Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

In the course of the pandemic housing growth, housing demand surged quickly amid ultralow rates of interest, stimulus, and the distant work growth. Federal Reserve researchers estimate “new development would have needed to improve by roughly 300% to soak up the pandemic-era surge in demand.”

In contrast to housing demand, housing stock isn’t as elastic and may’t shortly ramp up. Because of this, the heightened demand drained the market of lively stock and induced house costs to overheat, with U.S. home prices in June 2022 sitting a staggering 43.2% above March 2020 ranges.

Since that nationwide growth led to mid-2022, the housing market has been transferring by means of a cyclical cooling part and present process a interval of recalibration and normalization after such a big burst.

Look no additional than the share of U.S. houses that offered beneath their unique listing worth, by 12 months, in response to a new Redfin report:

- 2018 —> 62%

- 2019 —> 64%

- 2020 —> 55%

- 2021 —> 38%

- 2022 —> 42%

- 2023 —> 54%

- 2024 —> 58%

- 2025 —> 62%

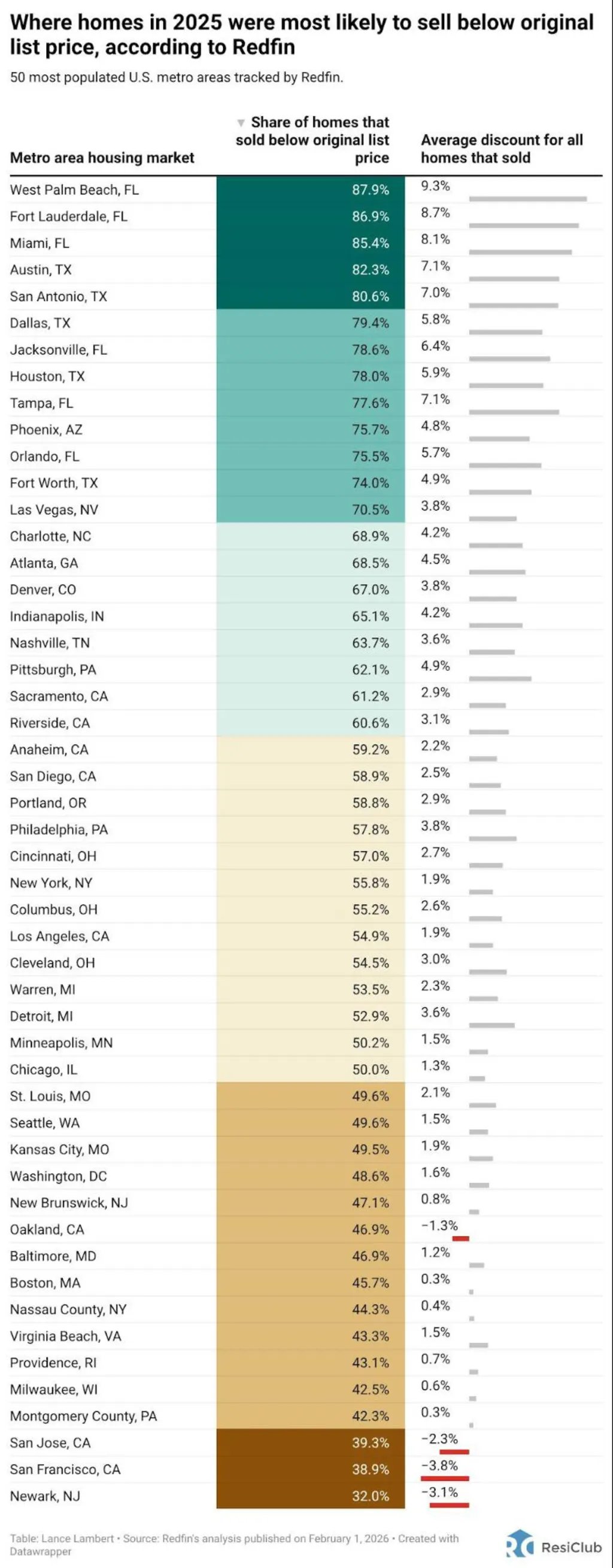

The share of houses promoting beneath their unique listing worth varies by area. Many Solar Belt pandemic-boom markets—significantly throughout Florida and Texas—are seeing the very best prevalence of houses promoting beneath their preliminary ask.

Against this, many Northeast and Midwest metros stay, comparatively talking, extra resilient, with fewer than half of houses promoting beneath listing worth in a number of markets. Elements of San Francisco and San Jose have regained a little bit of mojo amid the AI growth.

window.addEventListener(“message”,perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.model.top=d}}});

“Some sellers are recognizing the market has modified, and others will not be. I’ve one vendor who overpaid for his or her house just a few years in the past and needs to listing it at $950,000. The issue is, current comps name for an inventory worth of $825,000,” writes Connie Durnal, a Redfin Premier actual property agent in Dallas. “I’ve one other vendor who paid $400,000 for his or her house however was keen to listing it at $385,000, which was an incredible technique. As a result of the house was pretty priced, it bought a number of provides and offered for $10,000 over the asking worth.”

Redfin’s evaluation is predicated on annual MLS information evaluating unique listing costs with last sale costs. The agency didn’t publish information for each metro.