Danielle KayeEnterprise reporter

Reuters

ReutersChip big Nvidia beat Wall Road’s expectations for income and upcoming gross sales, easing investor issues about heavy synthetic intelligence (AI) spending which have unsettled markets.

In its quarterly earnings report on Wednesday, the agency stated income for the three months to October jumped 62% to $57bn, pushed by demand for its chips utilized in AI information centres. Gross sales from that division rose 66% to greater than $51bn.

Fourth-quarter gross sales forecasts within the vary of $65bn additionally topped estimates, sending shares in Nvidia about 4% increased in after-hours buying and selling.

Nvidia, the world’s most beneficial firm, is seen as a bellwether for the AI increase. The chip-maker’s outcomes may inform market sentiment.

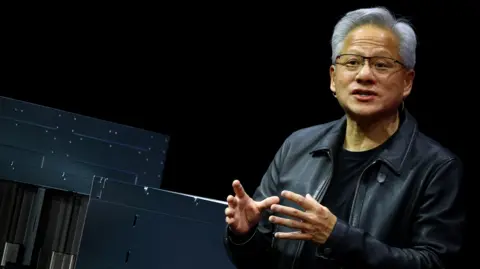

Chief government Jensen Huang stated in an announcement that gross sales of its AI Blackwell techniques had been “off the charts” and that “cloud GPUs [graphics processing units] are offered out”.

“There’s been quite a lot of speak about an AI bubble. From our vantage level, we see one thing very totally different,” he stated, on a name with analysts.

“We excel at each section of AI.”

The chip-maker’s quarterly report garnered much more consideration than regular on Wall Road amid mounting concern that AI shares are overvalued – fears which will persist regardless of Nvidia’s blockbuster outcomes.

These fears had fueled 4 consecutive every day drops within the S&P 500 index main as much as Wednesday, as questions swirl about returns on AI investments. The benchmark index has fallen practically 3% to this point in November.

The bar was excessive heading into Nvidia’s outcomes.

Adam Turnquist, chief technical strategist for LPL Monetary, stated the query was not whether or not the corporate would beat expectations, “however by how a lot”.

“Whereas AI valuations are dominating the information feeds, Nvidia goes about its enterprise in type,” stated Matt Britzman, senior fairness analyst at Hargreaves Lansdown.

He stated valuations for sure areas of the AI sector “wanted to take a breather, however Nvidia isn’t in that camp”.

Mr Huang had beforehand stated he anticipated $500bn in AI chip orders by means of subsequent 12 months. Buyers had been searching for particulars about when the corporate expects these revenues will come to fruition, and the way it plans to satisfy the orders.

Colette Kress, Nvidia’s chief monetary officer, advised analysts the corporate would “most likely” be taking extra orders on prime of the $500bn that had already been introduced.

However she additionally expressed disappointment about regulatory limits that stymie the corporate’s capacity to export its chips to China, saying the US “should win the assist of each developer” together with these in China.

She stated Nvidia was “dedicated to continued engagement” with the American and Chinese language governments.

EPA/Shutterstock

EPA/ShutterstockThe titans of the know-how sector are ramping up their spending on AI, as they rush to reap the advantages of a increase that has pushed shares to document highs.

Earnings reviews from Meta, Alphabet and Microsoft final month reaffirmed the colossal amounts of money these companies are shelling out for all the things from information centres to chips.

Sundar Pichai, the pinnacle of Google’s mother or father agency Alphabet, told the BBC that whereas the expansion of AI funding had been an “extraordinary second”, there was some “irrationality” within the present AI increase. His feedback got here amid different warnings from business leaders.

Nvidia, which makes chips which are essential for AI information centres, is on the coronary heart of an internet of offers amongst key gamers within the AI area equivalent to OpenAI, Anthropic and xAI.

The offers have drawn scrutiny for his or her round nature, as AI companies more and more put money into each other. The agreements embody Nvidia’s $100bn investment in OpenAI, the agency behind ChatGPT.