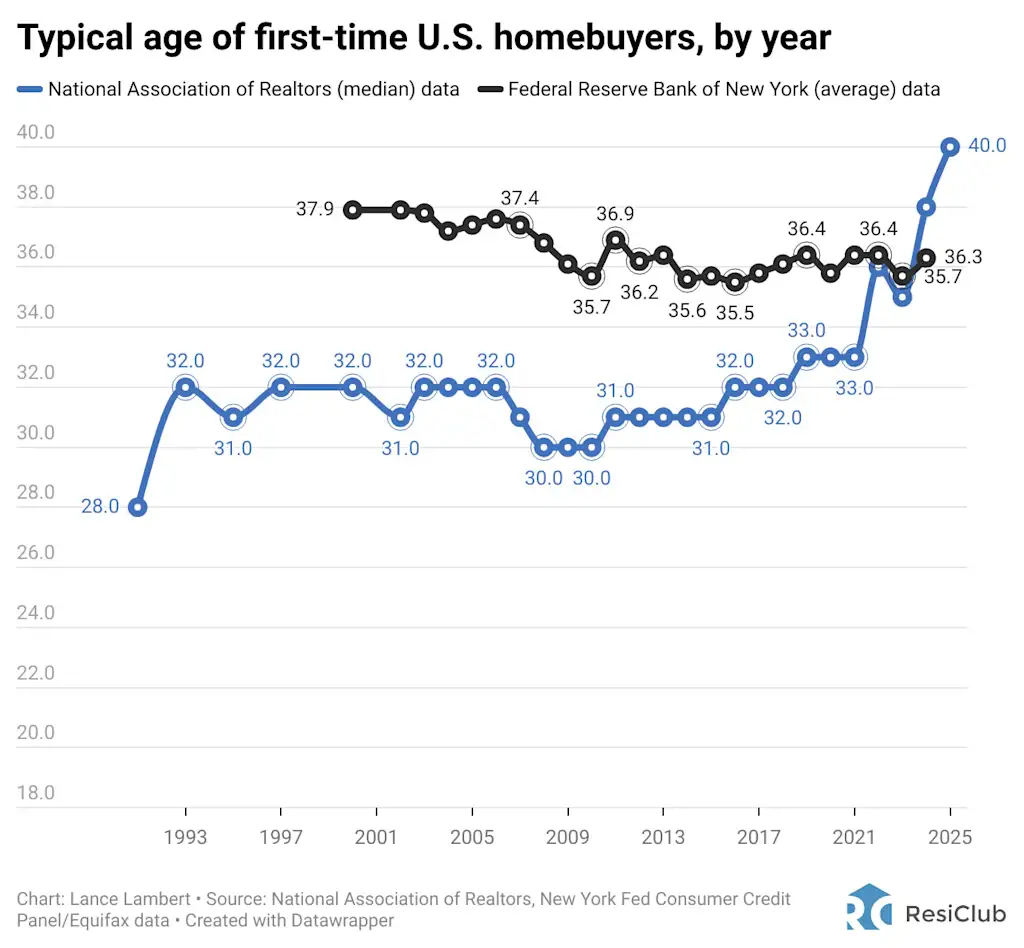

Earlier this month, the National Association of Realtors (NAR) released its annual survey, which discovered that the median age of first-time U.S. homebuyers in 2025 climbed to 40. That’s up from 38 in 2024—and much above the median age in 1992, when it was 28.

At first look, it seems that deteriorating housing affordability—pushed by the Pandemic Housing Growth and the 2022 mortgage-rate shock—has pushed the age of first-time consumers greater. Nevertheless, whenever you look throughout different information sources, together with the Federal Reserve Bank of New York and the U.S. Census Bureau, you don’t see the identical spike.

ResiClub dug deeper into the information to determine what’s actually occurring.

In accordance with the Federal Reserve Financial institution of New York, the typical first-time homebuyer in 2024 was 36.3 years previous—just a bit youthful than NAR’s estimate of the median first-time homebuyer age of 38 in 2024.

Initially, one would possibly suspect the distinction merely stems from the truth that the New York Fed reviews an “common” whereas NAR reviews a “median.” Nevertheless, whenever you peel again the onion, you’ll see there’s a big historic divergence between the 2 organizations’ figures.

That raises the query: How did they every accumulate their information?

The NAR information collection is calculated by an annual survey. For this yr’s survey, NAR mailed out a 120-question survey to 173,250 current homebuyers. The current homebuyers needed to have bought a main residence dwelling between July 2024 and June 2025. In whole, 6,103 responses had been obtained this yr.

The New York Fed doesn’t accumulate its information by survey. As a substitute, it’s taking a look at credit score report information, which it says has “5% of nationally consultant people since 1999.”

Again in August, ResiClub emailed each NAR and the New York Fed to get their ideas on the first-time homebuyer information divergence.

Jessica Lautz, NAR’s deputy chief economist, advised ResiClub on August 14:

“The Federal Reserve is basing their information on credit score information. The Profile of Dwelling Patrons and Sellers [from NAR] is predicated on a survey of those that bought a main residence dwelling within the final yr. Thus, the NAR survey contains the 9% of first-time consumers who paid money for his or her dwelling and didn’t finance their buy. Excluded are first-time consumers who bought a trip dwelling or mom-and-pop rental as their first buy. A development which has popularized as younger adults are unable to attain homeownership within the costly areas they might stay in. The NAR information assortment is mid 2023 to mid 2024 vs. a calendar yr. Lastly, NAR makes use of medians as a measure of central tendency vs. common.”

Donghoon Lee, an financial analysis adviser in microeconomics on the Federal Reserve Financial institution of New York, advised ResiClub on August 13:

“We will’t let you know how the NAR annual survey was constructed, however in our earlier weblog, we wrote a couple of comparability between our information and NAR supply.

Listed here are among the unsophisticated variations.

- New York Fed Client Credit score Panel is a panel of credit score report information the place we observe 5% of nationally consultant people since 1999, and isn’t a survey. We are not subject to any low response charge difficulty of the respondents.

- We establish first-time homebuyers when a mortgage account seems for the primary time on the person’s credit score reviews. If a house buy was made with no mortgage (equivalent to a money buy) then we don’t see them, and never included in calculating the statistics.”

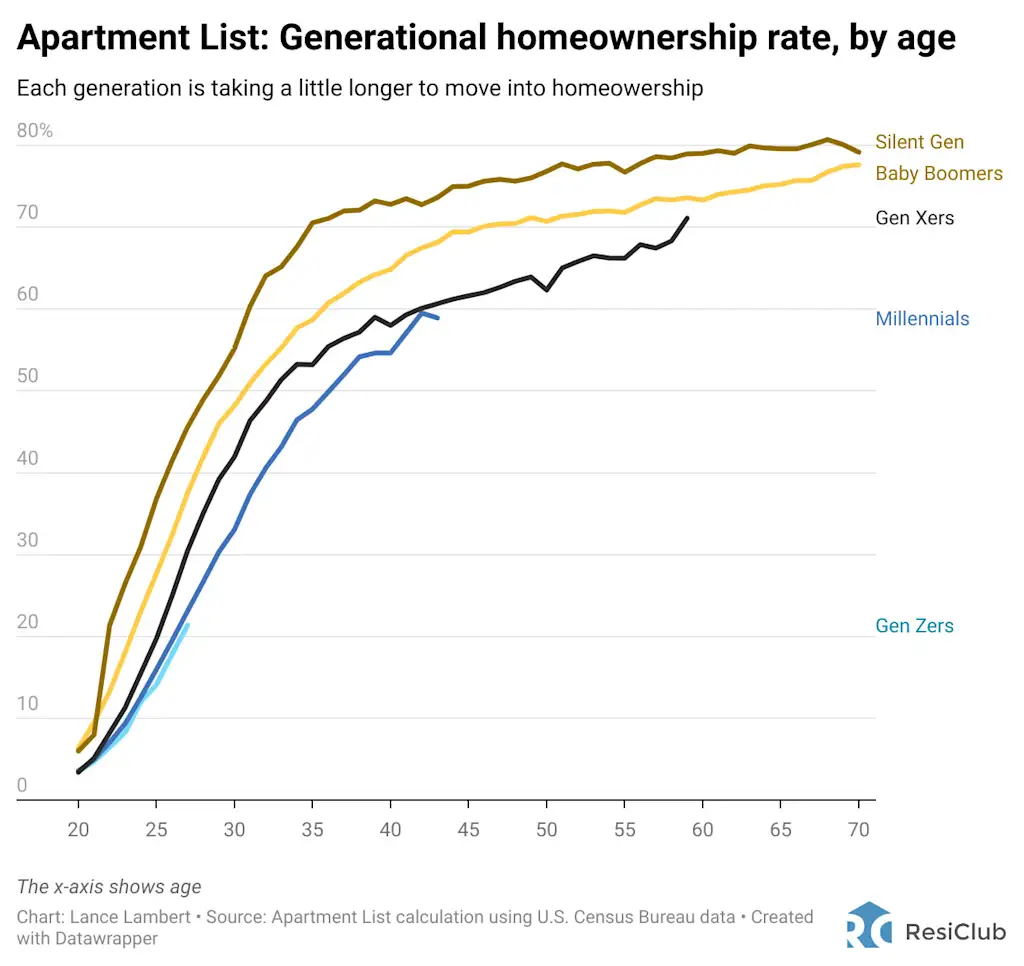

My takeaway? I’m going to take this specific first-time homebuyer information—particularly the NAR collection—with a grain of salt going ahead. As a substitute, I’ll lean extra on generational homeownership charges by age. And whenever you have a look at these figures, they clearly verify that youthful generations are coming into homeownership extra slowly than their older friends.

ResiClub additionally messaged Apartment List to get its latest calculation. See beneath:

Condominium Record’s evaluation exhibits that with every successive technology, homeownership charges take longer to ramp up. This sample isn’t distinctive to Gen Z—child boomers had been slower to succeed in key homeownership milestones than the Silent Era, Gen X was slower than the boomers, millennials had been slower than Gen X, and Gen Z is slower nonetheless.

The truth that every technology takes a little bit longer to enter homeownership—throughout each intervals of “good” and “poor” housing affordability—suggests an underlying secular shift that isn’t simply pushed by affordability. For my part, that secular shift largely comes right down to life-style/cultural shifts.

With every new technology, Individuals are spending extra years in class, marrying later, having youngsters later (and having fewer youngsters), and in the end shopping for houses later. I name this phenomenon “life-style delays.”

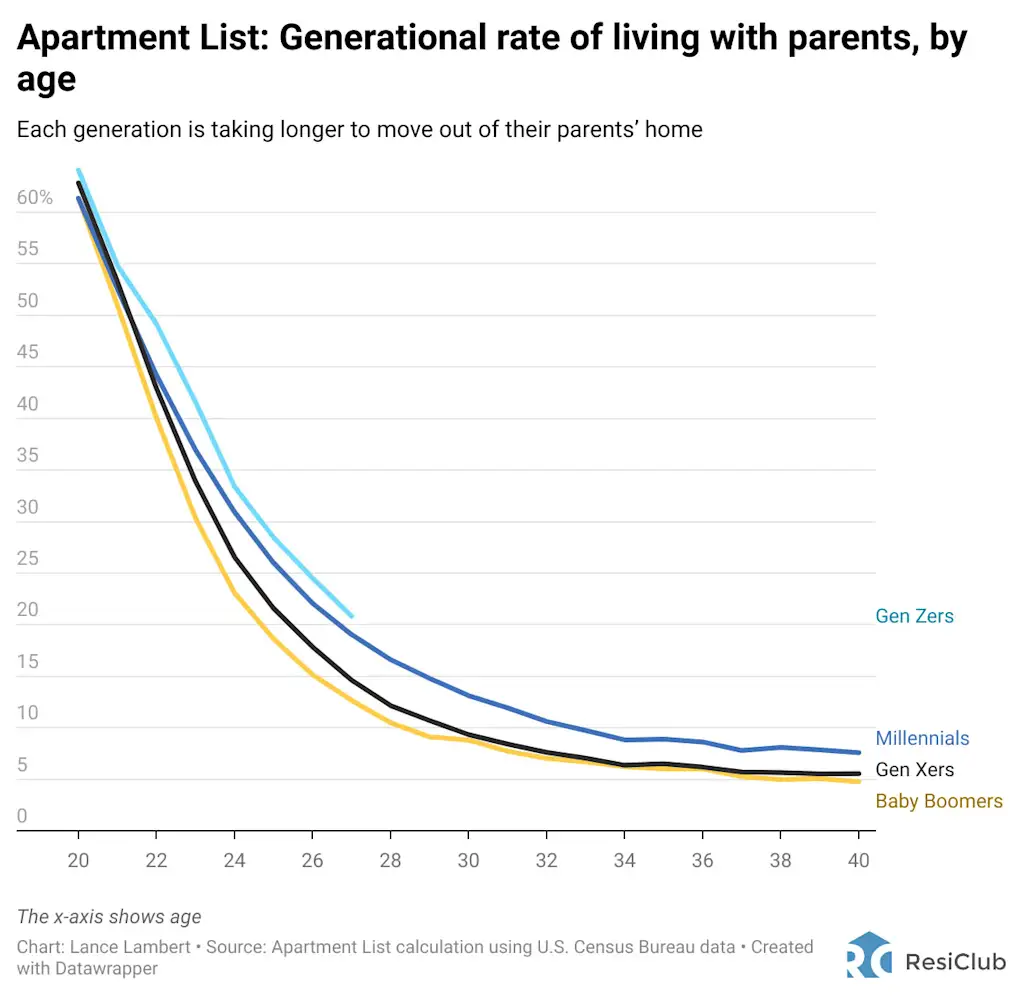

Given how homeownership charges are calculated (the variety of owner-occupied housing items divided by the whole variety of occupied housing items), it’s seemingly that the gradual slowdown in homeownership by technology is definitely understating the true drop-off.

In plain English, what do I imply? If somebody of their twenties or thirties continues to be residing with their mother and father, they technically aren’t counted as their very own family and due to this fact aren’t included within the denominator. And whenever you look intently on the generational information (see the Condominium Record evaluation above), you’ll notice that with every technology, Individuals are taking longer to maneuver out of their mother and father’ houses.

When you modify for this, the “actual” homeownership charges by technology—one thing John Burns Research and Consulting has analyzed—you discover that the generational homeownership drop-off is certainly bigger than the headline information suggests.