Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

When assessing residence worth momentum, ResiClub believes it’s vital to observe energetic listings and months of provide. If energetic listings begin to quickly improve as properties stay in the marketplace for longer intervals, it might point out pricing softness or weak point. Conversely, a speedy decline in energetic listings past seasonality might counsel a market that’s heating up.

For the reason that nationwide pandemic housing increase fizzled out in 2022, the nationwide energy dynamic has slowly been shifting directionally from sellers to patrons. After all, throughout the nation, that shift has diverse.

Typically talking, native housing markets the place energetic stock has jumped above pre-pandemic 2019 ranges have experienced softer home price growth (or outright worth declines) over the previous 36 months.

Conversely, native housing markets the place energetic stock stays far under pre-pandemic 2019 ranges have, typically talking, skilled, comparatively talking, extra resilient residence worth progress over the previous 42 months.

The place is nationwide energetic stock headed?

Nationwide energetic listings are on the rise on a year-over-year foundation (+10% between January 31, 2025, and January 31, 2026). This means that homebuyers have gained some leverage in lots of elements of the nation over the previous 12 months. Some vendor’s markets have was balanced markets, and extra balanced markets have was purchaser’s markets.

Nationally, we’re nonetheless under pre-pandemic 2019 stock ranges (-17.8% under January 2019), and a few resale markets (specifically, chunks of the Midwest and Northeast) nonetheless stay, comparatively talking, tight-ish.

Whereas nationwide energetic stock continues to be up 12 months over 12 months, the tempo of progress has slowed in latest months as softening has slowed.

Listed here are the January stock/energetic listings totals, in keeping with Realtor.com:

- January 2017 -> 1,154,120 📉

- January 2018 -> 1,043,951 📉

- January 2019 -> 1,110,636 📈

- January 2020 -> 951,675 📉

- January 2021 -> 531,775 📉 (Pandemic housing increase overheating)

- January 2022 -> 376,970 📉 (Pandemic housing increase overheating)

- January 2023 -> 616,865 📈

- January 2024 -> 665,569 📈

- January 2025 -> 829,376 📈

- January 2026 -> 912,696 📈

If we preserve the present year-over-year tempo of stock progress (+83,320 properties on the market), we’d have 996,016 energetic stock come January 2027. (Observe: That’s not a prediction—I’m simply exhibiting what the maths seems to be like if that tempo continued.)

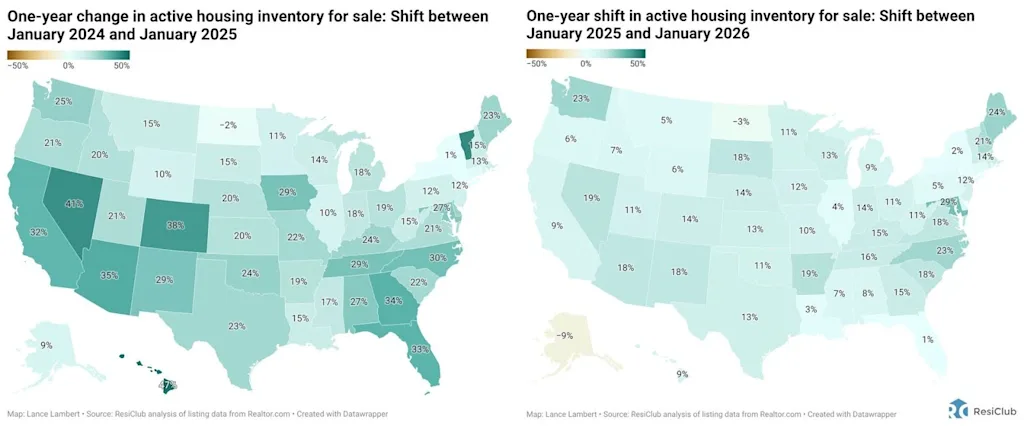

Beneath is the year-over-year energetic stock share change by state.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});

Whereas energetic housing stock is rising in most markets on a year-over-year foundation, the tempo of progress continues to decelerate throughout a lot of the nation.

LEFT: Year-over-year active inventory shift between January 2024 and January 2025

RIGHT: Year-over-year active inventory shift between January 2025 and January 2026

And whereas energetic housing stock is rising in most markets on a year-over-year foundation, some markets nonetheless stay tight-ish (though it’s loosening in these locations, too).

As ResiClub has been documenting, each energetic resale and new properties on the market stay probably the most restricted throughout big swaths of the Midwest and Northeast. That’s the place residence sellers within the spring are doubtless, comparatively talking, to have extra energy than their friends in lots of Southern markets.

In distinction, energetic housing stock on the market has neared or surpassed pre-pandemic 2019 ranges in lots of elements of the Solar Belt and Mountain West, together with metro-area housing markets akin to Austin and Punta Gorda, Florida.

Many of those areas noticed main worth surges throughout the pandemic housing increase, with residence costs getting stretched in comparison with native incomes. As pandemic-driven home migration slowed and mortgage charges rose, markets like Punta Gorda and Austin confronted challenges, counting on native earnings ranges to help frothy residence costs.

This softening pattern was accelerated additional by an abundance of recent residence provide within the Solar Belt. Builders are sometimes prepared to decrease costs or provide affordability incentives (if they’ve the margins to take action) to take care of gross sales in a shifted market, which additionally has a cooling impact on the resale market: Some patrons, who would have beforehand thought of current properties, are actually choosing new properties with extra favorable offers—which then places some extra upward strain on resale stock.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});

On the finish of January 2026, 9 states had been above pre-pandemic 2019 energetic stock ranges: Arizona, Colorado, Florida, Idaho, Nebraska, Tennessee, Texas, Utah, and Washington. (The District of Columbia—which we disregarded of this desk under—can be again above pre-pandemic 2019 energetic stock ranges. Softness in D.C. proper predates the present admin’s job cuts.)

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});

Massive image: Over the previous few years, we’ve noticed a softening throughout many housing markets as strained affordability tempers the fervor of a market that was unsustainably sizzling throughout the pandemic housing increase. Whereas home prices are falling some in pockets of the Sun Belt, a giant chunk of Northeast and Midwest markets nonetheless eked out a little bit worth appreciation in 2025. 12 months over 12 months, nationally aggregated residence costs had been fairly near flat.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});

Beneath is one other model of the desk above—however this one consists of each month since January 2017.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});

In the event you’d prefer to additional look at the month-to-month state stock figures, use the interactive under.

Over the approaching months, let’s control Florida, which has now entered its seasonal window when its energetic stock sometimes begins to rise once more. (To higher perceive softness and weak point throughout Florida over the previous couple years, read this ResiClub PRO report.)

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}});