Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

To conduct our first-ever actual property agent survey, ResiClub partnered with Zoodealio, a cash-offer platform and iBuyer-management software program designed for actual property brokers. Among the many 238 brokers who took the survey, half (50%) have been actual property brokers for 15 years or extra.

The Zoodealio-ResiClub Actual Property Agent Survey was fielded between July 28 and August 24, 2025. Respondents included actual property brokers spanning all areas of the U.S., giving us a ground-level view of purchaser urgency, vendor motivation, leverage shifts, fee constructions, and expectations for the subsequent 12 months.

Right here’s what the outcomes revealed.

Consumers are gaining energy

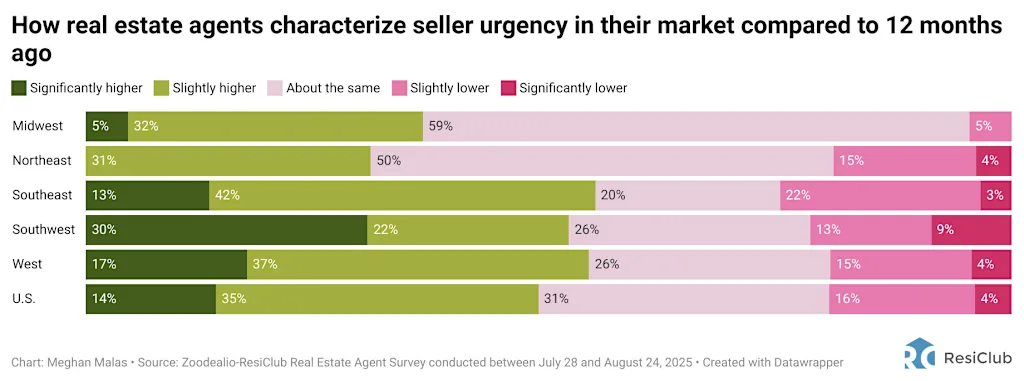

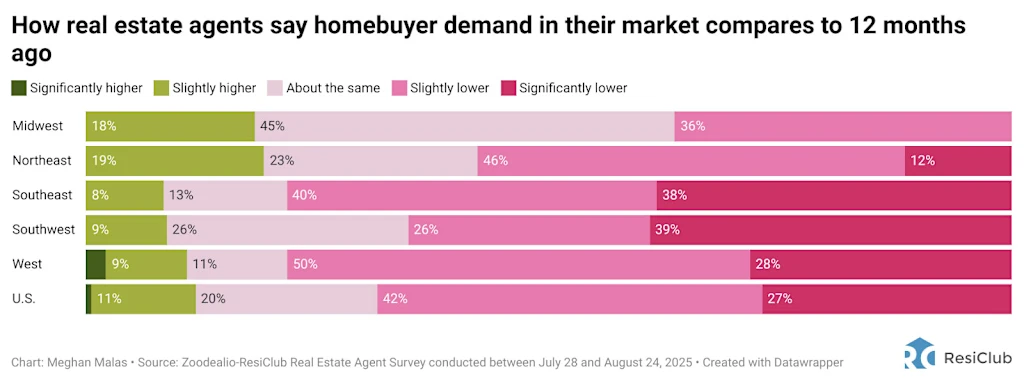

Brokers report that purchaser urgency of their native market has cooled off in contrast with a 12 months in the past, whereas sellers have develop into extra pressing. Within the Southeast, Southwest, and West, brokers say vendor urgency is selecting up essentially the most, whereas Midwest and Northeast sellers are steadier.

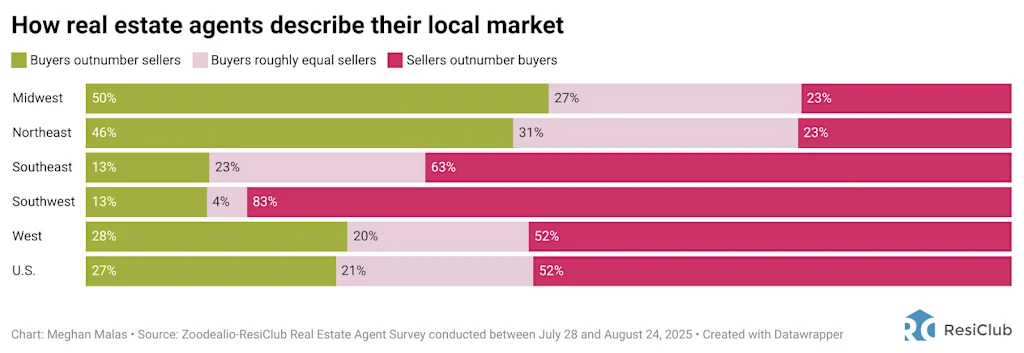

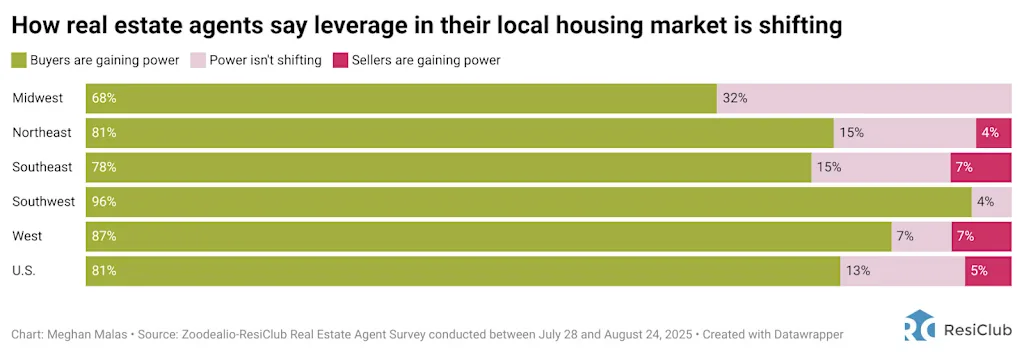

Many brokers describe their native markets as extra balanced, with leverage tilting again towards patrons as stock builds. Purchaser energy is especially robust throughout markets within the Southwest, with 96% of brokers surveyed within the area reporting patrons gaining leverage of their native market over the previous 12 months.

Wanting forward: Agent expectations for shoppers and residential costs

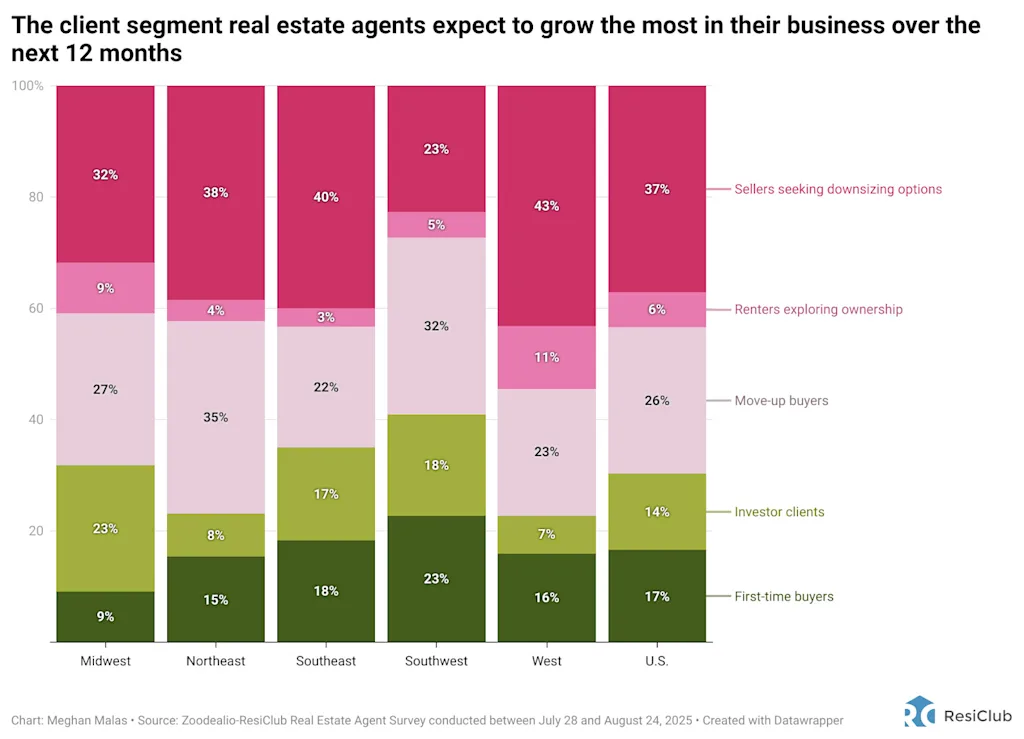

When requested who they anticipate to drive enterprise progress over the subsequent 12 months, brokers pointed to sellers looking for downsizing choices. This progress is probably downstream of in the present day’s strained housing affordability and growing old demographics.

Brokers additionally anticipate the move-up purchaser class to develop.

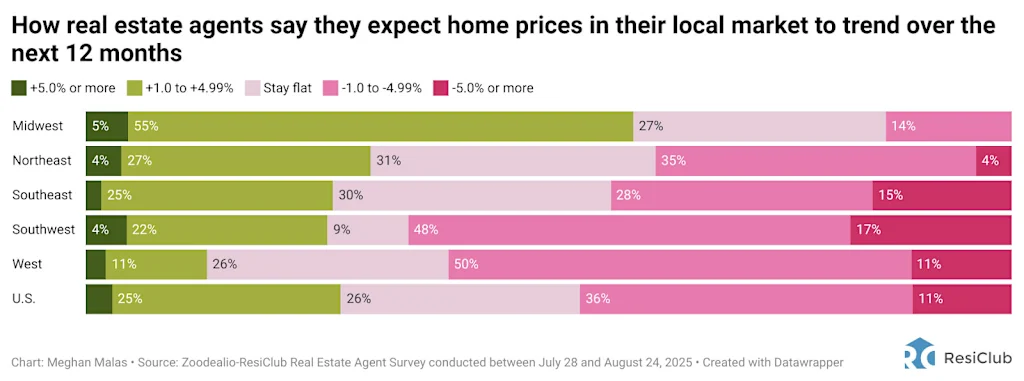

On a relative foundation, brokers within the Midwest are barely extra bullish about native dwelling costs over the subsequent 12 months. In distinction, many brokers within the Southeast, Southwest, and West anticipate slight dwelling worth declines—and even notable drops—over the subsequent 12 months as affordability pressures proceed to squeeze.

Nationwide perspective on mortgage charges and NAR

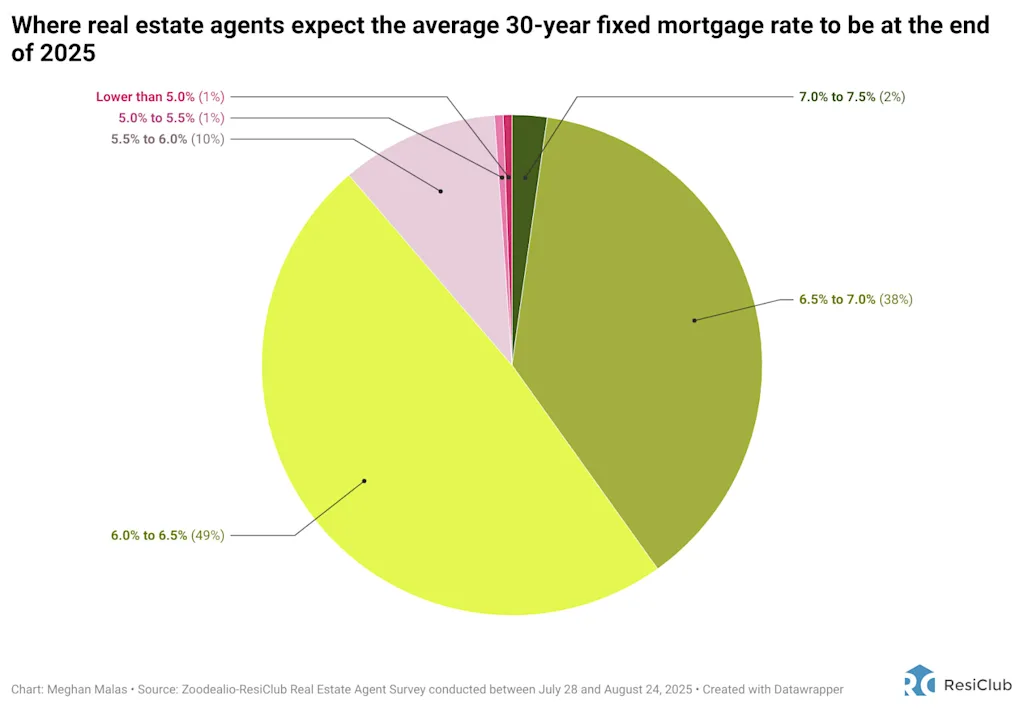

On mortgage charges, almost half of our surveyed brokers (49%) anticipate the common 30-year mounted mortgage fee will end 2025 within the 6% to six.5% vary—decrease than in the present day however nonetheless nicely above the pandemic lows. Greater than a 3rd of respondents (38%) nonetheless assume the common 30-year mounted mortgage fee will probably be within the 6.5% to 7% vary.

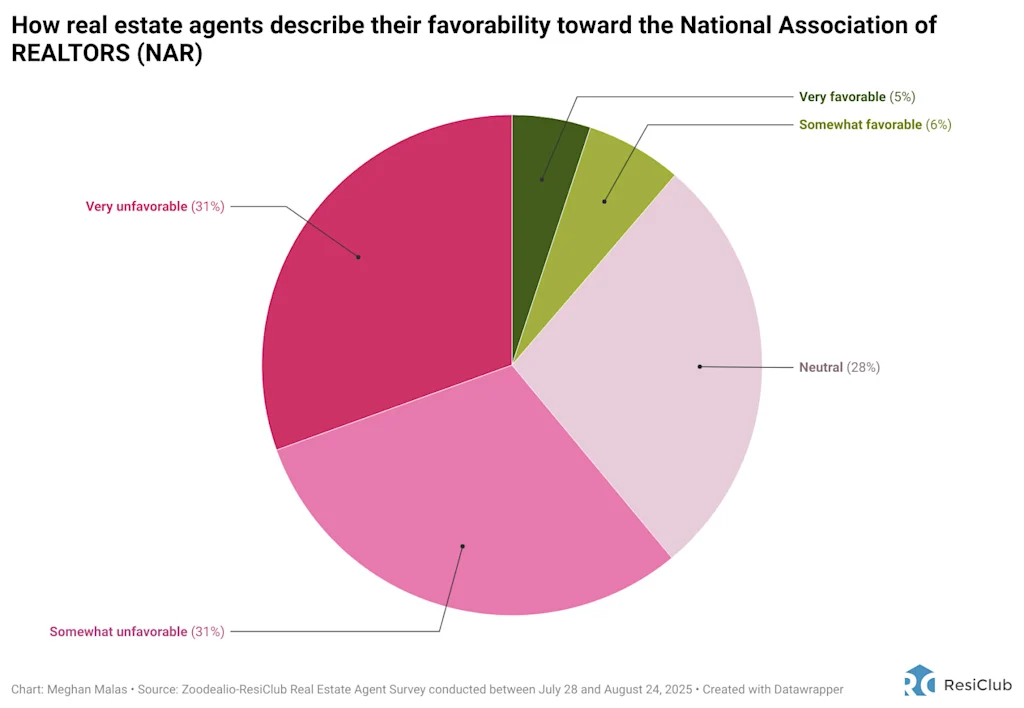

In terms of the Nationwide Affiliation of Realtors (NAR), sentiment skews detrimental: 31% describe their view as very unfavorable, one other 31% considerably unfavorable, and 28% impartial. Solely a small minority of surveyed brokers expressed a good opinion of the group.

Bluntly put, NAR has a picture drawback.

Commissions

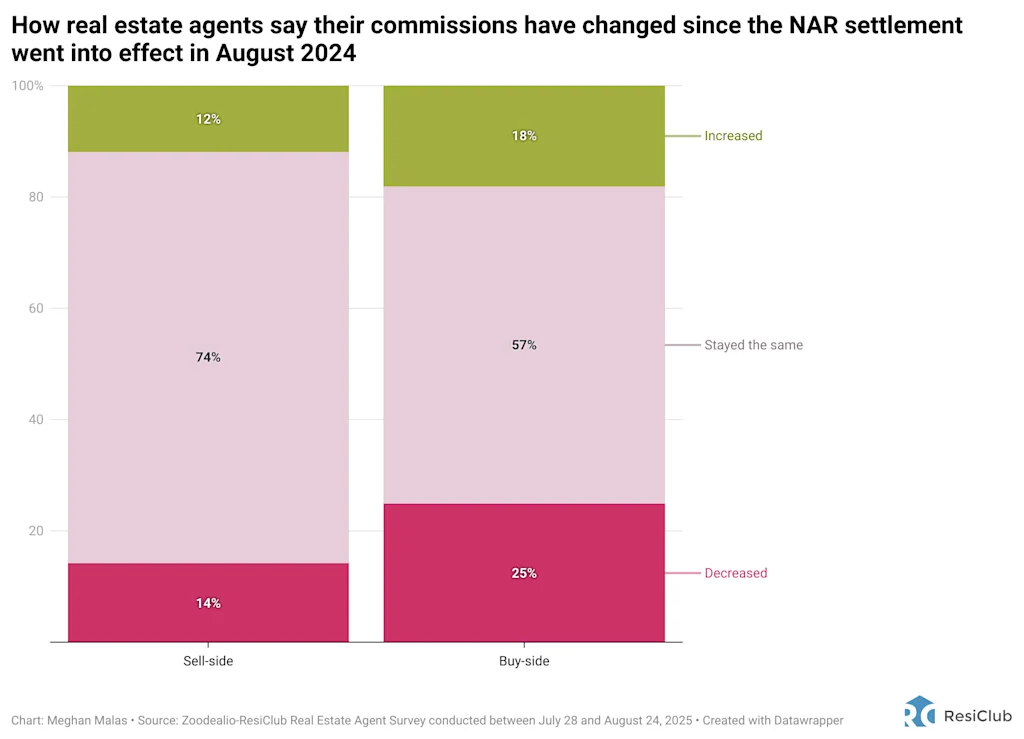

After the March 2024 Nationwide Affiliation of Realtors settlement, many anticipated commissions to drop sharply. Our survey exhibits some change on that entrance—however not a significant one.

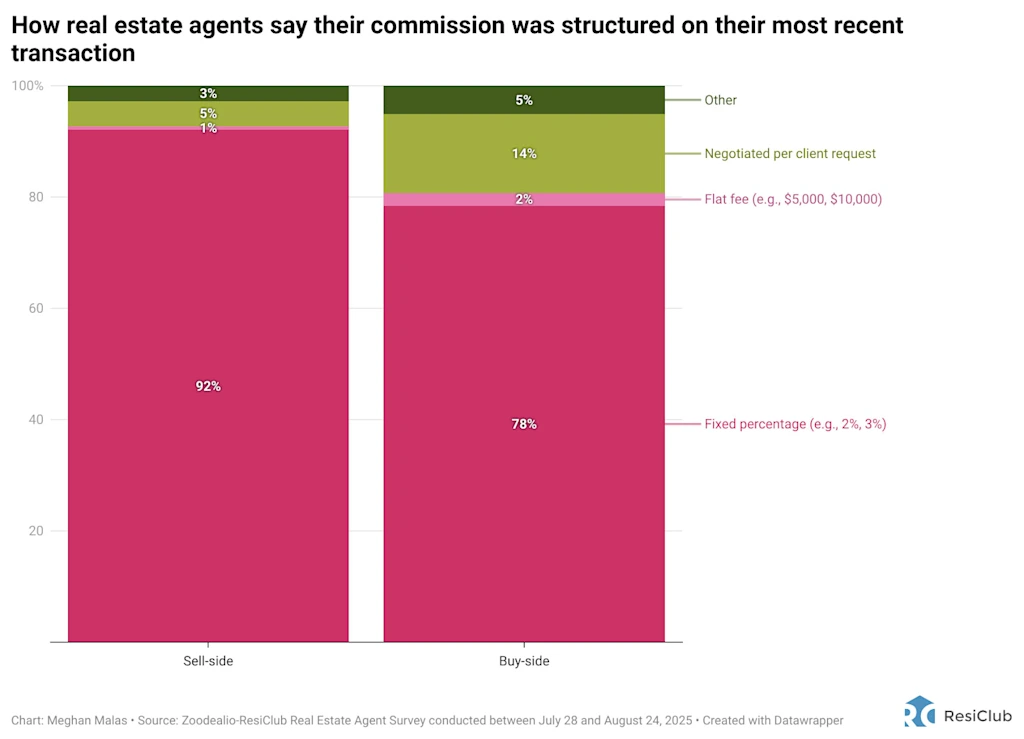

On the sell-side, a dominant 92% of brokers say their most up-to-date fee was a set share, in contrast with 78% on the buy-side. Practically 1 in 5 buy-side offers now contain both a flat payment, client-negotiated mannequin, or different type of fee.

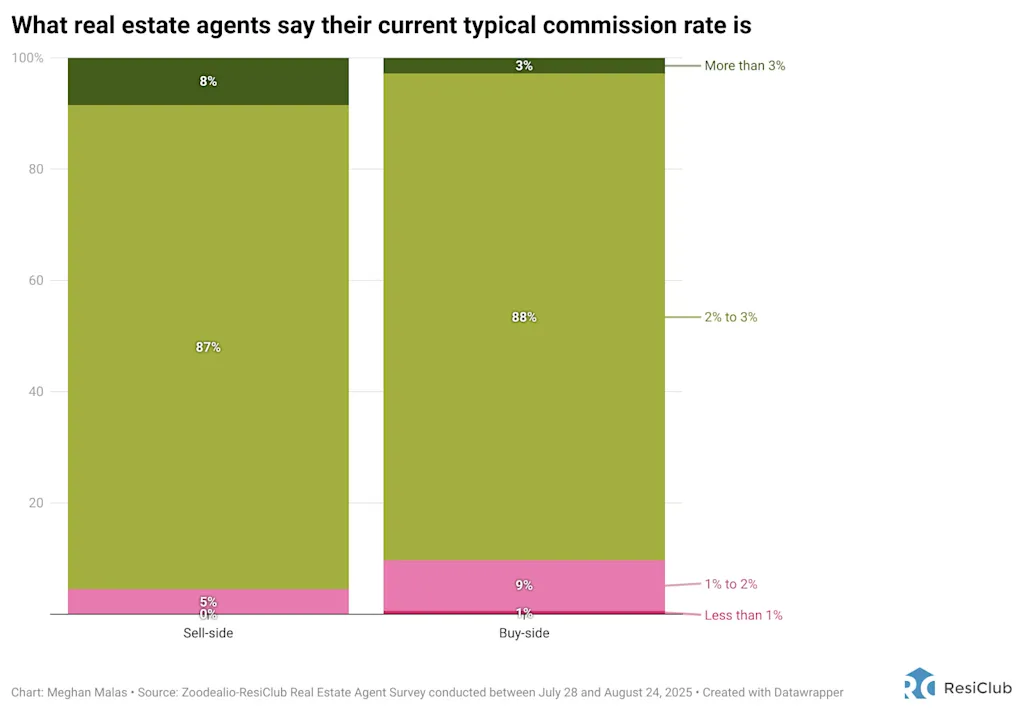

Moreover, nearly all of brokers stay within the conventional 2% to three% fee ballpark: 87% of sell-side brokers and 78% of buy-side brokers report their typical commissions fall inside that band.

Huge Image

The Zoodealio-ResiClub survey outcomes present a housing market wherein purchaser urgency is cooling, sellers are rising extra motivated, and leverage is shifting again towards patrons. Within the subsequent 12 months, brokers anticipate essentially the most shopper phase progress from downsizers and move-up patrons. In addition they predict modest dwelling worth features within the Northeast and Midwest; softer developments within the Southeast, Southwest, and West; and mortgage charges ending 2025 between 6% and seven%.

Publish-2024 settlement, sentiment towards NAR is essentially unfavorable, whereas commissions stay pretty steady.