Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

This week, the Federal Reserve Financial institution of New York printed its quarterly Household Debt and Credit Report. It exhibits that whereas nonetheless low, misery is creeping again into the housing market.

Right here’s how the U.S. housing foreclosures in Q1 of 2025 evaluate to earlier years:

Q1 2014: 144,500

Q1 2015: 111,820

Q1 2016: 96,680

Q1 2017: 90,460

Q1 2018: 76,360

Q1 2019: 71,040

Q1 2020: 74,720

Q1 2021: 11,400

Q1 2022: 24,220

Q1 2023: 35,640

Q1 2024: 44,180

Q1 2025: 61,660

When COVID-19 lockdowns started, the federal authorities applied a nationwide foreclosures moratorium to guard owners from the financial fallout. These protections—together with forbearance applications—had been prolonged a number of occasions. On the similar time, a historic surge in housing demand pushed dwelling costs to new highs throughout the pandemic housing growth, boosting house owner fairness and conserving foreclosures exercise unusually low.

However in current quarters, foreclosures have steadily returned, inching nearer to pre-pandemic 2019 ranges. That foreclosures rebound picked up tempo in Q1 2025, following the expiration of the moratorium on foreclosures of home loans backed by the U.S. Department of Veterans Affairs.

The query heading ahead: Will housing foreclosures proceed to rise by way of the remainder of 2025 and in 2026? Let’s take a more in-depth have a look at the main indicators.

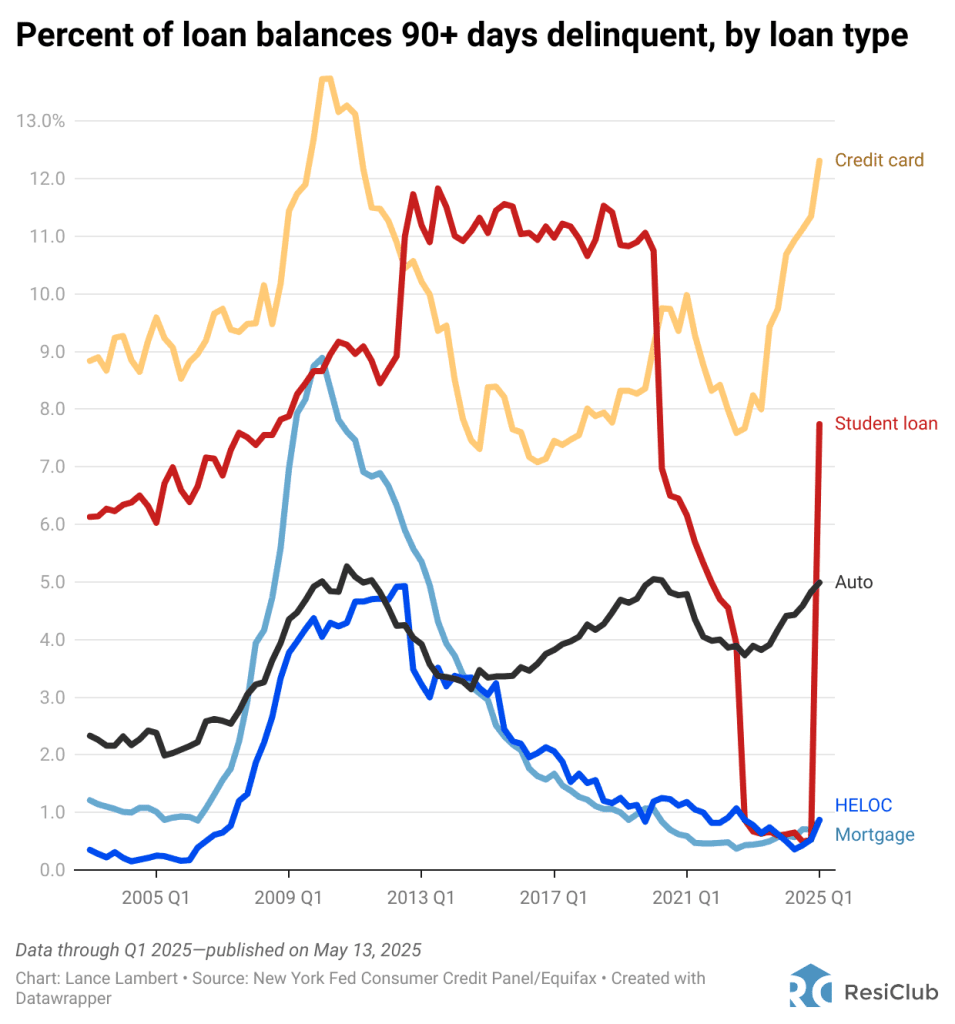

Earlier than U.S. housing foreclosures rise, delinquencies of 90-plus days usually enhance. Whereas bank card and auto delinquencies of 90 days or extra have surged in current quarters, delinquencies of 90-plus days on family mortgages stay nicely under pre-pandemic 2019 ranges.

Right here’s how the current share of family mortgage balances which can be 90-plus days delinquent compares to earlier years:

Q1 2014: 3.72%

Q1 2015: 2.95%

Q1 2016: 2.08%

Q1 2017: 1.67%

Q1 2018: 1.22%

Q1 2019: 1.00%

Q1 2020: 1.06%

Q1 2021: 0.59%

Q1 2022: 0.47%

Q1 2023: 0.44%

Q1 2024: 0.60%

Q1 2025: 0.86%

On the delinquency entrance, probably the most noticeable growth this quarter is that student loan delinquencies surged to a five-year excessive in early 2025. Whereas the bounce was anticipated after years of artificially low pupil mortgage delinquency charges, Fed researchers warned of significant penalties for behind student-loan debtors, together with broken credit score and decreased entry to mortgages and auto loans.

According to the New York Fed, superprime U.S. debtors—these with credit score scores above 760—who carry unpaid pupil mortgage balances are anticipated to see their credit score scores drop by a mean of 171 factors this spring. That’s as a result of pupil mortgage delinquencies, which hadn’t been reported to credit score bureaus because the begin of the pandemic, at the moment are being reported once more. This sudden credit score hit may briefly push some debtors out of the housing market in 2025 and 2026.

The Treasury has additionally resumed assortment techniques on pupil loans, together with wage garnishment and tax refund seizures, elevating questions on potential spillover into different areas of shopper credit score.

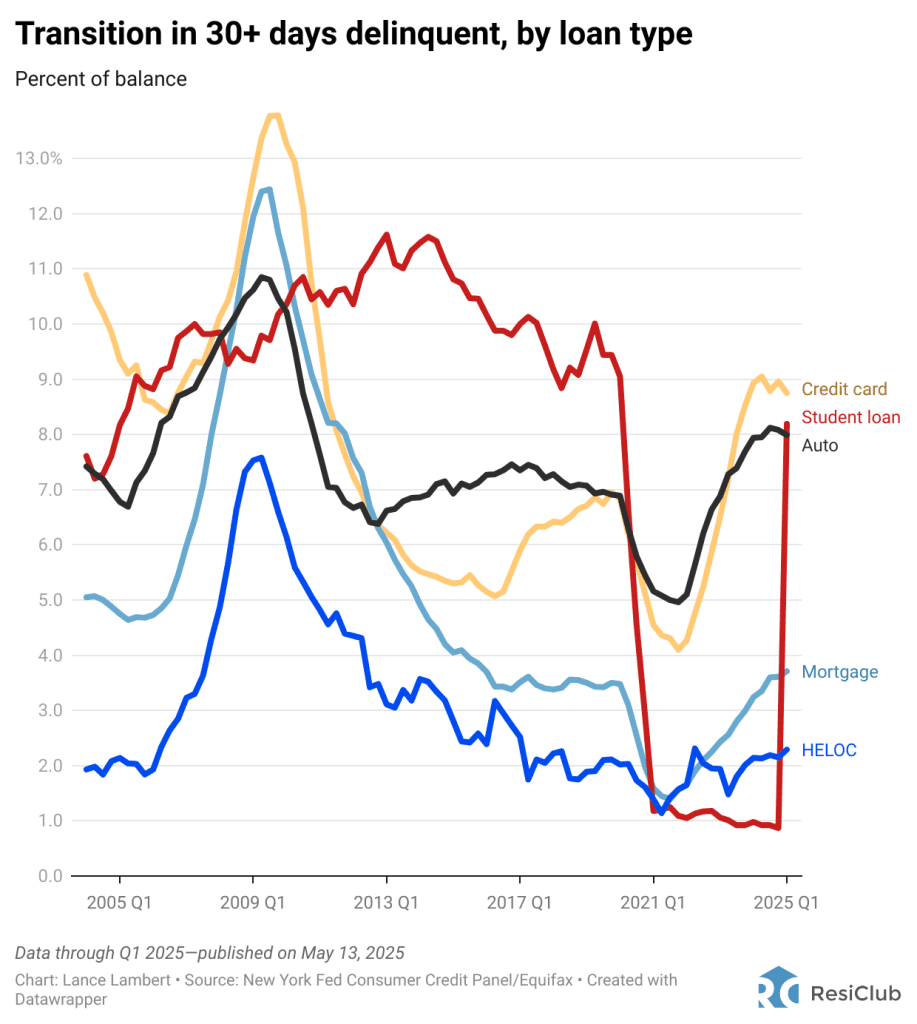

And earlier than 90-plus day delinquencies usually enhance, 30-plus day delinquencies normally rise first. Certainly, 30-plus day mortgage delinquencies have returned to pre-pandemic 2019 ranges.

Right here’s how the portion of family mortgages transitioning into 30-plus days delinquent compares to historic knowledge.

Q1 2014: 4.92%

Q1 2015: 4.05%

Q1 2016: 3.70%

Q1 2017: 3.51%

Q1 2018: 3.38%

Q1 2019: 3.50%

Q1 2020: 3.48%

Q1 2021: 1.59%

Q1 2022: 1.66%

Q1 2023: 2.43%

Q1 2024: 3.24%

Q1 2025: 3.71%

Large image: Whereas U.S. housing foreclosures stay low and under pre-pandemic 2019 ranges, the 30-plus days delinquency knowledge means that foreclosures may step by step close to pre-pandemic 2019 by the top of 2025.