Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

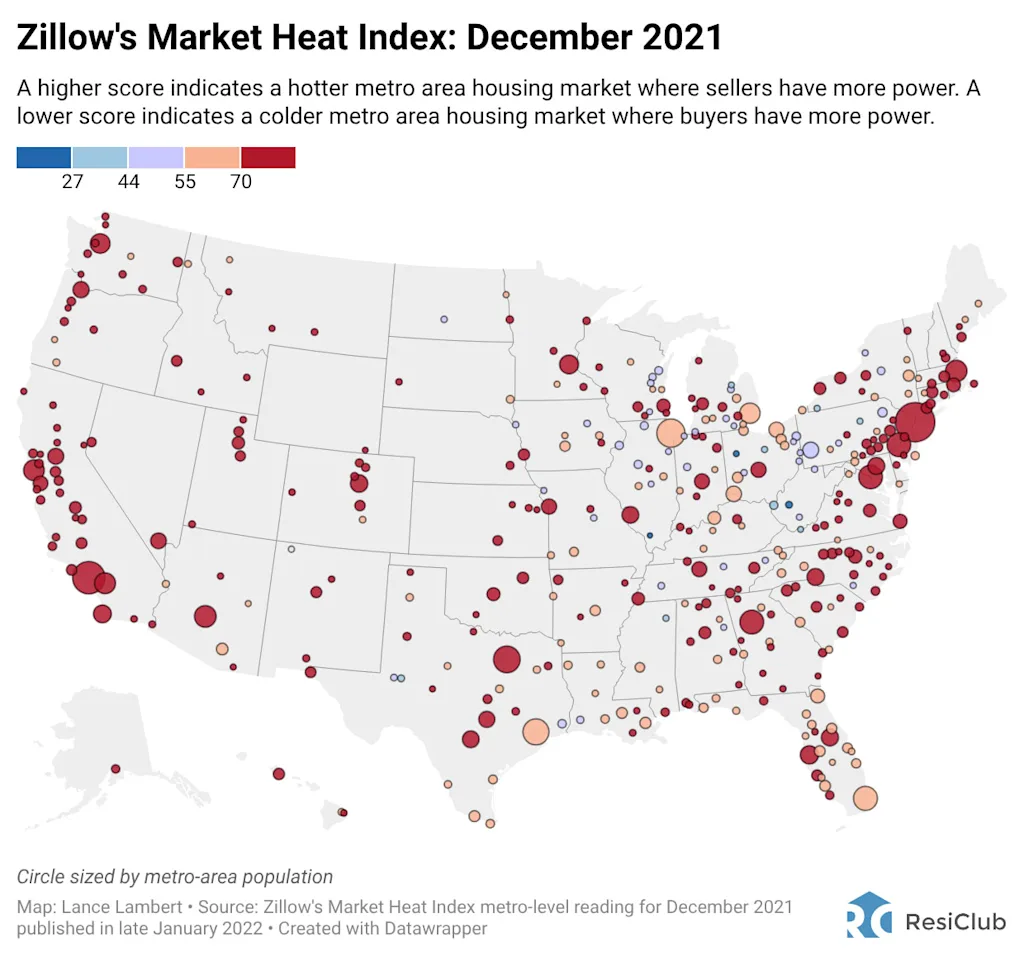

Zillow economists use an financial mannequin they name the Zillow Market Warmth Index to gauge the competitiveness of housing markets throughout the nation. This mannequin seems to be at key indicators—together with house value modifications, stock ranges, and days on market—to generate a rating exhibiting whether or not a market favors sellers or consumers.

Larger scores level to hotter, seller-friendly metro housing markets. Decrease scores sign cooler markets the place consumers maintain extra negotiating energy.

In line with Zillow:

- Rating of 70 or larger = robust vendor’s market

- Rating from 55 to 69 = vendor’s market

- Rating from 45 to 54 = impartial market

- Rating from 28 to 44 = purchaser’s market

- Rating of 27 or under = robust purchaser’s market

The Zillow mannequin reveals that, directionally talking, U.S. homebuyers have been gaining energy because the pandemic housing growth fizzled out in mid 2022.

window.addEventListener(“message”,operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.type.top=d}}});

Does ResiClub agree with Zillow’s evaluation?

Directionally, I imagine Zillow has appropriately recognized many regional housing markets the place consumers have gained probably the most energy—significantly across the Gulf—in addition to markets the place sellers have maintained (comparatively talking) considerably of a grip, together with massive parts of the Northeast.

Primarily based on my private housing evaluation, I think about Southwest Florida to be the weakest/softest chunk of the U.S. housing market this 12 months. Not too far behind are pockets of Texas and Colorado—which have additionally seen an even bigger build-up in resale stock and unsold new-build spec stock over the previous three years.

For my part, a lot of the Midwest is somewhat tighter than Zillow’s mannequin suggests.

Moreover, in my opinion, many West Coast markets are softer than Zillow’s evaluation suggests—specifically the areas which have not too long ago seen huge jumps in lively stock on the market—whereas some areas within the Midwest are somewhat tighter than Zillow suggests.

Another thought: The Zillow Market Warmth Index shouldn’t be the one metric that housing stakeholders have a look at when assessing market temperature. At a minimal, I’d additionally advocate wanting on the pace of lively stock change, lively stock now versus the identical month in 2019, year-over-year house value change, and seasonally adjusted month-over-month house value change. All of these metrics might be discovered within the ResiClub Terminal, all the way down to the zip code stage.

One other factor to bear in mind: Right now’s housing market is much softer than the overheated housing market throughout the pandemic housing growth. Under is Zillow’s evaluation again in December 2021.