Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Through the Pandemic Housing Growth, housing demand surged quickly amid ultralow rates of interest, stimulus, and the distant work increase—which elevated demand for house and unlocked “WFH arbitrage” as excessive earners had been capable of preserve their revenue from a job in say, NYC or L.A., and purchase in say Austin or Tampa. Federal Reserve researchers estimate “new building would have needed to enhance by roughly 300% to soak up the pandemic-era surge in demand.” In contrast to housing demand, housing stock supply isn’t as elastic and might’t ramp up as rapidly. In consequence, the heightened pandemic period demand drained the market of lively stock and overheated house costs, with U.S. home prices rising a staggering 43.2% between March 2020 and June 2022.

Whereas many commentators view lively stock and months of provide merely as measures of “provide,” ResiClub sees them extra as proxies for the supply-demand equilibrium. As a result of housing demand is extra elastic than housing inventory, massive swings in lively stock or months of provide are often pushed by shifts in demand. For instance, through the Pandemic Housing Growth, surging demand precipitated houses to promote sooner—pushing lively stock down, at the same time as new listings remained regular. Conversely, lately, weakening demand has led to slower gross sales, inflicting lively stock to rise—at the same time as new listings fell beneath pattern.

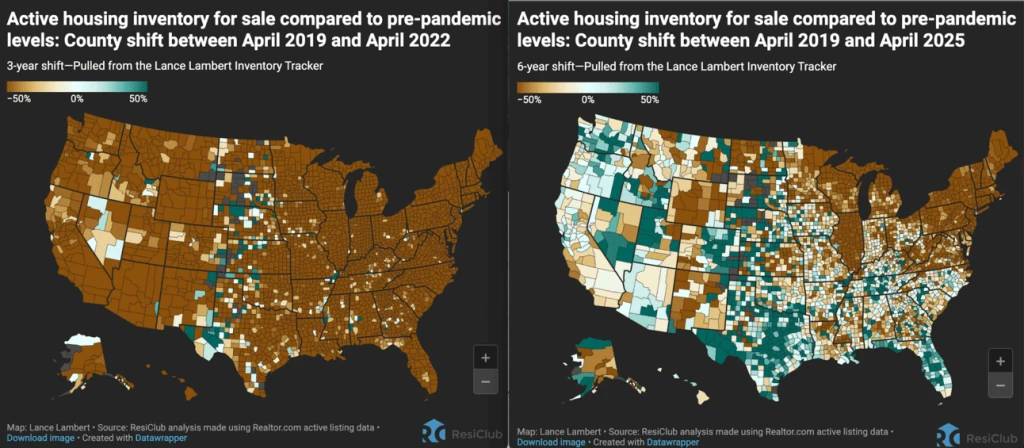

Certainly, through the ravenous housing demand on the peak of the Pandemic Housing Growth in April 2022, virtually all the nation was not less than -50% beneath pre-pandemic 2019 lively stock ranges.

BROWN = Lively housing stock on the market in April 2022 was BELOW pre-pandemic 2019 ranges

GREEN = Lively housing stock on the market in April 2022 was ABOVE pre-pandemic 2019 ranges

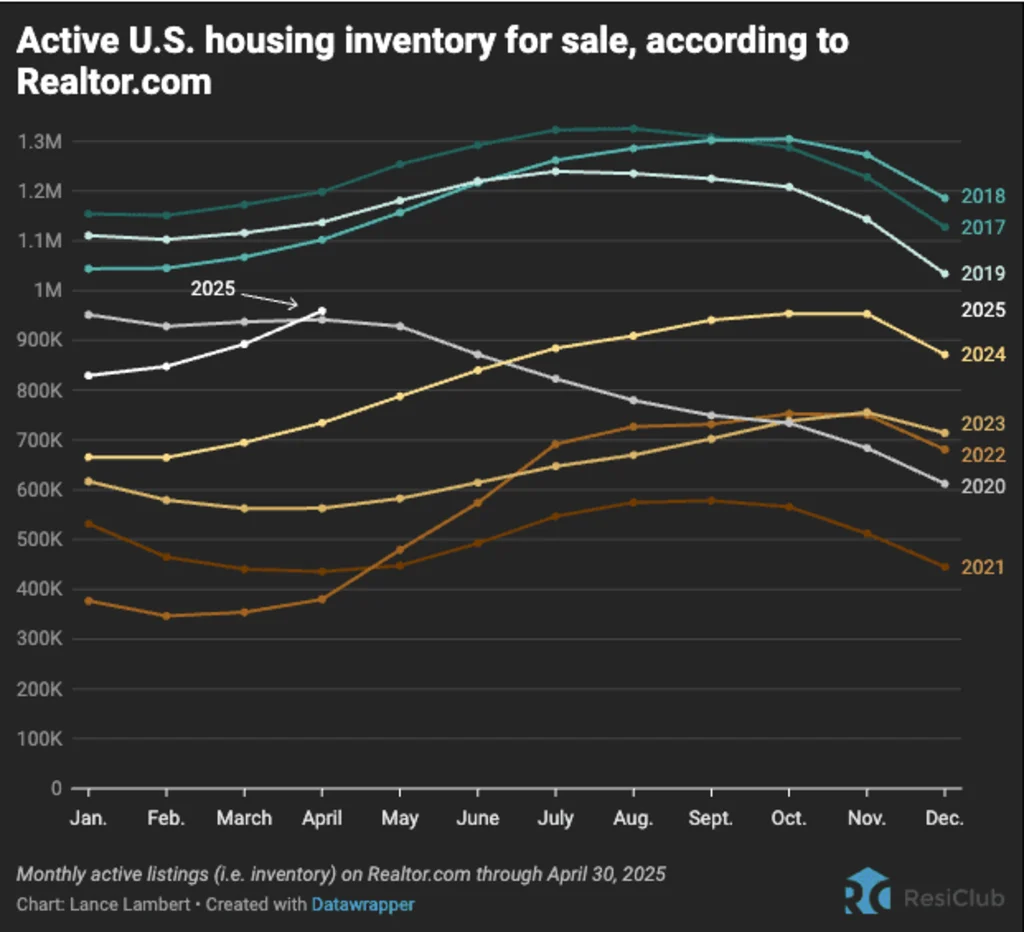

In fact, now it’s a unique image: Nationwide lively stock is on a multiyear rise.

Not lengthy after mortgage charges spiked in 2022—inflicting affordability to mirror the truth of the sharp house value will increase through the Pandemic Housing Growth—and return-to-office gained a little bit of momentum, nationwide demand within the for-sale market pulled again and the Pandemic Housing Growth fizzled out. Initially, within the second half of 2022, that housing demand pullback triggered a “fever breaking” in plenty of markets—notably in rate-sensitive West Coast housing markets and in pandemic boomtowns like Austin and Boise—inflicting lively stock to spike and pushing these markets into correction-mode within the second half of 2022.

Heading into 2023, a lot of those self same Western and pandemic boomtown markets (excluding Austin) stabilized, because the spring seasonal demand—coupled with still-tight lively stock ranges—was sufficient to quickly agency up the market. For a bit, nationwide lively stock stopped rising year-over-year.

Nonetheless, that interval of nationwide stock stabilization didn’t final. Amid nonetheless slumped housing demand, nationwide lively stock started to rise once more—and we’re now within the midst of an 18-month streak of year-over-year will increase in nationwide lively listings.

The place lively stock/months of provide has risen essentially the most, homebuyers have gained essentially the most leverage. Generally speaking, housing markets the place stock (i.e., lively listings) has returned to pre-pandemic 2019 ranges have skilled weaker house value progress (or outright declines) over the previous 34 months. Conversely, housing markets the place stock stays far beneath pre-pandemic 2019 ranges have, typically talking, skilled stronger house value progress over the previous 34 months.

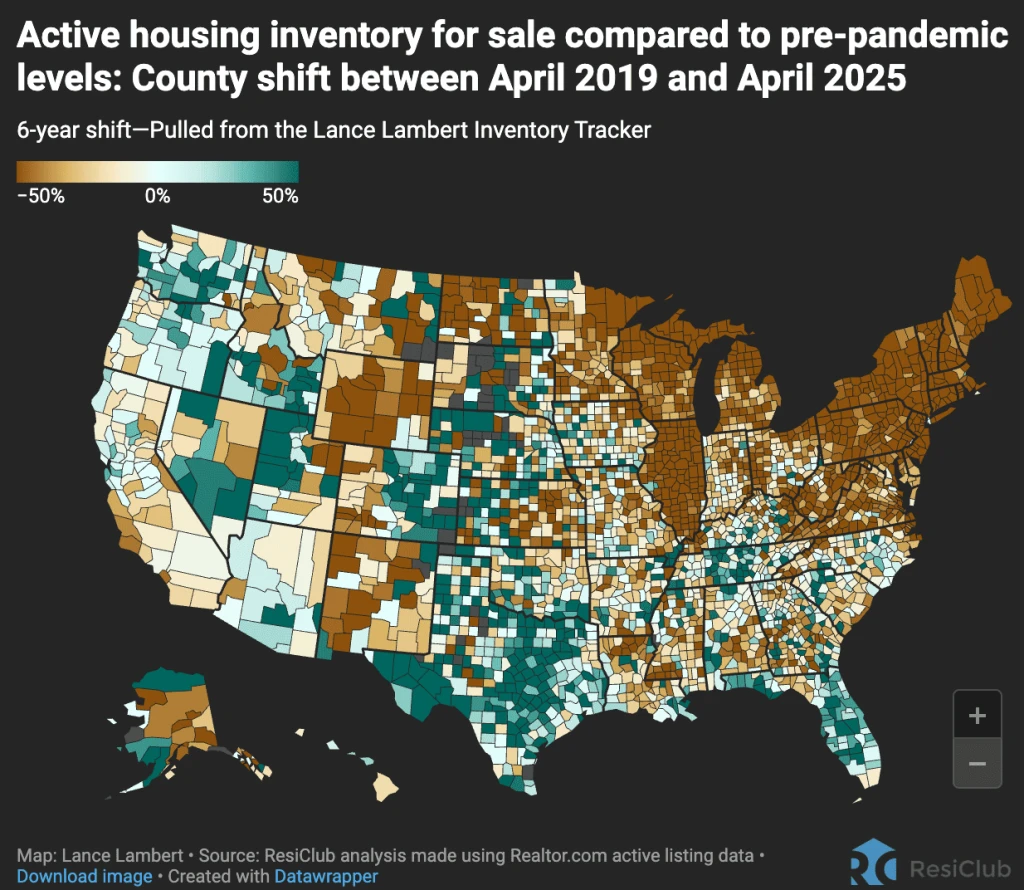

BROWN = Lively housing stock on the market in April 2025 was BELOW pre-pandemic 2019 ranges

GREEN = Lively housing stock on the market in April 2025 was ABOVE pre-pandemic 2019 ranges

As ResiClub has carefully documented, that image varies considerably throughout the nation: a lot of the Northeast and Midwest stay beneath pre-pandemic 2019 stock ranges, whereas many elements of the Mountain West and Gulf areas have bounced again.

Most of the softest housing markets, the place homebuyers have gained leverage, are situated in Gulf Coast and Mountain West areas. These areas had been among the many nation’s prime pandemic boomtowns, having skilled important house value progress through the Pandemic Housing Growth, which stretched housing fundamentals far past native revenue ranges. When pandemic-fueled home migration slowed and mortgage charges spiked, markets like Cape Coral, Florida, and San Antonio, Texas, confronted challenges as they needed to depend on native incomes to maintain frothy house costs. The housing market softening in these areas was additional accelerated by increased ranges of recent house provide within the pipeline throughout the Solar Belt. Builders in these areas are sometimes prepared to scale back costs or make different affordability changes to keep up gross sales in a shifted setting. These changes within the new building market additionally create a cooling impact on the resale market, as some consumers who might need opted for an current house shift their focus to new houses the place offers are nonetheless accessible.

In distinction, many Northeast and Midwest markets had been much less reliant on pandemic migration and have much less new house building in progress. With decrease publicity to that home migration pullback demand shock—and fewer builders doing large affordability changes to maneuver product—lively stock in these Midwest and Northeast areas has remained comparatively tight—with house sellers retaining extra energy relative to their friends within the Gulf and Mountain West areas.

Whereas national active inventory on the finish of April 2025 was nonetheless -16% beneath pre-pandemic April 2019, ResiClub expects nationwide lively stock to surpass pre-pandemic 2019 ranges later this yr.

Huge image: The housing market continues to be present process a means of normalization following the surge in housing demand through the Pandemic Housing Growth, when house costs went up too quick, too rapidly. To this point, that normalization course of has pushed some markets—together with Austin (mid-2022-present), Las Vegas (second half of 2022), Phoenix (second half of 2022), San Francisco (second half of 2022), Boise (mid-2022–2023), Punta Gorda (2022–current), Cape Coral (2023–current), and Tampa (2024–current)—into correction-mode. In another areas, to date, it has precipitated house value progress to stall out. In the meantime, some markets nonetheless stay tight and have solely seen a deceleration in house value progress from the highs of the Pandemic Housing Growth.

ResiClub PRO members can entry my newest month-to-month stock evaluation (+800 metros and +3,000 counties) here, and my newest month-to-month house value evaluation (+800 metros and +3,000 counties) here.