If healthcare in America weren’t so egregiously costly, extra individuals would retire earlier and dwell higher, happier lives. We’re one of many few international locations on the earth the place inexpensive healthcare is tied to employment, making monetary independence that a lot tougher to attain.

Given the excessive value of protection, earlier than you determine to retire early by alternative, attempt to negotiate a severance package and use your ultimate yr of labor to get in one of the best form of your life. Consider it as investing in your future well being dividends. The stronger and more healthy you might be, the much less probably you’ll have to depend on pricey medical care. As well as, the longer you possibly can stretch your freedom {dollars}.

My Determination To Voluntarily Retire Early Whereas Contemplating Healthcare Prices

Once I voluntarily retired in 2012, one in all my largest considerations was determining the way to pay for healthcare. For 13 years, my employers had backed a portion of my premiums via a gaggle plan. As an alternative of paying $850 a month for protection, I used to be solely paying round $375 towards the top.

So once I left work, after my 6 months of 100% subsidies healthcare ran out as a part of my severance bundle, I confronted an $850 month-to-month invoice as a wholesome 34-year-old who barely used the system. It felt extreme and I wanted a plan.

On the time, I requested my 31-year-old spouse to not YOLO her profession away with me. As an alternative, I inspired her to embrace equality and hold working one other three years to make sure my seemingly reckless transfer wouldn’t put our family in monetary jeopardy. Fortunately, she agreed.

Throughout that point, she maintained her employer-sponsored healthcare plan, which additionally lined me. A lot of her colleagues had household protection anyway, so becoming a member of her plan was completely regular.

Our Price For Healthcare Is Costly

In 2015, at age 34, we lastly initiated the method of engineering her own layoff as a high-performer to obtain a severance bundle. We knew we’d lose our healthcare subsidy and need to pay about $1,680 a month, however this was a aware alternative we made in change for freedom. It felt improper to govern our revenue simply to qualify for presidency healthcare subsidies once we may afford to pay full value.

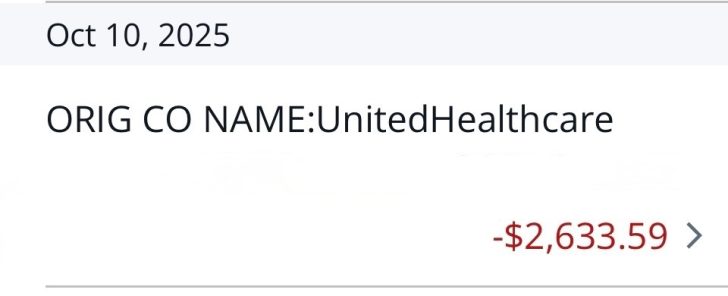

At present, for our family of 4, we pay $2,633.59 a month in unsubsidized premiums for a Silver plan, not even a Gold or Platinum plan. $2,633.59 does not sound inexpensive to me, regardless of the federal government calling it the “Inexpensive Care Act.” However the best way the system works is that those that make greater than 400% of the Federal Poverty Restrict subsidize those that don’t.

In essence, now we have a excessive deductible medical insurance plan. I am hoping my new funding in value stock UnitedHealthcare will assist us pay for our premiums sooner or later.

Loads of Millionaire Early Retirees Get Subsidies

The fact is, loads of early retirees reap the benefits of healthcare subsidies—even if they’re millionaires or multi-millionaires. Some even brag about it on-line. That’s all the time rubbed me the improper means, as a result of I doubt the federal government’s intent was to subsidize the highest 10% of wealth holders. Or possibly it was.

For instance, let’s say you could have a $2 million portfolio producing $80,000 a yr in revenue. As twin unemployed dad and mom (DUPs) with two kids, your family revenue is round 250% of the Federal Poverty Degree (FPL), which qualifies you for healthcare subsidies. Keep in mind, subsidies lengthen all the best way as much as 400% of the FPL.

Which means a family with a $5 million growth-stock-heavy portfolio incomes solely a 1.3% dividend yield—roughly $65,000 a yr—would sit round 210% of the FPL and qualify for a 50%+ low cost on healthcare premiums. Fairly unbelievable!

The Debate in Congress Over Extending Healthcare Subsidies

Congress is presently debating whether or not to lengthen the improved healthcare subsidies for households incomes above 400% of the Federal Poverty Degree. Democrats need to make the non permanent enlargement everlasting, whereas Republicans want reverting to the unique guidelines.

The American Rescue Plan Act of 2021, below the Democrats, briefly raised the worth of the premium tax credit and expanded eligibility past 400% of FPL. These “enhanced” subsidies capped a family’s premium prices at 8.5% of revenue.

Then, in 2022, the Inflation Discount Act, below the Democrats, prolonged these enhanced subsidies via 2025. Now they’re set to run out on the finish of 2025 below the Trump administration.

In keeping with the Congressional Budget Office, extending these enhanced subsidies would value about $350 billion over 10 years, or $35 billion a yr. Not nice given the scale of the prevailing price range deficit.

Prices Reverting Again To The Previous Trajectory

With out the extension, the common 60-year-old couple making $85,000 a yr (simply over 400% of FPL) would see premiums soar by $1,900 a month, or almost $23,000 a yr in 2026, based on KFF. If true, that’s an egregious quantity to pay below the “Inexpensive Care Act.” Nevertheless, that additionally means the 60-year-old couple has had at the very least $91,200 in healthcare subsidies for the reason that American Rescue Plan Act of 2021 handed.

If that $91,200 in healthcare subsidies was saved or invested since 2021, as all renters say they do to justify not shopping for a main residence, they’ve sufficient to pay for the subsequent 4 years of upper healthcare premiums. At the least, that is how private finance lovers suppose.

Preventing to Maintain Subsidies for Early Retiree Millionaires Feels Off

However does not arguing for extra healthcare subsidies for millionaires really feel just a little off to you? In the event you make $85,000 a yr as a retired couple, meaning your pension or investments are value $2,125,000 at a 4% protected withdrawal fee! Most individuals would argue you may be alright, particularly you probably have no debt. And should you’re an early retiree with that sort of web value, then receiving subsidies appears fully unusual.

CNBC lately profiled a “early retiree” couple, Invoice (61) and Shelly (59), who will earn $127,000 a yr in pension revenue in 2026—above the 400% FPL threshold. Their premiums would rise from $442 a month to $1,700, which sounds extra reasonable than KFF’s above estimate. That’s painful, however they’ve additionally loved roughly $70,000 in enhanced premium tax credit since 2021.

Nonetheless, a $127,000 pension is value roughly $3.2 million in annuity worth at a 4% fee of return. Ought to the ACA actually be subsidizing retirees with multimillion-dollar pensions and portfolios? Assets ought to give attention to these with out six-figure pensions or significant savings. You realize, the ~85% of Individuals who do not have lifetime pensions.

Nobody in America ought to undergo from a well being disaster just because they will’t afford care. Healthcare is a fundamental proper. So shifting the healthcare subsidies to the decrease center class and poorer makes extra logical sense.

Capitalize The Worth Of Your Pension And Funding Earnings

Now I’m beginning to marvel — do the common American, monetary reporter, or politician not know the way to capitalize the worth of an revenue stream to find out its true value? We do that on a regular basis in finance, and on Monetary Samurai. Merely take an affordable fee of return or withdrawal fee—say 4% or 5%—and divide your pension or funding revenue by that quantity.

Let’s discover out the capitalized value of a pension primarily based on varied Federal Poverty Degree (FPL) revenue limits for a household of 4:

- $31,200 (100% of FPL): $624,000 – $780,000 pension worth. You’ll probably qualify for 100% subsidies and pay 0% of your revenue towards healthcare premiums.

- $43,056 (138% of FPL): $861,120 – $1,076,400 pension worth. You’ll probably pay 0–2% of revenue towards premiums after subsidies — roughly $0 to $50/month for a Silver plan in lots of states.

- $46,800 (150% of FPL): $936,000 – $1,170,000 pension worth. You’ll probably pay 1–2% of revenue, or about $0 to $50/month for a Silver plan.

- $62,400 (200% of FPL): $1,248,000 – $1,560,000 pension worth. Anticipate to pay 2–2.5% of revenue, roughly $50 to $80/month.

- $78,000 (250% of FPL): $1,560,000 – $1,950,000 pension worth. You’ll probably pay round 4% of revenue, or $180–$220/month.

- $93,600 (300% of FPL): $1,872,000 – $2,340,000 pension worth. You’ll probably pay about 6% of revenue, or $300–$350/month for a Silver plan.

- $124,800 (400% of FPL): $2,496,000 – $3,120,000 pension worth. You’ll probably pay as much as 8.5% of revenue, or roughly $450–$550/month for a Silver plan.

In case you have a lifetime pension or passive funding revenue that generates $31,200 a yr or extra (100% of FPL), you are doing fairly nicely in comparison with the common employee or retiree. Therefore, to pay little-to-nothing in direction of the healthcare system appears off.

Adapting to the System Of Embracing The Rich

That mentioned, we should always take a look at this debate as a mirrored image of the occasions and adapt accordingly. Simply as we apply identity diversification relying on who’s in energy, we will lean into our wealth when the federal government decides to subsidize the rich.

If the federal government desires handy out healthcare subsidies to six-figure pensioners and multi-millionaires, then the rational economist in me says: take the free cash. In spite of everything, most politicians are over 40 and already rich, so it’s solely pure they design insurance policies that benefit their own demographic.

Nevertheless, political winds all the time shift. After they do, and policymakers refocus on serving to the true center class and poor, it’ll as soon as once more be time for the rich to pay full freight.

Will Proceed To Pay Full Freight To Assist America

With our current level of passive income, we’ll by no means qualify for healthcare subsidies. Our family bills are additionally too excessive to artificially decrease our revenue. And that’s most likely the way it ought to be. For the better good of society!

Within the meantime, I’ll hold doing my finest to remain in form so I can subsidize and make room for many who can’t or gained’t. Simply because it’s a privilege to pay taxes to help those that pay much less or none in any respect, it’s additionally a privilege to be wholesome sufficient to assist offset the prices for many who aren’t.

Readers, do you suppose the federal government ought to be preventing to offer healthcare subsidies for the rich? Or is it irresponsible to increase these enhanced tax credit given our huge price range deficit? The place ought to we draw the road in terms of providing healthcare subsidies?

Advice To Defend Your Life

In addition to recurrently understanding and maintaining a healthy diet to increase your life, you also needs to get an inexpensive time period life insurance coverage coverage to guard it.

Each my spouse and I received matching 20-year time period insurance policies via Policygenius. Merely enter your data and also you’ll obtain actual quotes from vetted life insurance coverage carriers inside minutes. In case you have debt and dependents, getting life insurance coverage is likely one of the most accountable issues you are able to do.

Subscribe To Monetary Samurai

Decide up a replica of my USA TODAY nationwide bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of monetary expertise that will help you construct extra wealth than 94% of the inhabitants and break away sooner. As you possibly can inform from my publish, the federal government loves millionaires by showering them with healthcare subsidies.

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and talk about a few of the most attention-grabbing matters on this website. Your shares, scores, and evaluations are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Financial Samurai newsletter. It’s also possible to get my posts in your e-mail inbox as quickly as they arrive out by signing up here.

Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. All the pieces is written primarily based on firsthand expertise and experience.