One of many extra entertaining elements of economic social media is watching hyperbole get handed round like a sizzling potato. Nearly each month, there appears to be a brand new label designed to categorise the place folks supposedly stand in society.

We have already got poor, low revenue, decrease center class, middle class, DINK, HENRY, higher center class, mass affluent, Fat FIRE, poor millionaire, and rich.

If there’s one factor we love greater than incomes cash, it’s categorizing ourselves and others. And if we will categorize others under the place we stand, we would really feel somewhat higher about our personal state of affairs.

Since 2009, I’ve seen this phenomenon play out repeatedly on Monetary Samurai.

Commenters will say issues like, “Issues are dire. The financial system is collapsing. Persons are dropping their livelihoods.” However when I attempt to empathize and ask how they’re doing, the response is nearly at all times the identical: “I’m truly doing nice. It’s all people else that’s doing badly.”

I at all times get a kick out of that response. And since 2009, the financial system together with threat property have typically carried out nicely.

Recently, the most recent label gaining traction, particularly with the rise of synthetic intelligence, is the so-called everlasting underclass.

What Is the Everlasting Underclass?

The time period sounds ominous, and that’s intentional.

The everlasting underclass refers to a bunch of individuals believed to be structurally locked out of financial mobility. They aren’t briefly struggling, however successfully excluded from significant participation within the labor market throughout generations. In contrast to cyclical or transitional poverty, the phrase everlasting implies that escape is statistically uncommon, even during times of financial development.

Though many individuals assume the idea emerged alongside artificial intelligence, the thought is many years outdated. Sociologists started utilizing the time period way back to the Nineteen Sixties to explain populations more and more indifferent from steady employment because of structural modifications in superior economies.

The idea gained wider consideration within the Nineteen Eighties, as researchers studied how deindustrialization, the disappearance of middle-skill jobs, and geographic segregation created pockets of persistent poverty largely untouched by financial expansions.

Artificial intelligence didn’t invent the thought. It resurrected and intensified the worry.

As AI expands into cognitive work, the priority is that tens of millions of jobs will disappear quicker than employees can retrain. If machines can write, analyze, diagnose, code, and design at scale, what occurs to the individuals who can’t sustain?

The argument is that AI gained’t merely widen inequality, it’s going to completely harden it.

A Shrinking Window to Escape The Underclass

As a result of AI is advancing so shortly, there’s a rising sense of urgency to flee the underclass earlier than the door closes for good. The answer is to personal as a lot appreciating property as attainable that generate as a lot passive income as attainable to interrupt free.

For traders, the bull market since 2023 has helped. The S&P 500 is up roughly 80% over the previous three years. Sadly, it nonetheless takes a lot of invested capital to generate life-changing wealth. A $100,000 funding that grows to $180,000 doesn’t immediately grant financial freedom.

When ChatGPT first got here onto the scene in 2022, a few of us, together with myself, estimated the window to flee was about 10-15 years. If true, 10-15 years is lengthy sufficient to save lots of aggressively, make investments constantly, get promoted, and generate good side income.

If the World Monetary Disaster hadn’t hit from 2008–2010, I’d have been capable of escape the underclass in 2009, ten years after graduating from William & Mary. As an alternative, the GFC delayed that exit till 2012.

On the time, I didn’t think about myself wealthy. I used to be incomes about $80,000 a yr in passive income. However I used to be pleased as a result of I used to be free, which was adequate for me on the time with out youngsters.

The Escape Window Is Narrowing

Right now, extra argue the window is far shorter. 5 years. Perhaps much less to construct sufficient wealth earlier than you are trapped. The CEO of Anthropic has publicly steered it may very well be as brief as two.

Creating sufficient wealth in 5 years is feasible if you have already got a stable base. However when you’re simply beginning your profession, or nonetheless in faculty, the percentages are impossibly low. That actuality helps clarify why so many younger persons are taking outsized dangers in speculative property that generate no earnings or revenue like crypto, meme cash, NFTs (so dumb), gold, and silver.

The pondering is easy: higher to take a shot at generational wealth than stay caught in a soul-sucking 9-to-5 eternally. The irony is that “eternally” is now an phantasm, as AI is already starting to disintermediate tens of millions of employees.

As a mum or dad of two younger kids, I’ve felt an growing strain to assist them keep away from getting caught after commencement, residing at house with restricted choices and no clear path upward. That worry is actual. Because of this, I’ve been spending extra time with them and attempting to show them as a lot as I can in an age acceptable means.

I inform myself I’ve 18 years to impart no matter knowledge I can, so I higher get cracking.

But when AI goes to remove accounting jobs, advertising and marketing jobs, finance jobs, educating jobs, medical jobs, writing jobs, tech jobs, appearing jobs, regulation jobs, actual property jobs, and gross sales jobs, as so many AI firm leaders virtually gleefully publicize, then I generally surprise what the purpose of attempting so exhausting is anymore. If complete profession paths are shrinking or disappearing, why not simply dwell life and YOLO?

At occasions, it even feels prefer it is perhaps more healthy to simply accept our destiny and to concentrate on having fun with the current as a substitute of continually striving. In any case, how can people realistically outwork or outsmart machines that by no means sleep and enhance exponentially?

And but, that rigidity is strictly why the dialog issues.

It’s Okay to Be A part of the Underclass

Being a part of the underclass doesn’t sound good, however it’s actually a matter of perspective.

Most of us gained’t starve. We adapt. And labels, finally, are simply labels. Let’s not get hung up on them.

Right now, I think about myself a part of the underclass as a result of I don’t have steady employment. There may be no upward mobility for me. At 48, it’s unlikely I may land a job able to comfortably supporting a household of 4 in San Francisco. All I’ve are my books and my investments.

If my spouse returned to work, finest case, we may earn a mixed $250,000 – $300,000 a yr. I’d assign a 20% chance. That may sound like so much elsewhere, however in San Francisco, ~$140,000 for a household of 4 qualifies as low revenue for sponsored housing and free childcare.

Extra realistically, our mixed lively revenue would prime out round $150,000–$200,000. To get there, I may very well be a tennis teacher making $70,000 – $90,000 a yr, whereas driving for Uber on the aspect. Perhaps my spouse may get a job as a grade faculty trainer making $65,000 – $100,000 a yr.

So as a substitute of striving 50 hours per week to climb additional up the socioeconomic ladder, being happy with what we’ve got could also be finest.

FIRE and the Underclass Might Be Two Sides of the Similar Coin

And but, I additionally consider myself FIRE, the motion I helped popularize beginning in 2009 whereas planning my escape from finance. Our passive and semi-passive revenue covers our fundamental residing bills.

Mockingly, these of us who’re FIRE are now not economically cell both, as a result of we’ve purposefully opted out. The longer we keep out of the labor market, the more durable it turns into to re-enter at a significant degree. In that sense, FIRE is a self-chosen model of the underclass.

Which is why labels matter far lower than we predict. We are able to name ourselves no matter most closely fits our mindset or life stage. FIRE. Underclass. One thing in between. No matter. So long as we’re surviving, we will name ourselves no matter we would like.

Why Escaping the Underclass Might Matter Much less Than We Assume

Most everlasting underclass arguments assume financial dignity should come primarily from paid labor. Fall behind within the labor market, and also you’re left behind in life.

That assumption ignores two main forces already reshaping outcomes.

- First, the enlargement of means-tested advantages.

- Second, the declining price of upward mobility

Means-Examined Advantages Are Growing

Many elite schools now supply free or free tuition for families earning under $200,000. That revenue would have positioned a family firmly within the higher center class a era in the past. Now, it is thought of low revenue, which is nice for now ~80% of households who make this a lot or much less.

With out having to save lots of $500,000 or extra for faculty, dad and mom achieve flexibility. They’ll retire earlier or select work that’s extra significant, even when it pays much less.

They’ll additionally redirect a few of that cash towards enhancing their lives right now, whether or not meaning extra journey, extra time with household, or just much less monetary stress.

Run the calculations your self and see what number of working years you reclaim by not having to save lots of so aggressively for faculty. The distinction could shock you.

Authorities assist now extends nicely past meals help to incorporate healthcare subsidies, youngster tax credit, housing assist, and training grants. In occasions of disaster, intervention has been swift and substantial – from PPP loans and stimulus checks to pressured mortgage modifications.

The federal authorities is already rolling out funding accounts for newborns. Over time, some type of common fundamental revenue (UBI) could emerge to additional stabilize baseline residing requirements. The federal government should in the event that they proceed to let AI run rampant, and if politicians need to keep energy.

These applications don’t make anybody wealthy, however they increase the ground and cut back draw back threat.

The Flooring Is Rising, Even because the Ceiling Compresses

If synthetic intelligence reduces conventional employment whereas society concurrently supplies training, healthcare, and fundamental safety at a decrease private price, the urgency to flee the underclass diminishes.

Not as a result of ambition disappears, however as a result of survival and dignity are now not as tightly tied to dominance within the labor market.

I went by means of the meat grinder in my earlier years, pushing as exhausting as I may to earn as a lot cash as attainable whereas the chance was there. Throughout that interval, I developed TMJ, sciatica, plantar fasciitis, persistent decrease again ache, and floor my molars practically flat. The bodily and psychological sacrifice required to maximise revenue took an actual toll.

That have helped me notice one thing necessary. Even when folks have sufficient, many can not assist however proceed sacrificing their time, well being, and peace of thoughts in pursuit of extra money and status. The ladder by no means feels tall sufficient as soon as you might be on it.

Nonetheless, given the labor market is weakening, it turns into simpler to let go. And when you’re off the standing ladder, you would possibly surprise why you climbed it for thus lengthy.

I see this dynamic not simply in my well being, however in my private life as nicely. Considered one of my biggest regrets is delaying having children by about 5 years as a result of I used to be overly targeted on my profession. Sure, elevating kids in San Francisco is dear. However I did not want not less than one million greenback internet price to take action.

If I had extra confidence that I wouldn’t slip by means of the online, I’d have proposed to my spouse and began a household sooner.

We Can Make investments In Our AI Overlords

We should not have to take a seat again and settle for getting disrupted by AI whereas its staff turn into terribly rich. Sure, it’s troublesome to land jobs on the prime AI corporations. However we will put money into them to keep away from getting let behind.

As soon as we turn into traders, the ability dynamic shifts. As an alternative of fearing displacement, we take part within the upside. The AI staff are actually working for us.

The bottom line is to construct sufficient publicity so your funding place resembles the fairness compensation of an worker.

For instance, think about a mid-level engineer at OpenAI earns a $350,000 base wage and holds $500,000 in firm inventory. In the event you strongly consider in OpenAI’s future, you can put money into an open-ended venture fund that owns OpenAI and construct a $500,000 proportional publicity your self instantly or over time.

You’ll not obtain the $350,000 base wage. However you additionally is not going to be working 50 hours per week beneath fixed efficiency strain.

One other method is to assemble your AI publicity as when you have been an entry-level worker throughout a number of corporations. Entry-level tech employees would possibly obtain roughly $50,000 in inventory grants. In case you have $500,000 in capital, you can allocate $50,000 into 10 promising AI corporations and diversify your ris.

Now that’s strategic investing the place you recreate a state of affairs the place you get the advantages of what a full-time AI worker would get with out having to work.

My AI Investing Hedge So Far

To this point, I’ve constructed over $700,000 in publicity by means of Fundrise Venture. About half of that whole has come from funding returns fairly than preliminary capital.

I do want I had invested extra in 2023 when valuations have been decrease. However I didn’t have that sort of liquidity on the time. As an alternative, I’ve been steadily allocating free money stream into the fund over the previous two and a half years. I additionally reinvested a few of my house sale proceeds from early 2025 into the fund.

On the identical time, I now acknowledge that I overfunded my kids’s 529 plans since 2017 and 2019. I used to be overly aggressive with superfunding and ongoing contributions, not anticipating how shortly AI would start compressing the worth of a conventional faculty diploma.

In hindsight, I most likely allotted about $250,000 an excessive amount of towards faculty financial savings. That capital may need been higher deployed into personal AI corporations with uneven upside.

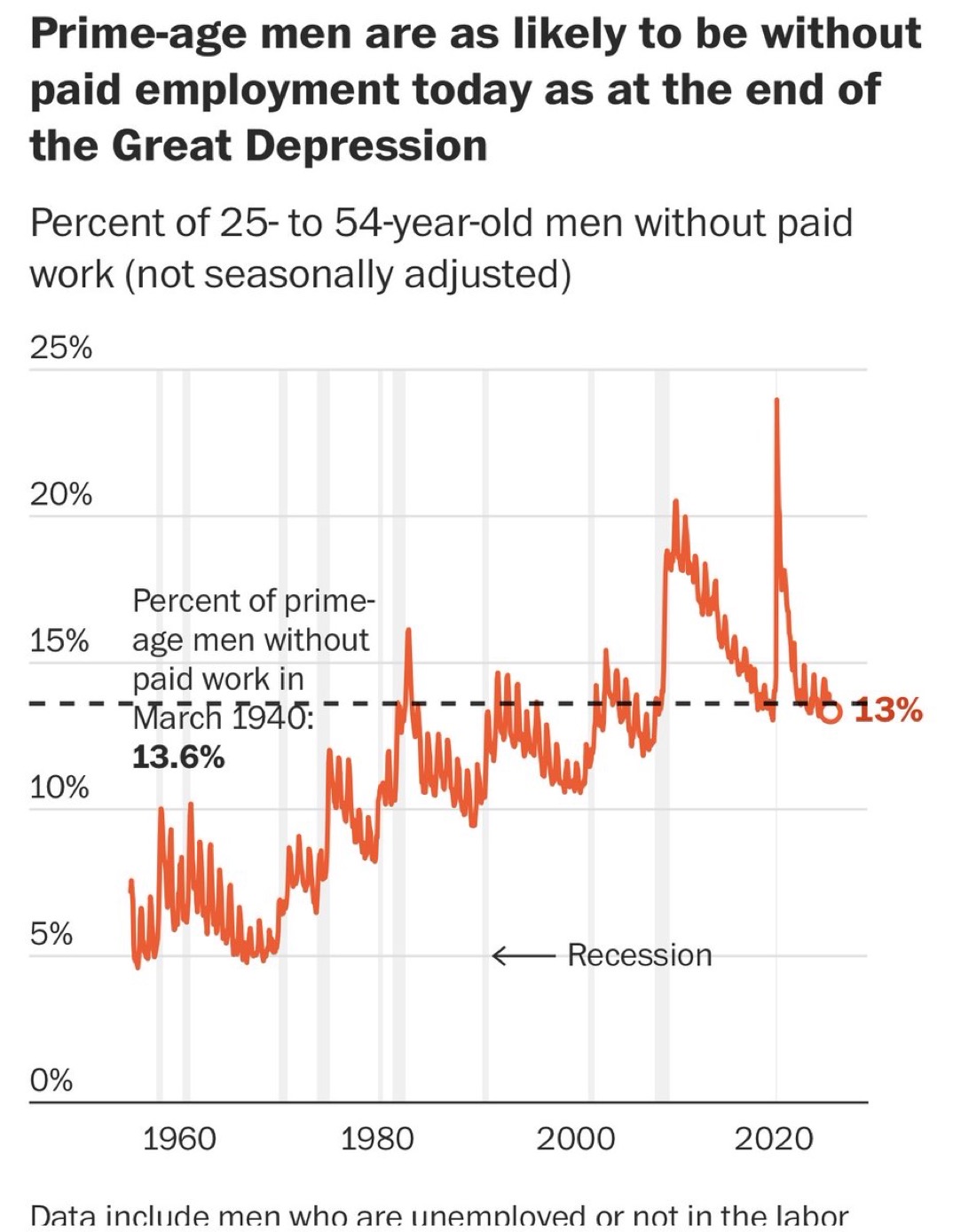

As this WSJ graphic photos reveals, the secret’s to INVEST more durable not work more durable. In the event you make investments more durable, your Return On Effort improves and so does life.

A Push Towards Larger Wealth or Larger Social Security Nets

There may be little doubt that AI will remove tens of millions of jobs over time. Instruments like Claude Code from Anthropic have already disrupted giant segments of the software program business. When an organization’s share value drops 40% in only a few months, layoffs are inevitable.

As an alternative of grinding endlessly in a dropping race, this path includes advocating for stronger social safeguards so folks can dwell with dignity even when conventional profession mobility declines. Meaning pushing governments and establishments to develop healthcare entry, training, housing assist, and baseline revenue safety.

Capital possession and scarce expertise will proceed to matter enormously in an AI-driven financial system. In the meantime, inequality will proceed to worsen. However falling out of the financial race is probably not the disaster many worry.

For some, opting out of hyper-competition could transform a rational selection, not a failure. Extra residing, much less grinding for extra money we don’t really want could turn into en vogue.

The Rise Of The FIRE Motion As soon as Extra

And if, after pondering by means of all of this, you continue to really feel a robust need to keep away from getting caught economically, then lean absolutely into the FIRE movement.

Minimize bills ruthlessly. Elevate your financial savings price to 50% or extra. Make investments aggressively and constantly. Deal with market volatility not as a menace, however as an opportunity to accumulate ownership within the very corporations reshaping the world.

For many who are particularly pushed, or maybe particularly anxious in regards to the future, purpose increased.

Construct sufficient investable property to generate enough passive revenue not simply in your family, however doubtlessly for your children’s future households as nicely. There’s something profoundly calming about understanding your loved ones is financially safe no matter how the labor market evolves.

If you attain that time, you’ll be able to observe the modifications introduced by AI with curiosity as a substitute of worry. You possibly can watch how industries remodel with out worrying whether or not your paycheck survives the transition.

Monetary independence doesn’t remove uncertainty.

However it offers you the area to navigate it with confidence. And which may be the last word benefit in an age of exponential change.

Reader Questions And Recommendations

Readers, do you think about your self a part of the underclass? Would being completely caught within the underclass be such a nasty factor if governments, establishments, and the wealthiest folks do extra to assist others? Are you contemplating taking work down a notch because of rising assist? Or do you propose to undertake the rules of FIRE to flee earlier than the gates shut?

Subscribe to the Monetary Samurai podcast on Apple or Spotify. Your opinions and shares are appreciated. To extend monetary independence sooner, be part of 60,000+ others and join the free Financial Samurai newsletter. This manner, you by no means miss a factor.