Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

There’s little doubt about it: Housing market softening throughout the Sunbelt—the epicenter of U.S. homebuilding—has brought on homebuilders to lose pricing energy over the previous 12 months.

Amid the extra margin compression, some large homebuilders are adjusting their methods. Lennar is finally easing up a little on its market share, taking volume-over-margin strategy, whereas KB Dwelling—a homebuilder ranked No. 526 on the Fortune 1000—mentioned on December 18 that it plans to lean even tougher into built-to-order (extra on that beneath).

On the finish of final week, KB Home posted its This autumn 2025 earnings—the three months ending November 30. Throughout its earnings name, it underscored simply how difficult the present housing market stays, even for builders which have averted essentially the most aggressive incentive wars and speculative stock methods.

In immediately’s article, ResiClub highlights seven key takeaways from KB Dwelling’s newest earnings.

1. KB Dwelling’s margins compress to the bottom This autumn degree since 2016

In the course of the Pandemic Housing Growth, many publicly traded homebuilders achieved report revenue margins as dwelling costs soared and purchaser demand ran red-hot. Ever because the nationwide housing demand growth fizzled out in the summertime of 2022, many giant homebuilders have diminished margin and made affordability/pricing changes the place and when wanted to take care of their gross sales tempo or stop an even bigger gross sales pullback.

That features KB Dwelling, which reported a housing gross revenue margin of 17% in This autumn 2025—down from a This autumn cycle peak of 24.1% in This autumn 2021. Its margin has now compressed to its lowest This autumn degree since This autumn 2016.

As KB Dwelling CFO Robert Dillard mentioned on the corporate’s December 18, 2025 earnings name:

“Housing gross revenue margin was 17%, and adjusted housing gross revenue margin, which excluded $13.7 million of inventory-related costs, was 17.8%. Adjusted housing gross revenue margin was 310 foundation factors decrease resulting from pricing strain, damaging working leverage, larger relative land prices, regional combine, and product combine, which was pronounced because of the age and value of incremental quantity versus steerage.”

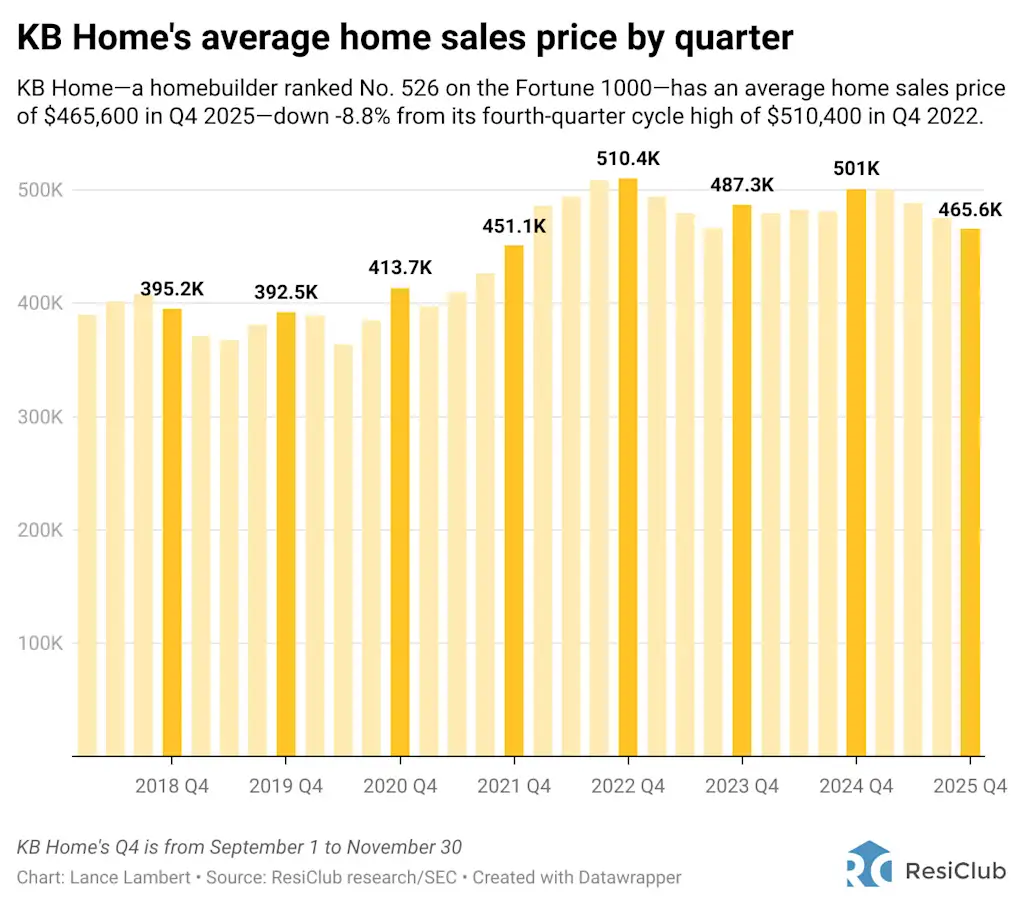

2. KB Dwelling’s common promoting value is down 8.8% from its 2022 peak

In contrast to many big homebuilders akin to Lennar—which has most popular to tug the mortgage fee buydown lever when making affordability changes this cycle—KB Dwelling has chosen to rely extra on outright value cuts. [Back in summer 2023, KB Home CEO Jeffrey Mezger told me that these price cuts would be their strategy if any of their regional housing markets weakened further.]

In This autumn 2025, KB Dwelling’s common promoting value ($465,600) was 7.1% beneath This autumn 2024 ($501,000) and eight.8% beneath its cycle peak in This autumn 2022 ($510,400). Whereas a part of this decline is because of combine shift, KB Dwelling has beforehand acknowledged reducing dwelling costs over the previous 18 months in markets akin to Austin and San Antonio, as well as in Orlando and Jacksonville, Florida.

“Common promoting value declined 7% to $466,000 resulting from regional and product combine and common market situations,” Dillard mentioned on the earnings name.

3. KB Dwelling’s margin protection plan: leaning tougher into Constructed-to-Order

KB House is making no secret of its purpose: Improve built-to-order deliveries as a share of enterprise to 70% or extra of complete quantity, up from 57% in This autumn 2025.

The reason being easy—built-to-order margins are materially larger for KB Dwelling. Constructed-to-order properties are inclined to generate larger margins as a result of they’re offered earlier than development begins, lowering stock carrying prices. Consumers additionally have a tendency to pick out higher-margin upgrades and choices, which lifts gross revenue per dwelling.

KB Dwelling COO Robert McGibney mentioned on the corporate’s December 18 earnings name:

“Whereas we at all times have some stock properties accessible for these consumers that want a faster move-in date, the superior margins we generate on built-to-order properties will enable us to appreciate larger worth from our communities. Our gross margins on built-to-order properties are trending 3 share factors to five share factors larger than on stock gross sales, and we started to see a shift towards extra built-to-order gross sales throughout November, an encouraging pattern that has continued into December. As we stay targeted on promoting our built-to-order properties and these gross sales change into deliveries over the course of fiscal 2026, we count on to attain a positive trajectory in our gross margins.

“We’re very targeted on getting again to a minimum of a 70/30 [built-to-order] ratio, and we see an amazing alternative to drive that change with the brand new communities coming within the spring.”

KB Dwelling executives imagine that by leaning extra into built-to-order, it’ll assist see their margins backside in Q1 2026.

KB Dwelling CEO Jeffrey Mezger mentioned on the earnings name:

“We’ve already shared that the primary quarter margins are the low-water mark, and we count on enchancment quarter-over-quarter because the 12 months progresses from there. And it’s a mixture of higher leverage as we develop income again and higher margins as our neighborhood combine rotates round.”

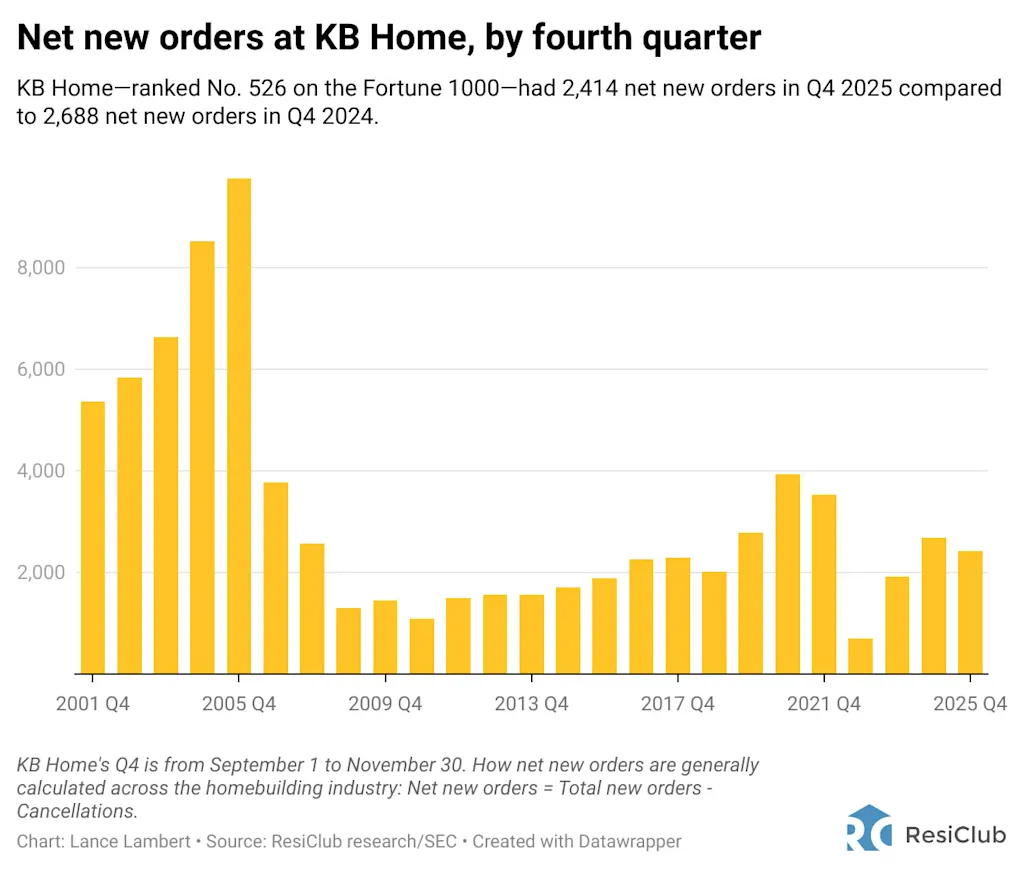

4. KB Dwelling’s dwelling gross sales are down 10% 12 months over 12 months

KB Dwelling’s internet new orders by This autumn 👇

- This autumn 2018 —> 2,013

- This autumn 2019 —> 2,777

- This autumn 2020 —> 3,937

- This autumn 2021 —> 3,529

- This autumn 2022 —> 692 (mortgage fee shock—pause earlier than pricing recalibration/easing backlog)

- This autumn 2023 —> 1,909

- This autumn 2024 —> 2,688

- This autumn 2025 —> 2,414

“We had been disciplined in not taking overly aggressive steps to seize gross sales through the seasonally slower fourth quarter,” Mezger mentioned on the earnings name. “By doing so, we imagine we’re positioned to attain higher margins on these gross sales in our 2026 first quarter than we might in any other case have produced.”

5. KB Dwelling’s margin compression could be larger proper now if not for modest declines in development and materials prices this 12 months

“This margin strain was once more partially offset by decrease direct development prices per unit,” Dillard mentioned on the earnings name. “It’s notable that common prices per unit declined within the quarter as direct development prices and materials prices declined greater than lot prices elevated.”

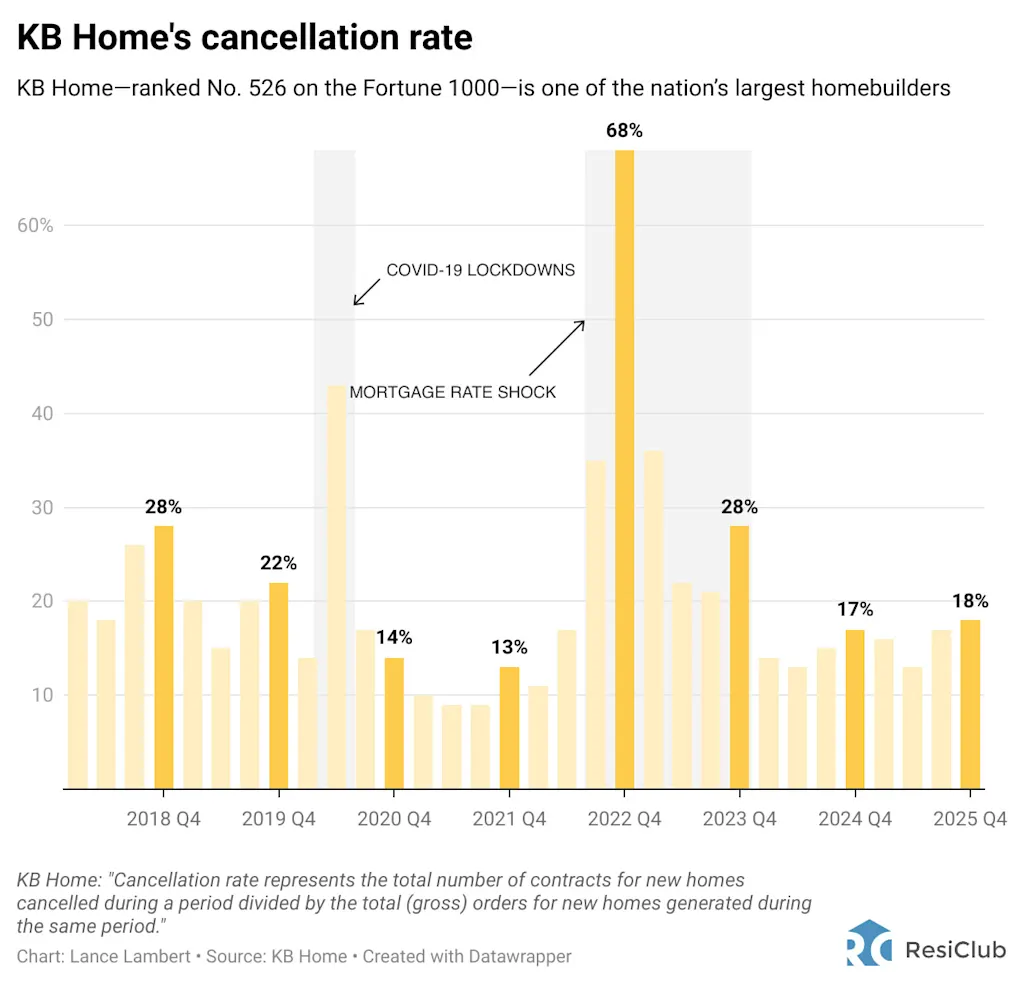

6. KB Dwelling’s cancellation fee stays secure

7. Quicker construct instances

KB Dwelling has diminished construct instances by roughly 20% 12 months over 12 months, hitting its company-wide goal of 120 days or higher for built-to-order properties. Some divisions are actually averaging underneath 100 days.

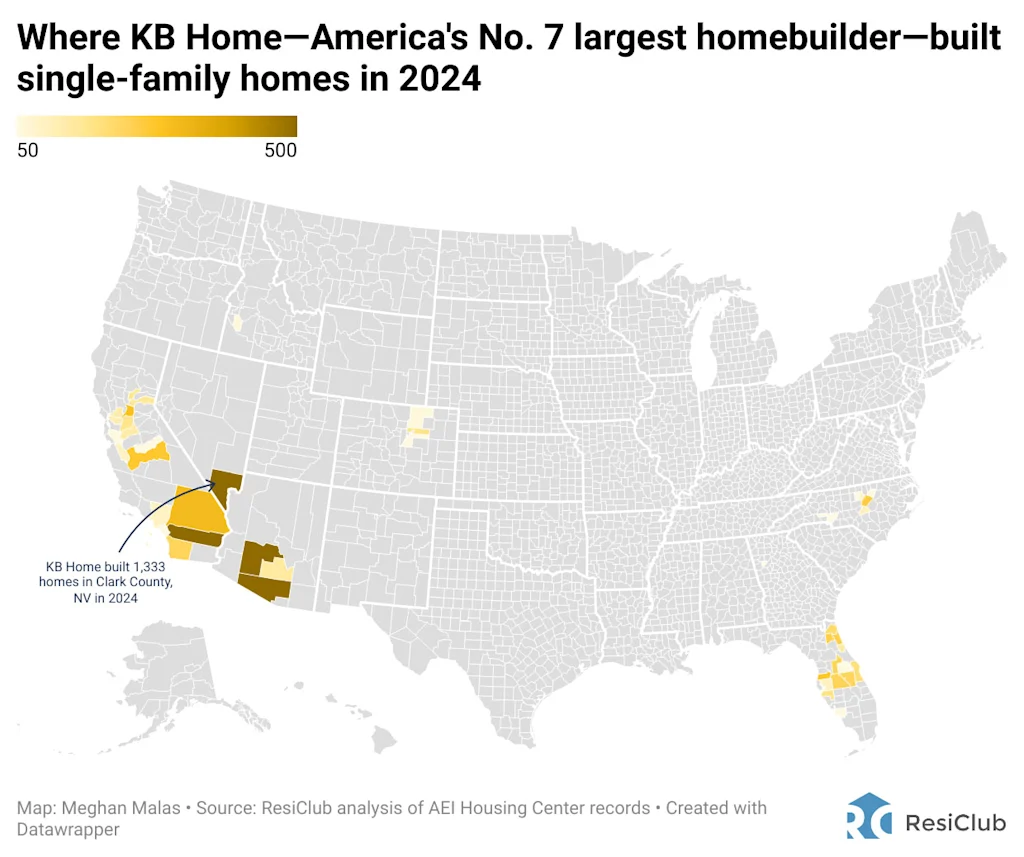

The place does KB Dwelling really construct?

Pulling information from the ResiClub Terminal—the place we hold footprint information for America’s 21 largest homebuilders—we made the map beneath.