BBC

BBCThe US has “dropped the ball” on chip manufacturing over time, permitting China and different Asian hubs to steam forward. So stated Gina Raimondo, who on the time was the US Commerce Secretary, in an interview with me again in 2021.

4 years on, chips stay a battleground within the US-China race for tech supremacy, and US President Donald Trump now needs to turbocharge a extremely advanced and delicate manufacturing course of that has taken different areas many years to good.

He says his tariff coverage will liberate the US economic system and convey jobs residence, however it’s also the case that a number of the largest firms have lengthy struggled with a scarcity of expert staff and poor-quality produce of their American factories.

So what is going to Trump do in a different way? And, provided that Taiwan and different elements of Asia have the key sauce on creating high-precision chips, is it even doable for the US to provide them too, and at scale?

Making microchips: the key sauce

Semiconductors are central to powering every little thing from washing machines to iPhones, and army jets to electrical autos. These tiny wafers of silicon, often called chips, had been invented in the USA, however at this time, it’s in Asia that probably the most superior chips are being produced at phenomenal scale.

Making them is pricey and technologically advanced. An iPhone for instance might include chips that had been designed within the US, manufactured in Taiwan, Japan or South Korea, utilizing uncooked supplies like uncommon earths that are largely mined in China. Subsequent they could be despatched to Vietnam for packaging, then to China for meeting and testing, earlier than being shipped to the US.

Getty Photographs

Getty PhotographsIt’s a deeply built-in ecosystem, one which has developed over the many years.

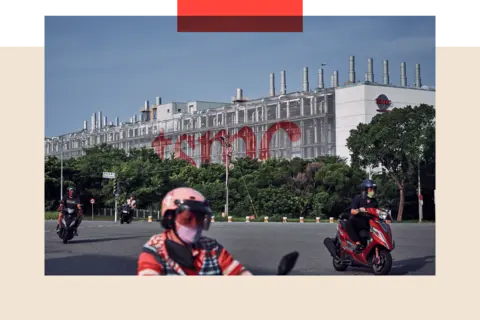

Trump has praised the chip business but in addition threatened it with tariffs. He has instructed business chief, Taiwan Semiconductor Manufacturing Firm (TSMC), it must pay a tax of 100% if it didn’t construct factories within the US.

With such a fancy ecosystem, and fierce competitors, they want to have the ability to plan for greater prices and funding calls in the long run, nicely past Trump’s administration. The fixed adjustments to insurance policies aren’t serving to. Thus far, some have proven a willingness to spend money on the US.

The numerous subsidies that China, Taiwan, Japan and South Korea have given to non-public firms creating chips are a giant cause for his or her success.

That was largely the considering behind the US Chips and Science Act, which turned legislation in 2022 underneath President Joe Biden – an effort to re-shore the manufacture of chips and diversify provide chains – by allocating grants, tax credit, and subsidies to incentivise home manufacturing.

Getty Photographs

Getty PhotographsSome firms just like the world’s largest chipmaker TSMC and the world’s largest smartphone maker Samsung have turn into main beneficiaries of the laws, with TSMC receiving $6.6 billion in grants and loans for crops in Arizona, and Samsung receiving an estimated $6 billion for a facility in Taylor, Texas.

TSMC introduced an extra $100 billion funding into the US with Trump, on high of $65 billion pledged for 3 crops. Diversifying chip manufacturing works for TSMC too, with China repeatedly threatening to take management of the island.

However each TSMC and Samsung have confronted challenges with their investments, together with surging prices, problem recruiting expert labour, building delays and resistance from native unions.

“This is not only a manufacturing unit the place you make containers,” says Marc Einstein, analysis director at market intelligence agency Counterpoint. “The factories that make chips are such high-tech sterile environments, they take years and years to construct.”

And regardless of the US funding, TSMC has stated that almost all of its manufacturing will stay in Taiwan, particularly its most superior laptop chips.

Did China attempt to steal Taiwan’s prowess?

At this time, TSMC’s crops in Arizona produce high-quality chips. However Chris Miller, writer of Chip Conflict: The Struggle for the World’s Most Important Know-how, argues that “they seem to be a era behind the innovative in Taiwan”.

“The query of scale is dependent upon how a lot funding is made within the US versus Taiwan,” he says. “At this time, Taiwan has much more capability.”

The fact is, it took many years for Taiwan to construct up that capability, and regardless of the specter of China spending billions to steal Taiwan’s prowess within the business, it continues to thrive.

Getty Photographs

Getty PhotographsTSMC was the pioneer of the “foundry mannequin” the place chip makers took US designs and manufactured chips for different firms.

Driving on a wave of Silicon Valley start-ups like Apple, Qualcomm and Intel, TSMC was capable of compete with US and Japanese giants with one of the best engineers, extremely expert labour and information sharing.

“May the US make chips and create jobs?” asks Mr Einstein. “Certain, however are they going to get chips all the way down to a nanometre? In all probability not.”

One cause is Trump’s immigration coverage, which may doubtlessly restrict the arrival of expert expertise from China and India.

“Even Elon Musk has had an immigration downside with Tesla engineers,” says Mr Einstein, referring to Musk’s assist for the US’s H-1B visa programme that brings expert staff to the US.

“That is a bottleneck and there is nothing they’ll do, until they alter their stance on immigration solely. You possibly can’t simply magic PhDs out of nowhere.”

The worldwide knock-on impact

Even so, Trump has doubled down on tariffs, ordering a nationwide safety commerce investigation into the semiconductor sector.

“It is a wrench within the machine – a giant wrench,” says Mr Einstein. “Japan for instance was basing its financial revitalisation on semiconductors and tariffs weren’t within the marketing strategy.”

The longer-term impression on the business, based on Mr Miller, is prone to be a renewed deal with home manufacturing in most of the world’s key economies: China, Europe, the US.

Some firms may search for new markets. Chinese language expertise large Huawei, for instance, expanded into Europe and rising markets together with Thailand, the UAE, Saudi Arabia, Malaysia and lots of nations in Africa within the face of export controls and tariffs, though the margins in creating nations are small.

“China finally will need to win – it has to innovate and spend money on R&D. Take a look at what it did with Deepseek,” says Mr Einstein, referring to the China-built AI chatbot.

“In the event that they construct higher chips, everybody goes to go to them. Value-effectiveness is one thing they’ll do now, and looking out ahead, it is the ultra-high-tech fabrication.”

Within the meantime, new manufacturing hubs might emerge. India has a variety of promise, based on specialists who say there may be extra probability of it changing into built-in into the chip provide chain than the US – it is geographically nearer, labour is affordable and training is sweet.

India has signalled a willingness that it’s open to chip manufacturing, but it surely faces quite a lot of challenges, together with land acquisition for factories, and water – chip manufacturing wants the best high quality water and a variety of it.

Bargaining chips

Chip firms aren’t fully on the mercy of tariffs. The sheer reliance and demand for chips from main US firms like Microsoft, Apple and Cisco may apply strain on Trump to reverse any levies on the chip sector.

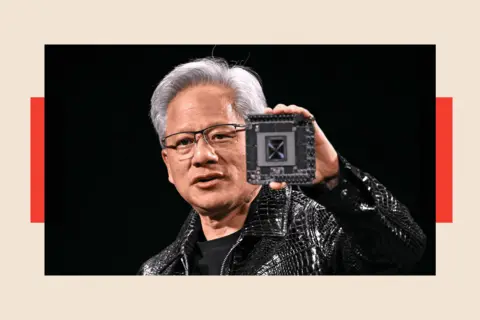

Some insiders imagine intense lobbying by Apple CEO Tim Cook dinner secured the exemptions to smartphone, laptop computer and digital tariffs, and Trump reportedly lifted a ban on the chips Nvidia can promote to China on account of lobbying.

Requested particularly about Apple merchandise on Monday within the Oval Workplace, Trump stated, “I am a really versatile individual,” including that “there can be perhaps issues developing, I converse to Tim Cook dinner, I helped Tim Cook dinner lately.”

Getty Photographs

Getty PhotographsMr Einstein thinks all of it comes all the way down to Trump finally making an attempt to make a deal – he and his administration know they cannot simply construct an even bigger constructing in terms of chips.

“I feel what the Trump administration is making an attempt to do is what it has carried out with TikTok’s proprietor Bytedance. He’s saying I am not going to allow you to function within the US anymore until you give Oracle or one other US firm a stake,” says Mr Einstein.

“I feel they’re making an attempt to fandangle one thing comparable right here – TSMC is not going wherever, let’s simply power them to do a cope with Intel and take a slice of the pie.”

However the blueprint of the Asia semiconductor ecosystem has a precious lesson: nobody nation can function a chip business by itself, and if you wish to make superior semiconductors, effectively and at scale – it should take time.

Trump is making an attempt to create a chip business by means of protectionism and isolation, when what allowed the chip business to emerge all through Asia is the alternative: collaboration in a globalised economic system.

BBC InDepth is the brand new residence on the web site and app for one of the best evaluation and experience from our high journalists. Below a particular new model, we’ll convey you contemporary views that problem assumptions, and deep reporting on the most important points that can assist you make sense of a fancy world. And we’ll be showcasing thought-provoking content material from throughout BBC Sounds and iPlayer too. We’re beginning small however considering large, and we need to know what you assume – you may ship us your suggestions by clicking on the button beneath.