Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Simply weeks in the past, Moody’s chief economist Mark Zandi was signaling cautious optimism. In a mid-May conversation with Gunnar Branson, CEO of the Association of Foreign Investors in Real Estate (AFIRE)—a world community of worldwide buyers centered on U.S. actual property—Zandi mentioned the economic system appeared resilient and that the extra housing market softening this spring appeared extra like “yellow flares” than something extra critical.

That warning has since escalated: Zandi is now issuing a “crimson flare.”

In a July 13 post on X, Zandi warned that dwelling gross sales, homebuilding, and even home costs are set to droop except mortgage charges fall materially from their present 7% vary—one thing he believes is unlikely.

“The housing downturn to this point has been principally concerning the depressed present dwelling gross sales,” Zandi instructed ResiClub. “New dwelling gross sales, housing completions, and home costs have held up properly—that’s about to alter.”

Current dwelling gross sales have been caught at historic lows for the reason that pandemic housing growth resulted in mid-2022. Between early 2020 and 2022, hovering home costs after which hovering mortgage charge hikes quickly deteriorated U.S. housing affordability.

Since then, the housing sector has been in a droop, with continued job losses and slashed commissions for mortgage brokers and brokers as transaction volumes receded.

However now, the housing market could possibly be headed for much more weak spot.

One of many clearest tells, in line with Zandi, is that builders at the moment are suspending land deliveries—a transfer that sometimes precedes a drop in building exercise and will imply fewer begins and completions within the quarters forward.

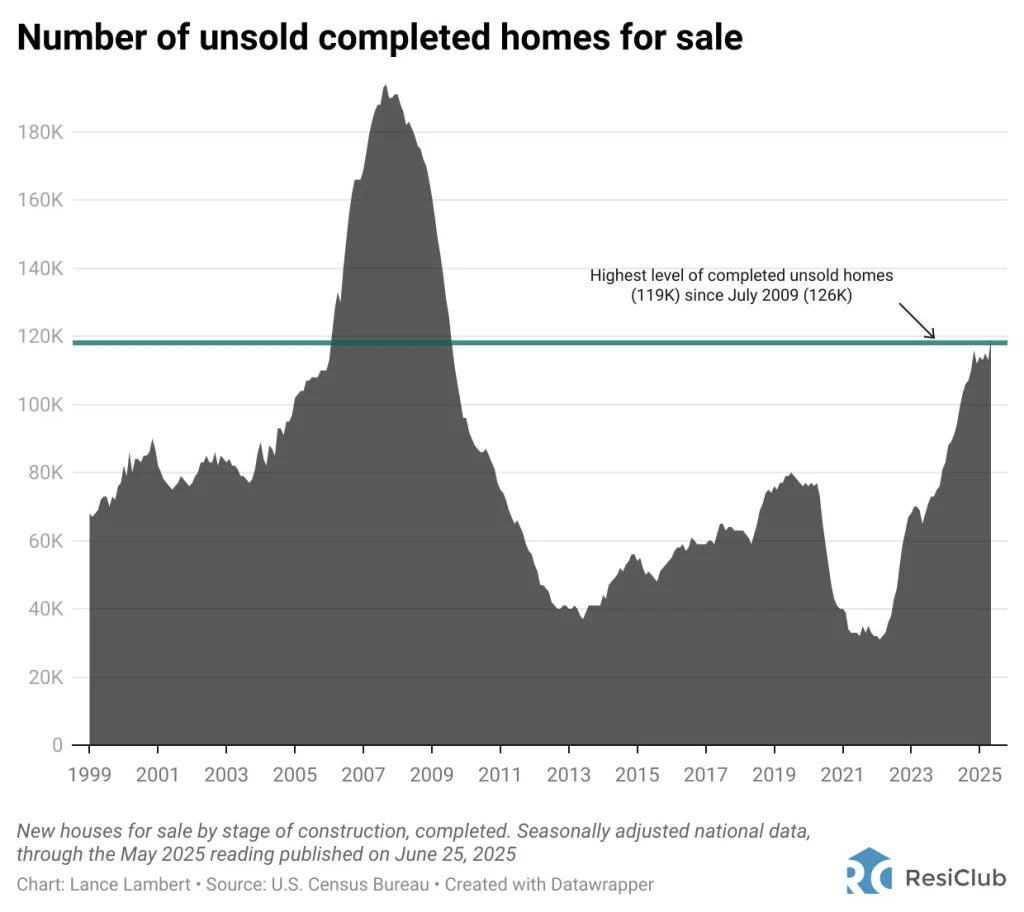

It’s not stunning that homebuilders are pulling again, on condition that unsold stock simply hit one other 15-year excessive.

Click here for an interactive model of the chart under

In keeping with an evaluation of U.S. Census Bureau information by ResiClub, the variety of unsold accomplished houses hit 119,000 in Might 2025—the best it’s been since July 2009, when it hit 126,000.

Extra dwelling value declines are seemingly, particularly within the South and West

Zandi instructed ResiClub that he expects nationwide home costs to fall by a mid-single-digit share, from peak to trough, over the subsequent 18 to 24 months, assuming mortgage charges stay close to 7%.

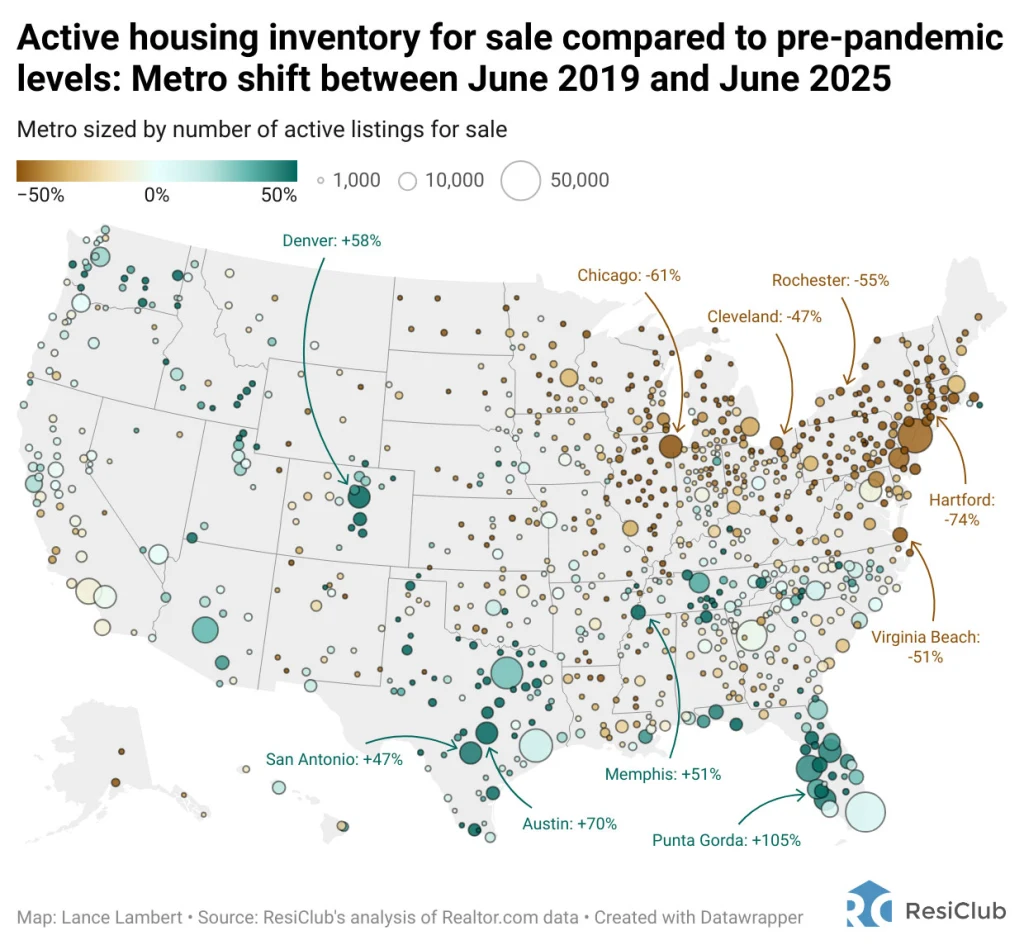

However not each area might be impacted equally.

“Costs might be weakest within the South and West, the place affordability is lowest and there was extra building,” he mentioned.

These areas—a lot of which noticed dwelling costs stretch far past native revenue ranges throughout the pandemic—are now seeing softening demand and rising inventory.

In contrast to the Solar Belt, many Northeast and Midwest markets skilled much less pandemic-era migration and restricted new building. With tighter stock and fewer builder-driven value changes, dwelling costs in these markets have remained extra steady heading into spring 2025.

Builders in metro areas like Austin, Phoenix, and Tampa, Florida, have leaned on incentives—like mortgage charge buydowns—to maintain dwelling costs elevated and preserve gross sales. However as these incentives turn into much less efficient or too pricey, some builders are starting to cut prices outright, placing stress on each the brand new and resale markets.

Merely put, Zandi thinks the housing downturn is broadening. Thus far, the housing downturn since mid-2022 has principally hit one facet of the market: present dwelling gross sales—which stay at traditionally low ranges resulting from lock-in and affordability obstacles. However Zandi’s warning suggests the subsequent section of the downturn may minimize deeper, dragging down dwelling costs in some regional markets in addition to building exercise.