Chris BaraniukKnow-how Reporter

Boston Steel

Boston SteelAn exercise centre for infants and toddlers, an Indian restaurant, an indoor golf centre – and a mini experimental metal plant. These companies are amongst those who make up a small retail and industrial property within the metropolis of Woburn, Massachusetts.

“Individuals are dropping off their children. That type of reveals you an excessive instance of what the way forward for metal seems like,” says Adam Rauwerdink, vice chairman of enterprise improvement at US-based inexperienced metal start-up, Boston Steel. “You could be making metal and sharing a car parking zone with a daycare.”

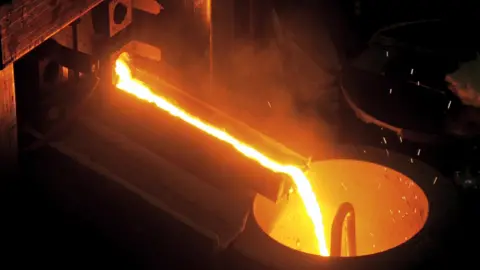

Boston Steel has give you a means of utilizing electrical energy to take away oxides and different contaminants from iron ore, which is the substance it’s important to mine from the Earth earlier than you may make new metal.

The method entails distributing the ore inside an electrolyte after which utilizing electrical energy to warmth this combination to 1,600C. Molten iron then separates from impurities and could be tapped off.

Historically, extracting that all-important iron from ores requires blast furnaces that run on fossil fuels. However the iron and metal trade are responsible for 11% of worldwide emissions – an enormous quantity, equal to all the world’s private cars and vans – and so now a race is on to search out greener methods of manufacturing these necessary metals.

US firms are, arguably, on the forefront. Steelmaking within the US is already greener than in lots of international locations, due to the recognition of electric arc furnaces there. These furnaces use electrical energy, not warmth from burning fossil fuels, to soften scrap metal – for instance – and recycle it.

Plus, a handful of rising start-ups equivalent to Boston Steel say they will go one higher and use electrical energy for the iron-making course of, an important step in making model new, or virgin, metal.

Nevertheless, the Trump administration has taken a less than enthusiastic stance in the direction of renewable power and decarbonisation initiatives. It stays to be seen whether or not these new start-ups will make an enormous, molten splash within the metal trade any time quickly.

Switching from conventional blast furnaces to electrical arc furnaces can lower carbon emissions per tonne of metal produced from 2.32 tonnes of CO2 to 0.67 tonnes of CO2.

For iron-making, some crops might use inexperienced hydrogen – made utilizing electrical energy from 100% renewable sources – says Simon Nicholas, lead metal analyst on the Institute for Vitality Economics and Monetary Evaluation.

However switching iron and steel-making crops over to inexperienced hydrogen hasn’t gone as easily as some had anticipated.

In June, Cleveland-Cliffs, a significant US metal producer, appeared to back away from its plans to construct a $500m (£375m) hydrogen-powered metal plant in Ohio. The BBC has contacted Cleveland-Cliffs for remark.

“We’re seeing initiatives cancelled, proponents pulling out of initiatives everywhere,” says Mr Nicholas, of inexperienced hydrogen initiatives, particularly.

Bloomberg through Getty Photos

Bloomberg through Getty PhotosPlus, there’s a restrict to how a lot steel-making can depend on electrical arc furnaces since they at the moment largely rely on a supply of scrap metal.

A comparatively low provide of scrap metal in China, versus demand, has slowed the rollout of electrical arc furnaces there, according to some analyses.

These complications would recommend that there’s a area of interest for firms growing alternative routes of creating iron and metal. Boston Steel is one.

“It seems rather a lot like how we make iron and metal at present – it is rather a lot simpler to conceive how that will get to scale [as a result],” says Paul Kempler, an skilled in electrochemistry and electrochemical engineering on the College of Oregon.

Nevertheless, he notes that there are nonetheless challenges in guaranteeing that electrolysis programs like this do not corrode too shortly over time. Boston Steel says it hopes to have its first demonstration-scale metal plant operational by 2028.

Electra

ElectraIndividually, the US agency Electra is taking a unique method to producing extremely purified iron from ores. Not like Boston Steel, Electra’s course of runs at a comparatively low temperature, round 60-100C. First, iron ore is dissolved into an acidic answer after which {an electrical} cost causes the iron to gather onto metallic plates. That is just like the method at the moment used for making sheets of copper and zinc at present.

“These plates are extracted mechanically out of the answer and the iron is harvested,” says Sandeep Nijhawan, co-founder and chief govt. An indication plant in Colorado, which might produce 500 tonnes of iron yearly, is at the moment set to open subsequent yr.

Initially, iron produced on this method would value greater than iron made utilizing conventional strategies. However that “inexperienced premium” might fall away ought to the corporate be capable to scale sufficiently, says Mr Nijhawan.

Bloomberg through Getty Photos

Bloomberg through Getty PhotosMr Nicholas says that rising applied sciences equivalent to this are hopeful, however one problem they face is in breaking into the market in an enormous means inside only a few years, since the necessity to slash emissions and curb local weather change is turn into an increasing number of pressing: “We’re working wanting time for addressing carbon emissions.”

Corporations equivalent to Electra and Boston Steel provide a totally completely different imaginative and prescient of the steel-making trade however they will not get far with out additional funding – and a market that appreciates what they’re doing.

President Donald Trump’s tariffs on metal imports to the US are supposedly designed to guard the home metal trade – and but they threat elevating the price of metal considerably for US clients.

I ask whether or not Dr Rauwerdink, for one, is blissful to see this transfer, or not. “We’re fairly blissful to see the sturdy give attention to important metals,” he says, arguing the tariffs are “helpful” for Boston Steel.

Although he acknowledges that US authorities’s perspective in the direction of renewable electrical energy, which Boston Steel says it need to prioritise as an power supply, has modified recently. And, globally, maintaining the price of renewable power low is necessary for any agency hoping to impress industries beforehand dominated by fossil fuels.

“The trade has rising pains there, for certain,” he says.