Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Financial forecasting has by no means been straightforward, and it turns into much more difficult within the face of unprecedented occasions like COVID-19 lockdowns and extraordinary ranges of fiscal and financial intervention. This was adopted by a speedy cycle of rate of interest hikes, including additional complexity. Look no additional than the truth that for 3 consecutive years (2022, 2023, and 2024) financial forecasts at massive considerably underestimated mortgage charges.

Just lately, nevertheless, forecasters have fared higher. Among the 17 mortgage rate forecasts rounded up by ResiClub heading into 2025, the common prediction was that 30-year mounted mortgage charges would common 6.33% in This autumn 2025. On the time we revealed that roundup, the common 30-year mounted mortgage price was sitting at 7.03%. What occurred? The 30-year mounted mortgage price ended up averaging 6.23% in This autumn 2025.

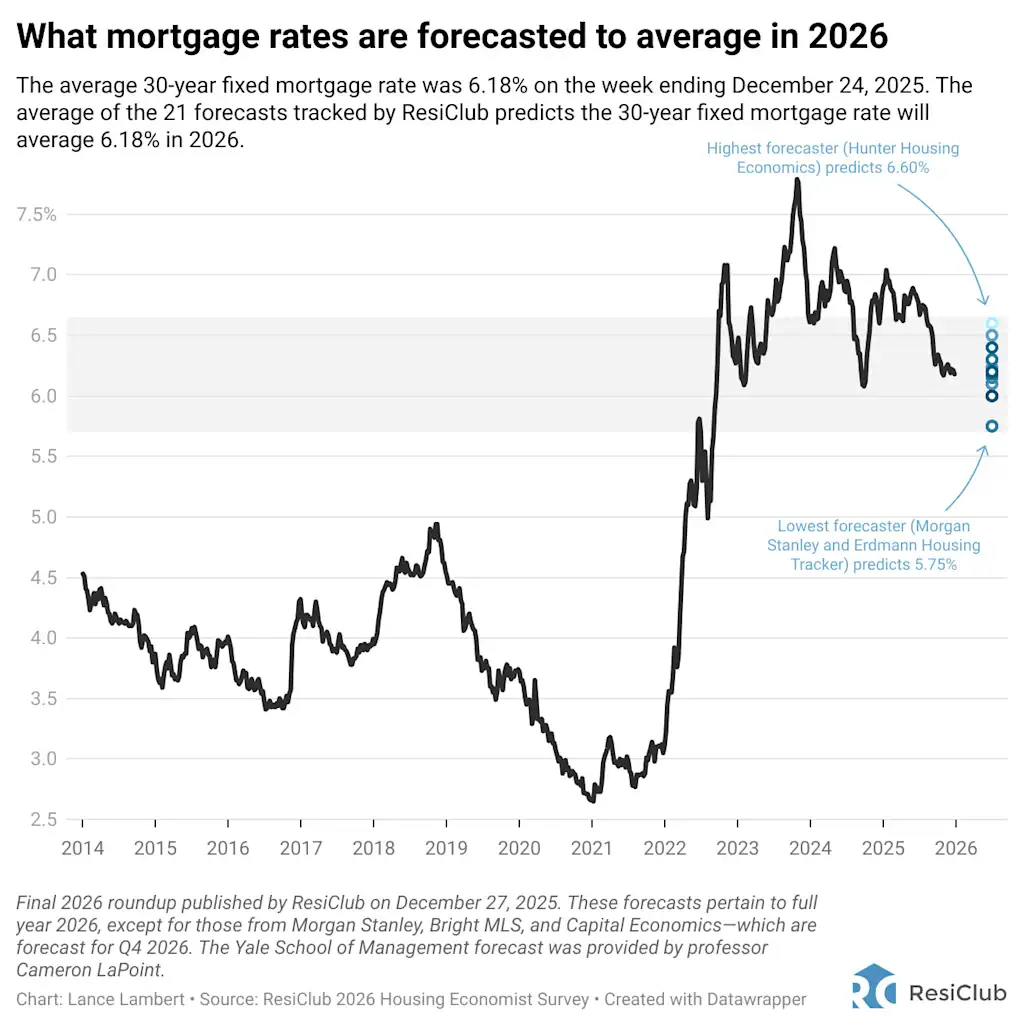

For our 2026 mortgage price roundup, ResiClub collected 21 mortgage price forecasts. Some had been publicly accessible, although most had been gathered via the ResiClub 2026 Housing Economist Survey, which we fielded in December 2025. Quite than asking solely about This autumn, we requested respondents to supply their forecast for the complete 2026 calendar 12 months.

Whereas ResiClub approaches price forecasts with a wholesome dose of skepticism—for instance, if the labor market had been to unexpectedly weaken, charges may drop greater than anticipated—there’s nonetheless worth in understanding the place financial fashions predict mortgage charges will head.

Beneath are 21 mortgage price forecasts (sorted from highest to lowest).

Hunter Housing Economics: The analysis agency predicts that the 30-year mounted mortgage price will common 6.6% in 2026. Housing economist Brad Hunter informed ResiClub: “The upcoming change in management on the Fed may result in simpler financial coverage, which may result in decrease mortgage charges, however this isn’t clear. The extent of the decline and mortgage charges will depend on elements like bond market inflation expectations and the price range deficit in addition to the speed of GDP development.”

Capital Economics: Economists on the unbiased financial analysis enterprise based mostly in London forecasts that the 30-year mounted U.S. mortgage price will common 6.5% in This autumn 2026.

Mortgage Bankers Affiliation: The newest forecast revealed by the commerce group has the 30-year mounted mortgage averaging 6.4% in 2026.

PNC Financial institution: Economists on the American financial institution forecasts that the 30-year mounted mortgage price will common 6.4% in 2026 and 6.4% in 2027.

Compass: Mike Simonsen, the chief economist of Compass, forecasts a mean 30-year mounted mortgage price of 6.30% in 2026.

Realtor.com: Economists at the true property itemizing web site forecast that the 30-year mounted mortgage price will common 6.30% in 2026, together with 6.3% in This autumn, writing: “The mortgage price lock-in impact—brought on by market charges which are nicely above the charges on present mortgages—has left many owners with a powerful purpose to remain put. In reality, latest information confirmed that 4 out of each 5 householders with a mortgage has a price under 6%. The share has waned regularly, a development that can proceed in 2026. Consequently, turnover can be restricted with strikes more likely to be spurred by life requirements comparable to job or household adjustments.”

Redfin: Economists on the residential actual property brokerage are predicting a mean 30-year mounted mortgage price of 6.3% in 2026, writing: “A weaker labor market will lead the Fed to chop rates of interest in 2026 and convey financial coverage to a extra impartial place, which ought to maintain mortgage charges within the low-6% vary. However lingering inflation danger and the chance that we’ll keep away from a recession will maintain the Fed from reducing greater than the markets have already priced in. That’s why charges could dip under 6% often, however not for any significant interval. The Fed will change management in 2026, however that can be unlikely to convey considerably decrease mortgage charges, as long run charges–like mortgage charges–are set by bond markets.”

Windermere Actual Property: The economics crew at Windermere Actual Property forecasts the 30-year mounted mortgage price will common 6.25% in 2026.

Moody’s: The forecast by Moody’s chief economist Mark Zandi has the 30-year mounted mortgage price averaging 6.23% in 2026—and 6.22% in This autumn.

Cotality: Economists at the true property analytics big are predicting a mean 30-year mounted mortgage price of 6.2% in 2026. Selma Hepp, Cotality chief economist, tells ResiClub: “The 2026 outlook factors towards a return to extra typical market circumstances, with mortgage charges anticipated to settle close to 6%, residence costs growing regularly by about 2% to 4%, and enhancements in each affordability and availability of houses on the market. Even so, persevering with hurdles like increased non-mortgage bills, together with surging insurance coverage prices and rising property tax payments, restricted affordability, and uneven regional traits will maintain bifurcating the market and affect choices of each consumers and sellers.”

Yale Faculty of Administration: Finance professor Cameron LaPoint forecasts the 30-year mounted mortgage price to common 6.2% in 2026—and 6.05% in This autumn.

Wells Fargo: Analysts on the financial institution forecast 30-year mounted mortgage price averages of 6.18% in 2026 (and 6.2% in This autumn). Wanting even additional forward, they’re forecasting a 6.25% common in 2027.

Nationwide Affiliation of House Builders: Robert Dietz, chief economist at NAHB, forecasts a mean 30-year mounted mortgage price of 6.17% in 2026.

Brilliant MLS: Economists on the agency anticipate the 30-year mounted mortgage price to common 6.15% in This autumn 2026. Brilliant MLS chief economist Lisa Sturtevant writes: “Decrease charges will enhance affordability and convey extra consumers into the market in 2026. Mortgage charges started falling on the finish of the third quarter of 2025. With extra Federal Reserve price cuts deliberate for 2026, a response to weakening financial circumstances, anticipate mortgage charges to fall from about 6.25% firstly of 2026 to six.15% by the top of 2026.”

Zonda: Ali Wolf, chief economist at Zonda, forecasts the 30-year mounted mortgage price to common 6.10% in 2026.

Reventure App: Founder Nick Gerli tells ResiClub he expects the 30-year mounted mortgage price to common 6.1% in 2026.

Nationwide Affiliation of Realtors: The economics crew on the commerce group forecasts the 30-year mounted mortgage price to common 6% in 2026. NAR chief economist Lawrence Yun writes: “As we go into subsequent 12 months, the mortgage price can be just a little bit higher. . . . It’s not going to be a giant [mortgage rate] decline, however it is going to be a modest decline that can enhance affordability.”

Miami Realtors: Economists on the group—which represents greater than 60,000 actual property professionals and is the biggest native Realtor affiliation within the U.S.—forecast the 30-year mounted mortgage price to common 6% in 2026, and 6.2% in This autumn. Homosexual Cororaton, chief economist of Miami Realtors, tells ResiClub: “With the Fed fastidiously balancing to attain its twin mandate, inflation is more likely to regulate downward to 2% slowly whereas the unemployment price will edge up flippantly or stay steady because the Fed avoids a tough touchdown. The one manner for inflation to regulate shortly is that if unemployment rises sharply as nicely to impact a decline in actual wages. Both the Fed [is] nonetheless caught between the satan and the deep blue sea, I anticipate mortgage charges to primarily simply transfer sideways, so gross sales and costs can even put up very modest single-digit will increase. Affordability will barely enhance however I don’t see costs falling considerably regardless of the modest demand as a result of sellers can even pull again to protect their residence fairness positive factors. With residence affordability nonetheless the largest problem for homebuyers, the higher value tier or the market will proceed to be probably the most energetic section.”

Fannie Mae: The latest forecast issued by Fannie Mae in December has the 30-year mounted mortgage price averaging 6% in 2026 and 5.9% in 2027.

Morgan Stanley: Strategists on the funding financial institution forecast the common 30-year mounted mortgage price will end 2026 at 5.75%. In a report revealed on November 19, 2025, Morgan Stanley analysts write: “As we gaze into our proverbial crystal ball for the 12 months forward, we see affordability bettering on the margins as mortgage charges dip under 6%. That ought to present a modest increase to each present and new residence gross sales, although we predict there’s extra upside in 2027 than 2026. . . . The modest rally within the major price we anticipate to five.75% will possible convey some new debtors into the cash, however the affect can be marginal: Solely about 6% of typical debtors would profit from that 50bp decline. Past that, the subsequent 100bp drop would solely add one other 8% of debtors. Significant refinance incentives don’t emerge till charges fall under 4%, leaving the market in what we name a “refi wasteland” for a lot of 2026—although we’ll word that simply because we’re in a refi wasteland doesn’t imply mortgages in-the-money gained’t see valuation challenges pushed by shorter lags and growing originator effectivity.”

Erdmann Housing Tracker: Housing analyst Kevin Erdmann tells ResiClub he expects the 30-year mounted mortgage price to common 5.75% in 2026—and end 2026 at 5.22%.

Topline discovering?

Among the many 21 mortgage price forecasts tracked by ResiClub, the common prediction is 6.18% for calendar 12 months 2026. That’s on par with the current average 30-year fixed mortgage rate (6.09%).

Among the many 21 mortgage price forecasts for 2026 tracked by ResiClub, the best is 6.6% (Hunter Housing Economics), whereas the bottom is 5.75% (Morgan Stanley and Erdmann Housing Tracker).

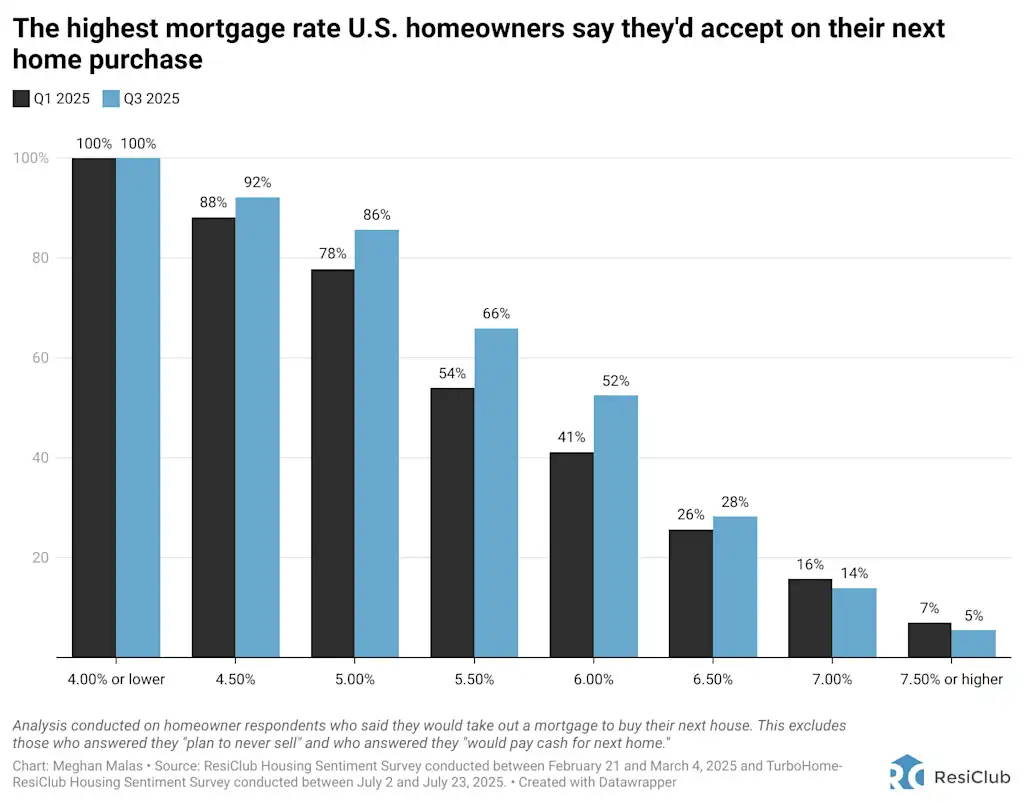

Over the previous three years, turnover within the U.S. existing-home market has been constrained. A few of that displays “pulled-forward” gross sales that occurred in 2020, 2021, or early 2022 reasonably than in 2023, 2024, or 2025.

However a lot of the slowdown stems from affordability and the lock-in impact created by the speed shock and sharply increased switching prices: Many householders who wish to promote and transfer are both unwilling to tackle a a lot increased month-to-month cost or unable to qualify for one.

All else being equal, if mortgage charges had been to fall greater than anticipated, there can be barely extra turnover and gross sales within the present residence market.

Let’s say they’re mistaken and mortgage charges fall greater than anticipated. What occurs?

- There’s a possible wildcard—an financial slowdown. If joblessness had been to climb sooner than anticipated or if the financial system had been to meaningfully deteriorate, that might put extra downward strain on each Treasury yields and mortgage charges. In that situation, mortgage charges may dip greater than the baseline forecasts counsel.

- The “mortgage spread” represents the distinction between the 10-year Treasury yield and the common 30-year mounted mortgage price. This week, the unfold stood at 207 foundation factors. If the unfold—which widened when mortgage charges spiked in 2022—continues to compress/normalize towards its long-term common since 1972 (176 foundation factors), it may assist push mortgage charges decrease even when Treasury yields maintain regular.

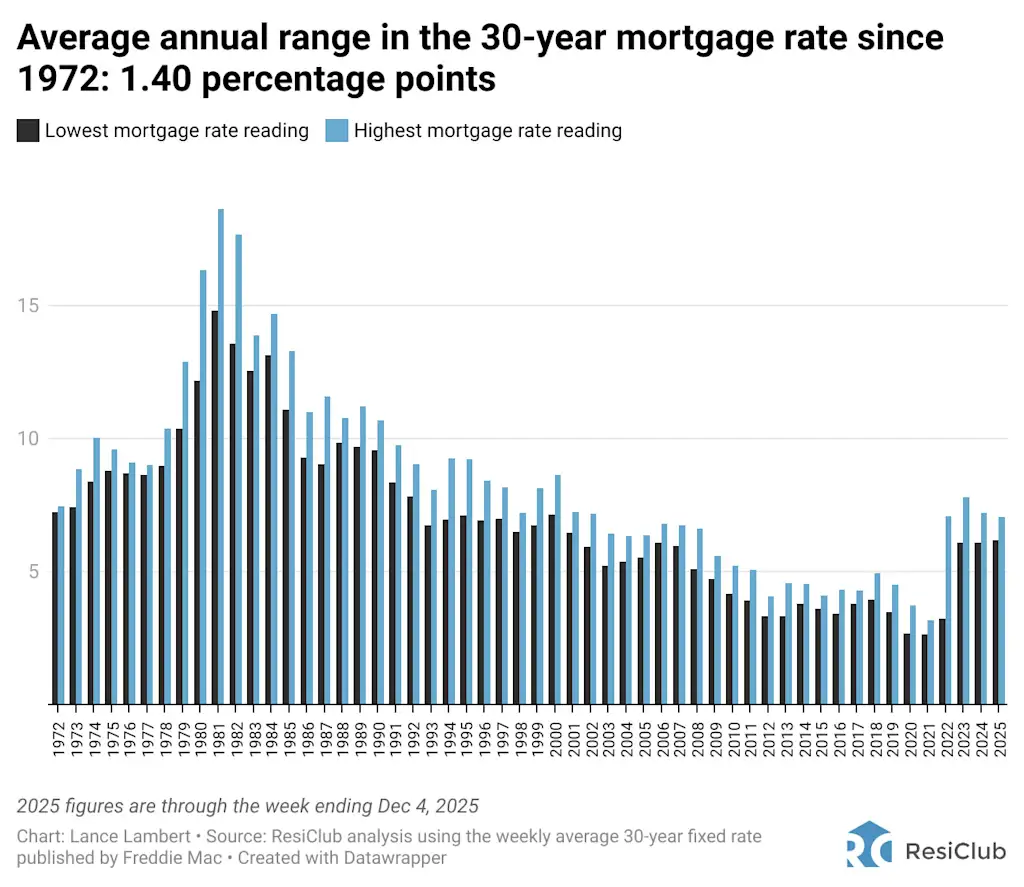

Housing stakeholders ought to needless to say a mortgage price forecast will not be a agency’s projection for the best—or lowest—price within the coming 12 months. Quite, it displays the common price for the calendar 12 months. And, after all, in any given 12 months the common 30-year mounted mortgage price can transfer nicely above and nicely under that annual common.

A recent ResiClub analysis of Freddie Mac’s weekly mortgage-rate dataset finds that since 1972, the common annual vary within the 30-year mounted mortgage price is 1.4 share factors. In case you transfer the goalpost to only this century—since 2001—the common annual vary within the 30-year mounted mortgage price is 1.08 share factors. In 2025, the vary was 0.87 level.

One final thought: Mortgage price forecasts ought to at all times be taken with a grain of salt—a minimum of to a point. Predicting long-term yields depends upon precisely anticipating inflation, Federal Reserve coverage, and the broader trajectory of the U.S. and international economies, all of that are notoriously arduous to get proper. Over simply the previous 5 years, forecasters have been caught off guard by a pandemic, a historic inflation spike, and one of many quickest rate-hiking cycles in fashionable historical past.

The lesson? Even the most effective fashions can’t account for each shock. Mortgage price forecasts are helpful guideposts—however not ensures.