Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Again in his 1996 letter to shareholders, Warren Buffett famously wrote: “Should you aren’t keen to personal a inventory for 10 years, don’t even take into consideration proudly owning it for 10 minutes.”

That assertion solely makes the latest homebuilder inventory purchases and gross sales by Berkshire Hathaway—led by Buffett, who will step down as CEO on the finish of 2025—much more eyebrow-raising.

Right here’s the timeline.

- August 2023: Berkshire Hathaway disclosed that in Q2 2023, the corporate made a guess on U.S. homebuilders and acquired 5,969,714 shares of D.R. Horton, 152,572 shares of Lennar, and 11,112 shares of NVR.

- February 2024: Berkshire Hathaway disclosed that in This autumn 2023, the corporate had offered off 5,969,714 shares of D.R. Horton—the overwhelming majority of Buffett’s massive homebuilder guess he made early in 2023.

- August 2025: Berkshire Hathaway disclosed that in Q2 2025 (the three months ending June 30), the corporate made a guess on U.S. homebuilders by buying round 1.5 million shares of D.R. Horton (valued at round $191.5 million). Within the first half of 2025, Berkshire Hathaway acquired simply over 7 million shares of Lennar, valued at almost $800 million.

- November 2025: Berkshire Hathaway disclosed that it has offered its D.R. Horton stake of round 1.5 million shares.

Whereas Berkshire Hathaway has offered off its shares of D.R. Horton (No. 123 on the Fortune 500), it nonetheless owns round 7.2 million shares of Lennar (No. 129 on the Fortune 500) and round 11,112 shares of NVR (No. 396 on the Fortune 500), in keeping with ResiClub’s overview of Berkshire Hathaway’s newest SEC filings.

Given Buffett’s personal recommendation—“Should you aren’t keen to personal a inventory for 10 years, don’t even take into consideration proudly owning it for 10 minutes”—it’s most likely honest to keep away from drawing sweeping long-term housing market conclusions from Berkshire Hathaway’s homebuilder inventory trades over the previous two years. In spite of everything, the agency purchased them, offered them, purchased them once more, and offered them 4 instances in simply over a two-year window.

That mentioned, in case you compelled me to invest, I’d guess Berkshire Hathaway initially eyed homebuilder shares within the first half of 2023, after their sharp pullback in 2022, as builders adjusted to the speed shock. However heading into 2024, Berkshire Hathaway could have gotten chilly toes on homebuilders as an extended maintain, because it grew to become clear that the housing market’s early-2023 firming was a little bit of a head pretend—and {that a} greater energy shift towards consumers, additional housing-market softening, and extra homebuilder margin compression had been nonetheless forward.

After that performed out, earlier this 12 months, Berkshire Hathaway could have concluded that almost all of that margin compression had already been priced in and that it needed again in on homebuilders.

That hypothesis does go away one remaining query: Why would Berkshire Hathaway now unload D.R. Horton whereas nonetheless holding onto Lennar and NVR?

First, D.R. Horton’s inventory has had a stronger bounce-back over the previous few months, whereas Lennar and NVR haven’t. (Maybe Berkshire Hathaway believes that bounce-back nonetheless awaits.) So it may not be that D.R. Horton has fallen out of favor with Berkshire Hathaway, however as a substitute merely that D.R. Horton’s inventory has already priced in a lot of its short-term upside.

Second—and that is me studying deep between the strains—maybe Berkshire Hathaway likes that Lennar has been extra aggressive throughout this gentle window in taking market share. Whereas all the general public homebuilders that ResiClub tracks have compressed revenue margins over the previous three years to supply bigger incentives and affordability changes in an try and keep away from a sharper pullback in housing begins, Lennar has been the most aggressive on that front.

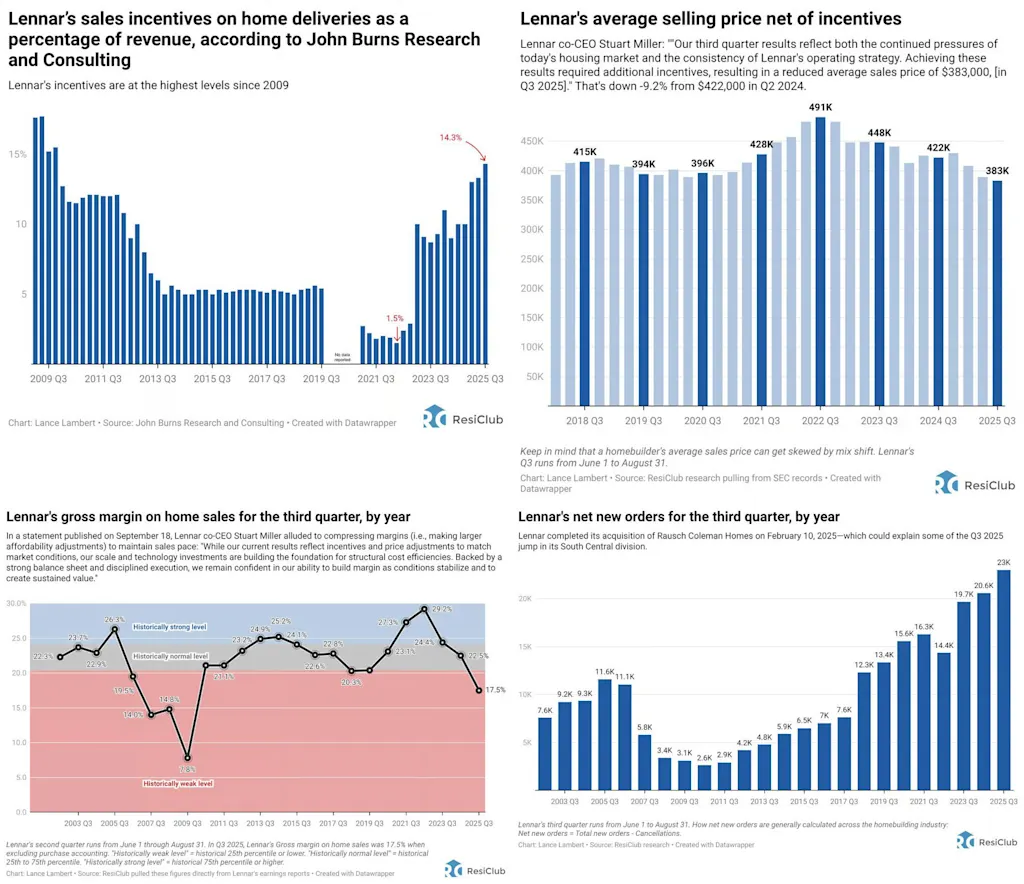

In reality, Lennar has compressed its margins all the best way again to 2009 ranges, and is spending the equal of roughly 14.3% p.c of ultimate gross sales on incentives (in contrast with the standard 5% to six% in regular instances) in an effort to develop residence gross sales and seize market share.

In September 2025, Lennar executives acknowledged that it’s lastly “time to pause [that strategy] and let the market catch up a little bit.” That doesn’t imply they’re fully reversing course or shedding the market share they’ve lately gained whereas utilizing the technique. As a substitute, it means they will’t be as aggressive in early 2026 in pursuing further market share, given how a lot margin compression they’ve already absorbed.

Some buyers, together with Berkshire Hathaway, may like that Lennar has pursued a much bigger market share by means of this uneven stretch and is now beginning to defend margins.

Right here’s what Stuart Miller, co-CEO of Lennar, mentioned throughout the firm’s September 19, 2025, earnings name:

“For Lennar, that is an opportune time to pause and let the market catch up just a little bit. Although mortgage charges started to pattern downward towards the tip of the quarter, stronger gross sales haven’t but adopted. We have now actually begun to see early indicators of larger buyer curiosity and stronger visitors coming into the market. With decrease mortgage charges, purchasers are displaying larger curiosity in contemplating their residence buy. And that is typically an early sign of stronger gross sales exercise to comply with, assuming charges stay decrease.

And if rates of interest proceed to fall, we’re fairly optimistic that this all will occur quickly. The prolonged interval of upper rates of interest for longer than anticipated compelled us, nonetheless, to regulate development prices [lower average sales price] in an effort to allow gross sales in tough market circumstances. Our decrease development value construction, along with diminished margin [bigger incentives], enabled us to fulfill affordability and help the supply-and-demand stability.

We drove gross sales tempo to match manufacturing tempo, and we fortified our market share and place in every of our strategic markets. We are actually located with a decrease value construction, environment friendly product choices, and robust market positions to accommodate pent-up demand as charges reasonable and confidence in the end returns. As I mentioned earlier than, that is the proper time. That is simply the proper time for us to tug again just a bit bit.

We imagine that we’ve gotten forward of the present market realities, and we now have constructed what we imagine is a stronger long-term margin-driving platform. We all know that this has taken a while because the market has remained weaker for longer, however we additionally know that our technique has helped construct a more healthy housing market and has positioned Lennar for robust money circulate and bottom-line development sooner or later.

Whereas our deliveries had been slightly below our aim for the quarter, and whereas we offered extra houses than anticipated throughout the quarter, these accomplishments got here on the expense of additional deterioration of margin, which got here all the way down to 17.5%. Accordingly, we’re going to start to ease again our supply expectations for the fourth quarter and full 12 months in an effort to relieve the strain on gross sales and deliveries and assist set up a flooring on margin. We are going to scale back our supply expectations for the fourth quarter to 22,000 to 23,000 houses, and we’ll scale back our full-year expectation to 81,500 to 82,500.”

Along with the Lennar and NVR homebuilder shares that Berkshire Hathaway nonetheless owns, the agency additionally absolutely owns Clayton Properties—the most important U.S. builder of manufactured and modular houses—and HomeServices of America, a Berkshire Hathaway affiliate (underneath Berkshire Hathaway Power) that provides a variety of actual property companies together with brokerage, mortgage origination, and title and escrow.