20 years in the past, I discovered an essential lesson: in the event you can’t beat them, be a part of them. And in the event you can’t discover a job with the monopolies, then you definitely may as nicely spend money on them!

Take what occurred on September 1, 2025. I obtained an e mail from Apple saying my Apple TV+ month-to-month subscription was going up from $9.99 to $12.99. My first response was annoyance. Who desires to pay an additional $3 a month for a similar reveals? The whole lot needs to be free, like my weekly newsletter serving to readers obtain monetary freedom sooner!

However as a shareholder, I used to be pumped. A 30% worth hike is huge for profitability given Apple’s tens of millions of subscribers. Then there’s the value hikes of its newest laptops. That is the kind of pricing energy you solely get if you’ve constructed a monopoly-like ecosystem.

The one logical factor I may consider after that e mail? Purchase extra Apple inventory.

For reference, a monopoly is a market construction the place a single firm or entity dominates the provision of a selected services or products, giving it vital energy to set costs, management distribution, and restrict competitors. As a result of boundaries to entry are excessive—equivalent to patents, unique sources, authorities regulation, or sheer economies of scale—the monopolist can preserve outsized earnings and pricing flexibility over time.

Money Hoards And Massive Ecosystems

Historically, Apple’s inventory sells off after its annual occasion the place it unveils new merchandise. The hype by no means fairly matches Wall Avenue’s lofty expectations, and 2025’s showcase was no completely different. However I’ve come to appreciate one thing: Apple doesn’t have to innovate in the best way we expect—by launching world-changing devices yearly. Simply shifting the digital camera lens 1 millimeter is sweet sufficient.

The actual “innovation” is Apple’s capacity to lock in clients and cost a toll. The App Retailer’s 30% fee is the proper instance. If you happen to’re a developer and also you need your app to succeed, you don’t have any selection however to be inside Apple’s ecosystem. And Apple is aware of this. The iPhone, Mac, iPad, AirPods, Watch—all of those {hardware} merchandise feed into one sticky universe of recurring income. When you’re in, you don’t go away.

That’s why Apple is just going to proceed dominating. As an investor, betting in opposition to Apple is betting in opposition to super-normal earnings.

Google’s Monopoly Appears Good Too

Then there’s Google, one other monopoly-like juggernaut. Google pays Apple $20+ billion a yr simply to be the default search engine in Safari. Think about that. How can every other search engine compete when Google buys the pole place on the world’s most useful and fashionable gadgets?

Google nonetheless instructions roughly 90% of the worldwide search market, and that dominance stays unshaken regardless of the rise of AI LLMs. To my dismay, Google now lifts writer content material and shows it in its AI Overviews, making it even more durable for publishers to seize priceless search visitors.

In September 2025, Google was spared the worst potential judgment in its landmark antitrust case. Decide Amit Mehta dominated that whereas Google can not enter into unique agreements with corporations, it’s nonetheless allowed to pay companions like Apple to distribute its providers. Translation: Google can preserve sending tens of billions to Apple, and Apple can preserve cashing the checks.

That could be a win-win for each corporations—and their shareholders. It would even be a win for Decide Mehta and his household.

How Many Corporations Can Compete at This Stage?

Solely a tiny handful of corporations on the planet have the monetary firepower to play at this degree.

The one firm that would theoretically compete is Microsoft, with Bing, which no person cares about. If Microsoft ever decides to go bananas and bid in opposition to Google, we’d see Apple’s annual payout rise into the $30–$40 billion vary. That’s greater than the annual GDP of some small nations.

From an investor’s standpoint, you root for these bidding wars. So long as Apple stays the gatekeeper of the world’s most coveted consumer base, it’s going to receives a commission.

And as historical past has proven, regulators and courts not often break aside such entrenched dominance. When you have got sufficient scale, cash, and affect, you’ll be able to bend politics and coverage in your favor.

Strategically, Google ought to spend extra on politicians, as a substitute of the $20 – $30 million a yr on lobbying, to guard its monopoly and acquire even additional floor.

The Winners Preserve On Profitable

This dynamic isn’t restricted to firms. It’s the identical in private finance.

Take into consideration the rich particular person in 2010 who had $10 million in investable property. If that particular person merely plowed all of it into the S&P 500 and reinvested dividends, they’d have round $57 million at the moment, assuming the S&P 500 closes up 10% in 2025. They’ve turn into a semi-human monopoly—in a position to purchase affect, present multi-generational wealth, and safe benefits most individuals can solely dream of.

Now distinction that with somebody who purchased an excessive amount of residence in 2006, obtained foreclosed on in 2010, and declared chapter. As a substitute of compounding tens of millions, they ended up with adverse internet price and a credit standing in tatters for seven years. They’re just like the small competitor making an attempt to claw market share from Apple or Google. The hole solely widens with time. The principle technique is to someday promote to Apple or Google, not compete with it.

Identical to corporations, people who have already got the sources are inclined to preserve pulling additional forward. The snowball impact is actual.

Human Monopolies and Duopolies

This is the reason I consider traders ought to focus extra of their consideration on monopoly-like and oligopoly-like corporations. If the federal government isn’t going to cease them—and historical past suggests it not often does—you may as nicely profit.

OpenAI and Anthropic, for instance, are the 2 rising giants in AI massive language fashions. Whereas each are personal for now, their oligopoly construction is already forming, together with Llama and Gemini.

In client merchandise, Coca-Cola and Pepsi dominate world tender drinks in a basic duopoly. If you happen to consider the world will preserve guzzling sugary drinks regardless of the well being dangers, these shares make sense.

In funds, Visa and Mastercard type one other entrenched oligopoly. If you happen to assume customers will preserve spending past their means and paying double-digit rates of interest on revolving credit score, proudly owning these corporations is a rational selection.

The sample is obvious: these entrenched gamers are allowed to develop larger and extra worthwhile whereas regulators look the opposite approach. Politicians typically personal shares within the very monopolies they’re supposed to manage.

So why shouldn’t you?

Adapt or Perish

In fact, disruption is all the time potential. OpenAI and Anthropic have already taken bites out of Google’s search enterprise as extra individuals depend on AI-generated solutions. That is another excuse why I’ve determined to invest in both OpenAI and Anthropic as a hedge.

However disruption doesn’t eradicate the monopoly dynamic—it simply shifts it. Right this moment’s upstart is tomorrow’s entrenched winner. For now, Apple, Google, Microsoft, Coca-Cola, Pepsi, Visa, and Mastercard are nonetheless firmly in management.

Firms adapt. Traders should as nicely. The choice is irrelevance.

My Investing Philosophy Going Ahead

For the common particular person, investing in a low-cost S&P 500 ETF stays the only and best wealth-building technique. However in the event you’re studying Monetary Samurai, you possible care about cash greater than most. Consequently, you’re keen to assume strategically about the best way to tilt the chances in your favor.

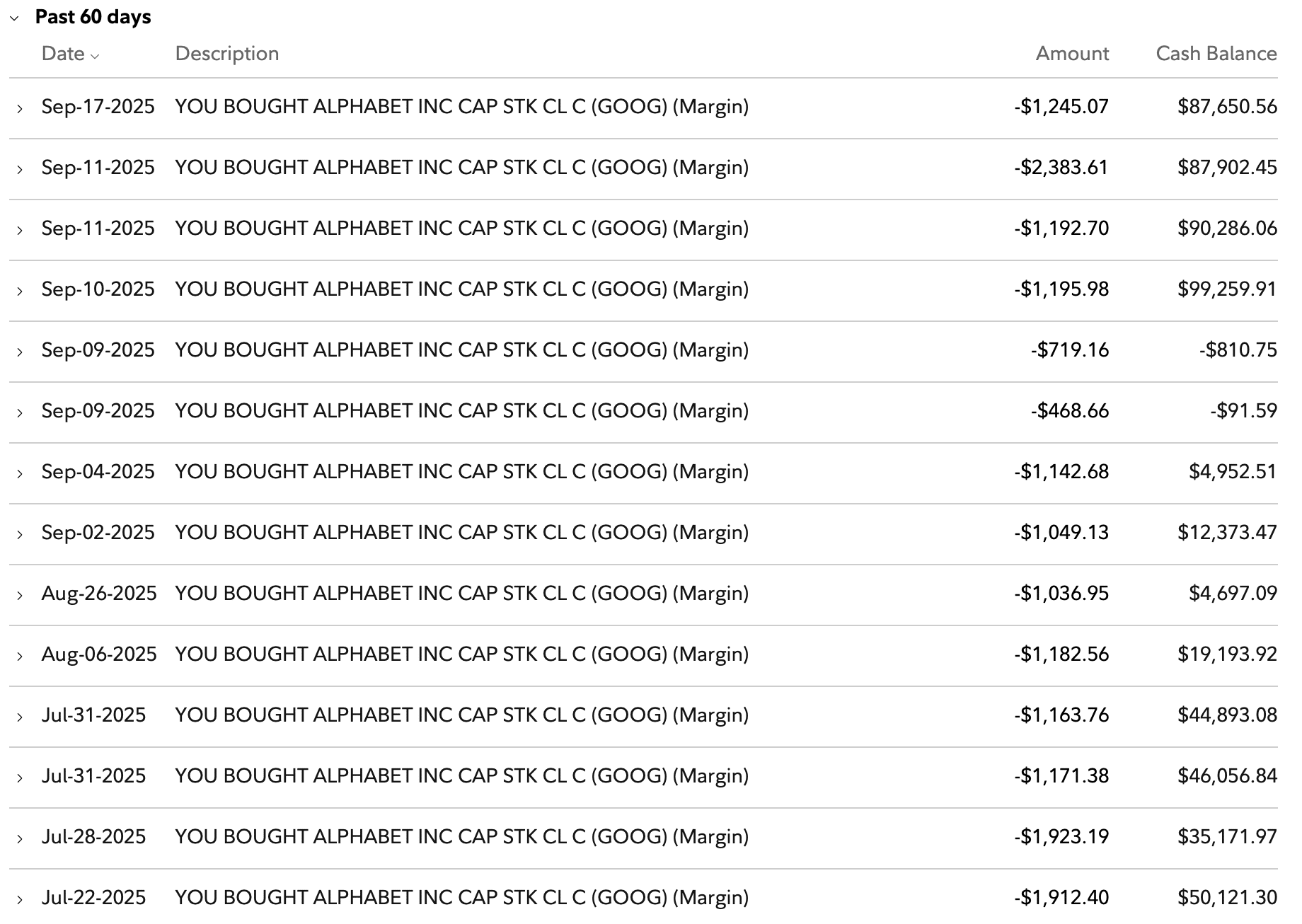

That’s why I like constructing concentrated publicity to pick monopolies and oligopolies inside your portfolio. These are the businesses that may possible generate essentially the most constant earnings, wield essentially the most pricing energy, and ship the strongest returns over time. When these corporations inevitably right, I’ll purchase extra.

Sure, complain about injustice in order for you. Sure, fear about inequality. However on the finish of the day, if it’s authorized and worthwhile, the rational investor joins the successful facet. As a result of in the event you can’t beat them, you may as nicely spend money on them.

That’s not cynicism. That’s survival.

Readers, are you investing in monopolies and oligopolies as a part of your technique? Or perhaps backing startups that would someday get acquired by them? I’d love to listen to your perspective—why do you assume the federal government and courts aren’t extra proactive in breaking apart these giants for the sake of customers?

Subscribe To Monetary Samurai

Decide up a duplicate of my USA TODAY nationwide bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of monetary expertise that can assist you construct extra wealth than 94% of the inhabitants—and break away sooner.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about a few of the most attention-grabbing subjects on this web site. Your shares, scores, and critiques are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Financial Samurai newsletter. You can too get my posts in your e-mail inbox as quickly as they arrive out by signing up here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. The whole lot is written primarily based on firsthand expertise and experience.