Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

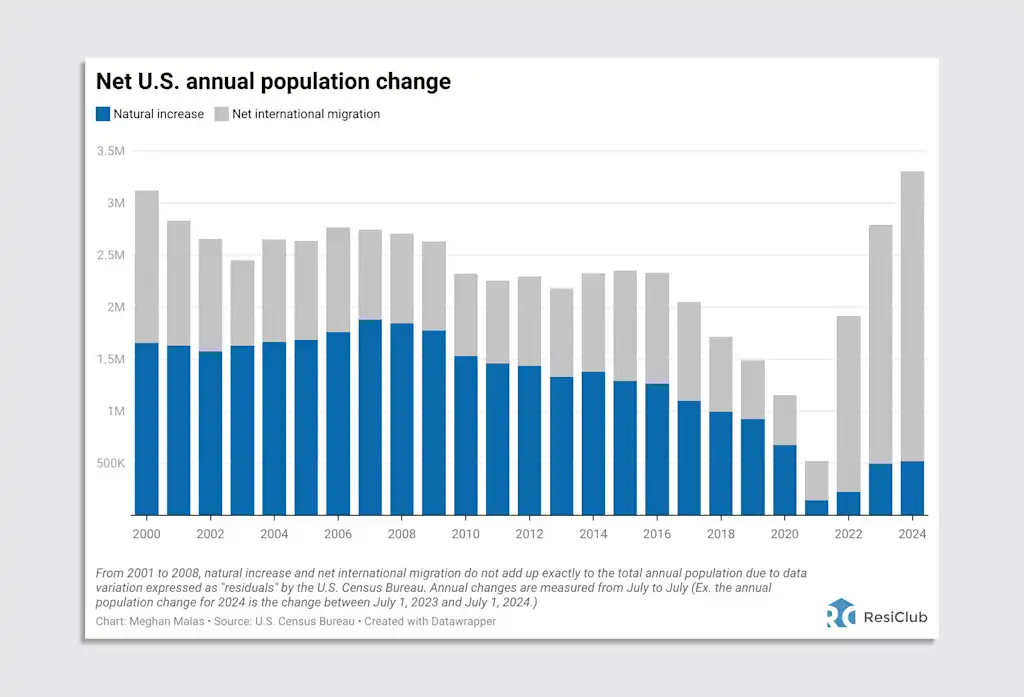

Between summer time 2021 and summer time 2024, the U.S. noticed a considerable upswing in web worldwide migration—much of it coming through the southern border. As of July 2024, the U.S. inhabitants stood at 340.1 million, up 3.3 million from 336.8 million in July 2023. Of that inhabitants enhance, 2.8 million (or 85%) got here from web worldwide migration.

That worldwide migration burst, after all, is behind us now. Just lately, border crossings have plummeted.

The up to date forecast by researchers at AEI expects that web worldwide migration in 2025 can be someplace between +115,000 and -525,000.

“We assess the macroeconomic implications of the noticed and anticipated adjustments to immigration coverage through the second Trump administration,” wrote AEI researchers in July. “We mission that web migration in 2025 can be between −525,000 and 115,000, reflecting a dramatic lower in inflows and considerably increased outflows. Internet migration could also be decreased even additional in 2026 earlier than rebounding in 2027 and 2028.”

Under is a ResiClub chart that reveals simply how giant a share of total inhabitants development comes from worldwide migration.

What does this worldwide migration hunch imply for the U.S. housing market?

All else being equal, in my opinion, a direct and direct housing influence of fewer immigrants coming via the southern border is decrease mixture rental demand—particularly, on the decrease finish of the market—than if that burst had continued.

Rental markets more likely to see the largest influence are in metro areas which have skilled essentially the most worldwide immigration lately. Specifically, main markets corresponding to New York Metropolis, Miami, and Houston might really feel the best results.

!operate(){“use strict”;window.addEventListener(“message”,operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.top=d}}})}();

Many economists, together with these on the AEI Housing Middle, consider this pullback in worldwide migration might dampen U.S. complete employment development and cut back total U.S. financial exercise.

Heading into 2025, many analysts speculated {that a} sharp pullback in immigration via the southern border would rapidly put upward strain on builders’ labor prices. Nevertheless, to date, dampened residential development exercise has greater than outweighed any of these pressures.

“Labor additionally appears to be extra obtainable in our markets, probably stemming from slower multifamily development and decreased begins within the business,” Hilla Sferruzza, CFO of Meritage Properties, stated through the builder’s July 24 earnings name.

America’s largest homebuilder, D.R. Horton, shared an identical take with analysts.

“From labor availability, it’s plentiful,” D.R. Horton CEO Paul Romanowski said through the firm’s earnings name on July 22. “We now have the labor that we want. Our trades are searching for work. And that’s why you’ve seen sequential and year-over-year discount in our cycle time. As a result of we have now the help we have to get our houses constructed. And, , given these efficiencies, reductions in stick and brick [costs] over time. A few of that’s from design. And effectivity of the product that we’re placing within the area. And a few of that’s simply from the effectivity of our operations.”

One different factor analysts ought to remember is that worldwide immigration, specifically, via the southern border, drastically exceeded pre-pandemic norms between summer time 2021 and summer time 2024. Even when web immigration had been to go flat or barely damaging, it’d nonetheless take awhile to offset / clean over the latest surge.

That pull-forward in worldwide immigration, coupled with at the moment softening aggregate residential construction activity, is one more reason why the latest sharp pullback in worldwide immigration would possibly take longer than some anticipated to tighten the residential development labor market. We’ll proceed to keep watch over it.