Know-how reporter

Getty Photos

Getty PhotosNatWest has apologised after prospects had been left unable to make use of its cell banking app within the UK, stopping some from accessing their financial institution accounts.

Greater than 3,000 folks have reported issues on outage-checking web site Downdetector because the points first emerged at 0910 GMT.

The agency stated on its service standing web site that its on-line banking service was nonetheless working usually – although this has been disputed by some prospects. Card funds are unaffected.

“We’re conscious that prospects are experiencing difficulties accessing the NatWest cell banking app this morning,” a NatWest spokesperson advised the BBC.

“We’re actually sorry about this and dealing to repair it as rapidly as potential.”

BBC/NatWest

BBC/NatWestProspects have taken to social media to complain concerning the impression the IT failure is having on them.

One particular person stated they needed to “put again my buying due to it”, whereas one other stated they had been “ready to buy groceries” however could not switch cash to take action.

NatWest has suggested prospects on social media that it has “no timeframe” for a repair, however stated its workforce is “working exhausting” to resolve it.

Prospects are being suggested to entry their accounts in different methods if they’ll – comparable to via on-line banking.

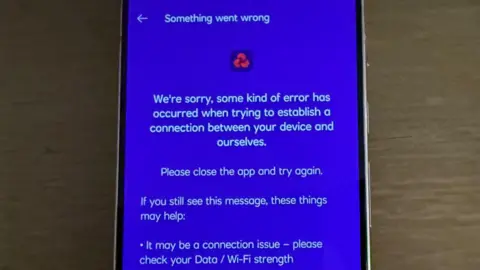

Nevertheless, some folks have reported issues with NatWest’s on-line service too, with one sharing an error message which they stated was displayed after they tried to make a cost.

Others have expressed frustration with the financial institution’s response, with one saying it was “disgraceful” there was no timeframe, whereas one other referred to as it “very poor service“.

“What I do not get is the financial institution closes a great deal of branches ‘to save cash’ and forcing folks to depend on the app and on-line banking… however clearly hasn’t invested in a system that works correctly,” one angry customer said.

A recurring downside

That is the most recent in an extended line of banking outages.

In May, a number of major banks disclosed that 1.2m folks had been affected by them within the UK in 2024.

According to a report in March, 9 main banks and constructing societies have had round 803 hours – the equal of 33 days – of tech outages since 2023.

Inconvenient for patrons, outages come at a price to the banks, too.

The Commons Treasury Committee discovered Barclays might face compensation funds of £12.5m over outages since 2023.

Over the identical interval, Natwest has paid £348,000, HSBC has paid £232,697, and Lloyds has paid £160,000.

Different banks have paid smaller sums.