Final yr, Cody Finke obtained game-changing information from the Division of Vitality (DOE): his climate tech startup was in line for a $189 million grant to assist construct its first commercial-scale plant. The corporate, Brimstone, has developed a brand new approach to make cement—one of many largest sources of carbon emissions on the planet.

The startup additionally makes smelter-grade alumina, a crucial mineral that the U.S. presently imports. The crew spent months going via the DOE’s grueling analysis course of, from a 200-page utility to a three-hour-long interview in entrance of a panel of 30 technical consultants. After the DOE moved the undertaking ahead, months of negotiations adopted. The grant was finalized in January, simply earlier than the inauguration. Then got here the Trump administration.

This summer time, the DOE introduced that it was pulling the funding, together with grants for greater than 20 different tasks engaged on industrial decarbonization and carbon seize. Brimstone is interesting the choice, since producing crucial minerals within the U.S. is a precedence for Trump. However the firm can also be transferring ahead with its plans to construct its plant no matter what occurs with the federal government funding.

“Our perception has been from the start that our know-how has to work with out subsidies,” Finke says. “And if it doesn’t work with out subsidies, then it in all probability isn’t going to have the impression we wish.”

Tech constructed for the underside line—not simply carbon cuts

Brimstone’s know-how tackles an trade that’s notoriously onerous to decarbonize. Cement manufacturing is accountable for round 8% of world CO2 emissions, or 3 times as a lot because the airline trade. That’s not simply due to the vitality it takes to make cement, however due to chemistry: Typical Portland cement is made by heating up limestone, and that course of releases CO2 from the rocks.

The startup makes use of silicate rocks as a substitute, similar to basalt, which don’t launch CO2. If the brand new course of runs on renewable vitality, the result’s zero-carbon cement. If it makes use of the combination of vitality on the grid, the emissions discount might nonetheless be as a lot as 75%. If it may be extensively scaled up within the trade—which produces greater than 4 billion tons of cement annually for every little thing from roads and bridges to properties—it might make a big dent in world emissions.

From the start, when Finke first began creating the concept along with his cofounder as a grad scholar at Caltech in 2019, he calculated what might make it economically viable. The brand new course of had a basic benefit—as a substitute of constructing CO2 as a byproduct, it makes invaluable supplies that may be offered.

Useful byproducts

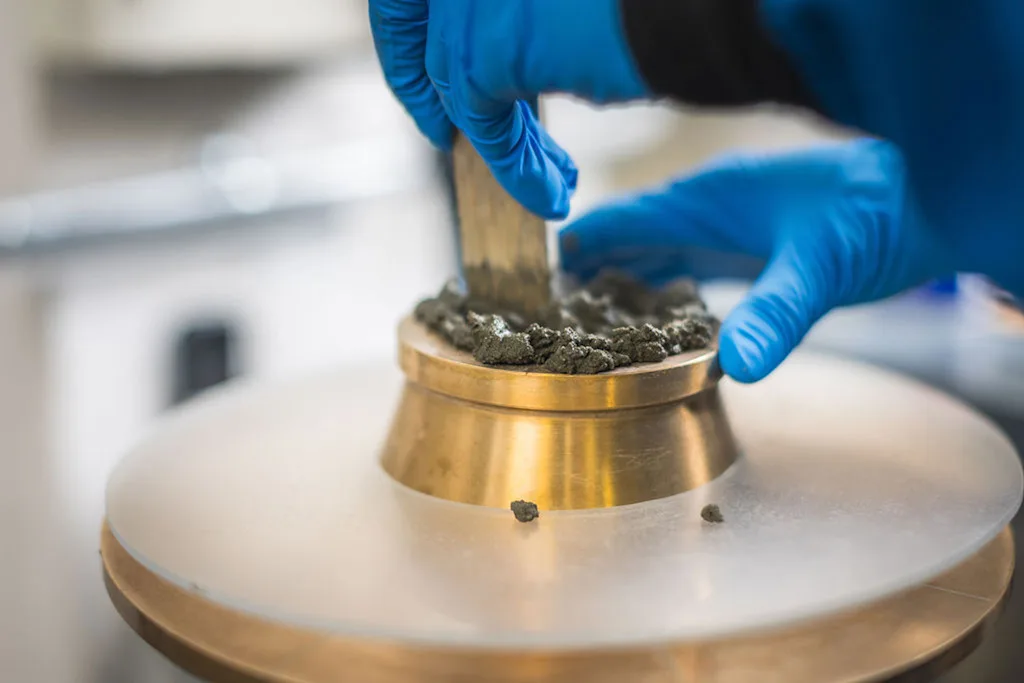

The primary plant will mine rocks which are particularly excessive in alumina, which can be utilized to make aluminum. The method is pretty simple. The corporate crushes the rocks into particles, after which makes use of chemical substances to extract calcium for making cement. (The calcium is heated up, after which milled with gypsum.) Different residue turns into the SCM (supplementary cementitious supplies), one other product that’s used to make cement. Aluminum compounds are extracted individually.

By making and promoting multiple product from the identical rock, all the merchandise—together with the low-carbon cement—may be cost-competitive after they’re produced at an industrial scale. The method is inherently extra environment friendly. Proper now, different firms make cement, alumina, and SCM individually, and begin every course of by mining and grinding rock.

“It’s three separate situations of mining and grinding,” Finke says. “Now we have one occasion of mining and grinding, which signifies that we solely need to develop a rock with a single quarry. We solely need to have a single piece of apparatus, and that piece of apparatus may be bigger, after which subsequently profit from economies of scale.” The corporate will mine seven instances much less rock for its merchandise than the usual processes in the present day.

Robust demand

Whereas another firms are making low-carbon options to cement, Brimstone needed to make atypical Portland cement—the usual product already in use within the constructing trade. Brimstone’s cement meets ASTM Worldwide’s requirements for Portland cement. It’s precisely as robust and sturdy and able to dealing with excessive temperatures or chemical exposures. The SCM and alumina are additionally the identical as what’s already available on the market.

“We make the very same merchandise,” Finke says. “Since these are all structural supplies, we expect that’s actually vital—nobody needs to take a threat on structural elements.”

Massive prospects already need to purchase it. Amazon, for instance, not too long ago introduced plans to order volumes of the cement and SCM from the upcoming plant. The tech large not too long ago went via rounds of third-party exams of the supplies, proving that it met necessities for energy and different components. Amazon has additionally invested within the startup via its Local weather Pledge Fund.

Because the first plant might be an indication plant, the preliminary value of the merchandise might be greater, however firms like Amazon are keen to pay a premium. There’s robust demand, whilst some firms are actually much less vocal about local weather targets.

“There are particular firms that care deeply about inexperienced attributes, and there are specific firms that don’t,” says Finke. “I believe that the variety of firms have modified considerably, however the variety of significant firms has not likely modified. We see that steadiness.”

A cautious funding technique

Brimstone has raised greater than $80 million thus far from traders together with Invoice Gates’s Breakthrough Vitality Ventures. Because the crew raised cash, it by no means counted on the inevitability of presidency grants.

“These subsidies are kind of on the political whims of anybody occasion, and we don’t need our know-how to be [subject to] political whims,” Finke says. “We need to have a strong financial footing. And that signifies that we have to have a fundraising technique that doesn’t depend subsidies till the {dollars} are in our checking account.”

The DOE cash was reimbursement-based, so funds would have been given out when the undertaking hit sure milestones. It was additionally centered on funding for the ultimate phases of constructing the plant.

As a result of the corporate hadn’t counted on that funding, it has cash out there now to proceed engaged on the undertaking. The corporate not too long ago introduced that it was partnering with a quarry in Oklahoma, Dolese Bros., after evaluating 23,000 totally different quarries throughout the nation. The placement of the brand new plant, referred to as the Rock Refinery, is being finalized now. It plans to start operations by the tip of the last decade.

Trying forward

The corporate isn’t disclosing its fundraising technique, although it says it has traders in place to assist it proceed constructing. After all, the grant might have helped the corporate transfer even sooner.

The corporate’s coverage crew continues to work on its attraction for the grant. “Smelter-grade aluminum is a crucial materials that america can’t make,” Finke says. “The Trump administration may be very focused on crucial supplies. And what we prefer to say is that if the Trump administration put out a grant for crucial supplies, we’d have utilized to that grant—principally the very same undertaking.”

However the attraction course of isn’t delaying the present work to construct the plant and plan for future progress. “Subsidies would assist our prices, completely,” Finke says. “But when it’s essential to have these subsidies, it’s not more likely to scale globally.”