Housing safety is one thing I hope everybody will someday get hold of. As soon as you’re home safe, you possibly can extra simply focus in your profession, household formation, and different stuff you care about. Nonetheless, in case you lease for all times, it’s possible you’ll face housing insecurity, which might really feel particularly uncomfortable once you’re older or now not keen or capable of work.

In fact, I perceive why some individuals argue towards homeownership. They are saying it’s a poor funding, a problem, and ties you down. I get it.

However a lot of those that are anti-homeownership have additionally missed out on large property worth appreciation over time. Most have been renters their whole lives, whereas I’ve been each a renter and a home-owner. I’ve additionally made and misplaced cash from actual property. Nonetheless, I consider homeownership is the trail to constructing wealth for most individuals.

Real estate FOMO is simply as highly effective as investing FOMO. However as you campaign towards homeownership, attempt to bear in mind the common individual – somebody who values stability, might need to begin a household, and isn’t making a fortune promoting programs or constructing an internet empire.

As a savvy investor, you need to put money into property that outpace inflation over time. Housing is a kind of property.

Repair Your Dwelling Prices Sooner, Slightly Than Later

That will help you construct extra wealth, your objective ought to be to repair your residing prices as a lot as doable as a result of inflation is just too highly effective of a power to beat. And in case you ultimately change into a landlord, the mixture of rising rents and property prices will doubtless construct you an amazing quantity of wealth over time.

Conversely, as a renter, you’re successfully quick the housing market. The one approach you actually profit is that if rents and property costs decline. Whereas they do drop throughout each cycle, the long-term development is undeniably up as a result of persistent undersupply of housing and a rising inhabitants.

Simply because it’s unwise to quick the S&P 500 over the long term, it’s additionally unwise to quick the true property market indefinitely by renting. Time and inflation are inclined to work in favor of the proprietor, not the renter.

The federal government additionally offers a number of tax incentives for homeownership — from the mortgage curiosity deduction to depreciation to the $250,000/$500,000 in tax-free capital gains in case you promote. By way of constant compelled financial savings, you’ll progressively construct fairness and unlock money movement to put money into different threat property like shares, if you want.

A Tough State of affairs With Rising Rents in NYC

Let me share a state of affairs that reinforces why I don’t suggest renting indefinitely. It’s based mostly on my expertise helping a relative manage her finances – one thing I did at no cost and, in hindsight, carried emotional prices of its personal.

I’m witnessing the results of housing insecurity firsthand, even for somebody with a seven-figure funding portfolio, partially due to a long time spent renting.

For privateness, I’ve modified all the particulars. Nonetheless, the ratios and percentages are the identical.

12 months-Finish Monetary Evaluation Time

Every time I conduct a financial review, I don’t simply take a look at investments. That’s just one a part of the equation. To really assist somebody, you must perceive their goals, bills, retirement timeline, and life plans. You possibly can’t set monetary targets with out figuring out what’s going out the door every month.

My relative has lived in New York Metropolis for about 32 years. However she’s been feeling large cost-of-living stress as a result of her $3,800-a-month two-bedroom condominium has change into unaffordable given she solely earns about $30,000-a-year in its place instructor and different part-time jobs. The one approach she will be able to cowl lease is by drawing down from her investments.

Initially of the yr, she requested whether or not she ought to transfer to a smaller condominium in a much less fascinating space to save lots of. Usually, I might have stated sure. However as a result of she had round $1.63 million in varied investments (IRA, Roth, Taxable), $800,000 of which was taxable, I advised her to remain put for now. At 55, she deserved some stability after a number of strikes, together with leaving Manhattan to Queens to economize.

Primarily based on my comparatively constructive market initially of the yr, I felt her 60/40 portfolio, which I constructed with low-cost ETFs, may maintain her life-style for some time longer. Fortunately, 2025 turned out to be one other sturdy yr for the markets.

Now the Landlord Is Aggressively Raised the Lease

Sadly, she simply obtained discover her landlord will hike her lease subsequent yr from $3,800 to $5,200 a month. That improve pushes her annual bills from roughly $80,000 to about $100,000, factoring in inflation throughout different classes as nicely.

On the floor, spending $80,000 a yr when your earnings is barely $30,000 gross is extreme. Nonetheless, she’s been working, saving, and investing diligently for greater than 30 years. And as we age, most of us need to keep and even enhance our lifestyle, not in the reduction of.

Primarily based on her internet price and my market outlook initially of the yr, I believed sustaining her life-style was affordable for yet another yr. To be frank, I additionally did not have the center to inform her to downshift her life-style at her age. She has the web price at her age.

Nonetheless, the maths tells a more durable story.

To sustainably assist ~$100,000 in annual spending, you usually want between $2 million and $2.5 million invested, assuming a 4%–5% withdrawal fee. She’s shut, at ~$1.8 million complete with $880,000 in a taxable portfolio to attract from, however not fairly there.

And whereas the numbers may counsel she may make it work, the emotional actuality may be very totally different. It’s extremely laborious to withdraw $8,000–$10,000 a month out of your portfolio and watching your steadiness slowly decline. One 10% correction and such a withdrawal quantity would really feel inconceivable.

Get a Larger Paying Job or Downgrade Your Life-style

The rational answer is evident: minimize bills and enhance earnings. Sadly, discovering a higher-paying job at age 55 in a aggressive, age-sensitive job market is tough. She had been out of the workforce for years as a keep at residence mother.

Not less than, for yet another yr, she managed to get pleasure from a life-style that her funds didn’t totally justify, due to a roughly 10% portfolio acquire. It was a threat we took initially of 2025, that has paid off. However the grace interval is over. With a 35% lease improve looming and the S&P 500 buying and selling at 23X ahead earnings, it’s time to downgrade.

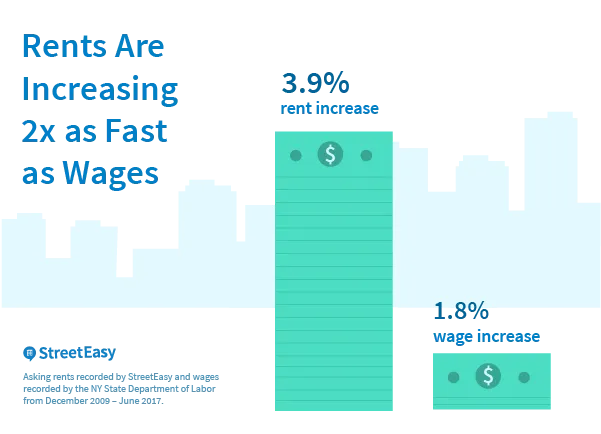

That is the unhappy actuality of lifelong renting. Over time, rents are inclined to rise quicker than wages and inflation. Ultimately, you get squeezed laborious sufficient that you must transfer — typically far-off from the neighborhood you’ve constructed.

Better Peace of Thoughts with Homeownership

If you personal your own home, you repair roughly 85% – 90% of your residing bills for so long as you personal it. You’re now not on the mercy of your landlord elevating lease or promoting the property. You might have housing safety – a type of peace that turns into more and more useful as you age and your profession power wanes.

As a result of let’s be trustworthy: as you become older, your need and ability to grind for income decline. In the event you take day trip of the workforce – for parenting, caregiving, or just burnout – it may be laborious to seek out one other well-paying job in a while.

Proudly owning your own home eliminates that uncertainty. It’s a monetary and emotional anchor.

Beneath is a tragic but fascinating chart exhibiting the rising median age of U.S. homebuyers. For first-time consumers, the median age is now 40.

You can argue this displays worsening housing affordability as renters are being compelled to save lots of longer earlier than they’ll purchase. However you possibly can simply as simply argue that this development underscores the worth of homeownership, given how a lot housing has appreciated over time.

After greater than 45 years of the median homebuyer age steadily rising, do we actually suppose this development will reverse anytime quickly? Unlikely. Demand continues to outpace provide, and extra foreign real estate buyers are scooping up what nonetheless appears to be like like cheap U.S. actual property in comparison with their residence markets.

Simply take a look at what has occurred in Canada, the place the federal government overtly allowed international consumers to buy actual property, typically with illicit funds, for many years. Consequently, foreigners helped drive costs to ranges that turned unaffordable for a lot of native residents.

When there are large monetary incentives at play, it’s laborious for some politicians to do the proper factor. Ultimately, in case you don’t see the worth in proudly owning U.S. property, another person will. Don’t depend on power-hungry strive politicians that can assist you.

Please Don’t Lease Without end If You Don’t Have To

My relative may have purchased a two-bedroom condominium 8–10 years in the past. I want we’d have had a monetary session again then. She selected the pliability of renting as a substitute. Had she bought again then, her month-to-month housing prices would now be comparatively fastened, and her condominium would doubtless be price 20%–40% extra. Not a implausible return in comparison with the S&P 500, however a fantastic trade-off for stability plus appreciation on a big asset.

If you already know the place you need to stay for a minimum of 5 years — ideally 10 — purchase as a substitute of lease. Inflation is just too highly effective to fight indefinitely, and lease will increase don’t cease for anybody.

Maybe if housing prices proceed to soar, new political management will step in with more practical options. However I wouldn’t rely on it. Relying on the federal government to save lots of you is an unstable technique. Relying on your self, however, is the inspiration of economic freedom.

Ultimately, proudly owning your own home isn’t nearly cash. It’s about peace, dignity, and management of your life. And in case you can safe that for your self, your loved ones, and your future, why wouldn’t you?

Construct Your Fortress Whereas You Can

Life is unpredictable, and all of us face totally different monetary and private challenges. However the one factor we are able to management is how a lot we rely on others for our fundamental wants. Shelter is foundational. When you safe it, every thing else—profession, household, goal—turns into simpler to handle.

Whether or not you select to lease or purchase, the hot button is to make a aware, numbers-based determination. Simply know that, paradoxically, the longer you lease, the more durable it turns into to interrupt free.

Listed below are 5 actionable steps to maneuver nearer to housing safety:

1) Run your lease vs. purchase numbers yearly.

Don’t depend on previous assumptions. Plug your lease, earnings, and native residence costs right into a calculator to see the place the crossover level lies. When lease inflation is factored in, possession typically wins before anticipated.

2) Suppose in a long time, not months.

In the event you plan to remain put for a minimum of 5 years, shopping for normally is smart. Actual property rewards time and endurance, not market timing.

3) Save aggressively for a down fee.

Deal with your down fee fund like an funding in freedom. Even in case you don’t purchase straight away, that financial savings cushion builds optionality and self-discipline.

4) Purchase what you possibly can comfortably afford.

You don’t want your dream residence proper out of the gate. A modest, well-located property that retains your month-to-month bills secure is usually the perfect wealth builder. Please comply with my 30/30/3 rule for home buying.

5) Don’t depend on luck, politicians, or anybody else.

Markets shift. Insurance policies change. Guarantees fade as politicians promise the world to get into energy. However proudly owning your own home provides you management over certainly one of life’s greatest variables—your value of residing. It’s a private hedge towards uncertainty.

Backside line: If you should buy and maintain for the long run, do it. Renters should continually adapt to the market, whereas householders ultimately let the market adapt round them.

Construct your fortress when you can, as a result of when you do, you’ll have the inspiration to stay the life you actually need.

Readers, what are your ideas on renting for all times? In the event you’ve been a lifelong renter, do you consider you’ve constructed extra wealth than in case you had bought a major residence? Have you ever ever been compelled to maneuver as a result of your landlord imposed an aggressive lease hike? And why do you suppose some individuals who’ve by no means owned a house are so strongly towards homeownership when there may be a lot knowledge exhibiting the median internet price of a home-owner is much higher?

Make investments In Actual Property Passively

In the event you can’t purchase a house but, don’t sit on the sidelines whereas housing costs and rents hold rising. You possibly can nonetheless take part in the true property market and construct wealth over time — without having to give you an enormous down fee.

That’s why I’ve invested with Fundrise, a platform that permits on a regular basis traders to realize publicity to residential and industrial properties nationwide. With over $3 billion in property underneath administration and 350,000+ traders, Fundrise makes it simple to personal a bit of the true property market that continues to compound in worth.

Actual property has traditionally been top-of-the-line methods to hedge towards inflation and develop wealth passively. And with a minimal funding of solely $10, anybody can begin investing right now.

Fundrise has been a long-time sponsor of Monetary Samurai as a result of our philosophies align — constant, disciplined investing in tangible property to construct monetary freedom.