Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Mortgage big Rocket Firms—the guardian firm of Rocket Mortgage, previously often called Quicken Loans—announced on Monday it has entered into an agreement to buy Redfin in an all-stock transaction valued at $1.75 billion fairness, or $12.50 per share. If accomplished, the transfer would combine Redfin’s actual property search platform, which attracts almost 50 million month-to-month guests, with Rocket’s mortgage providers.

“Redfin is understood for its stunning product however can be [a] information powerhouse in an AI-driven world—100 million properties, 50 million engaged month-to-month customers, 1000’s of the superb actual property brokers and 4 petabytes of information,” Rocket Firms CEO Varun Krishna wrote on LinkedIn on Monday. “Rocket has developed a platform that spans 40 years of mortgage experience and a digital nationwide lending platform, throughout 3,000 counties and parishes. Redfin and Rocket are a tremendous match for one another.”

In accordance with the press launch, there are 4 advantages Rocket Firms sees from the Redfin acquisition:

First, it would introduce extra customers to the Rocket ecosystem. “Rocket Firms will profit from Redfin’s almost 50 million month-to-month guests, 1 million energetic buy and rental listings and workers of two,200+ actual property brokers throughout 42 states,” the corporate writes. Secondly, it expects that can drive development within the buy of its mortgages.

Third, the businesses 14 petabytes of mixed information will assist drive its AI and personalization know-how. “This information will strengthen Rocket’s AI fashions enabling simpler and extra customized and automatic shopper experiences,” Rocket writes.

Lastly, the corporate expects to attain “greater than $200 million in run-rate synergies by 2027, together with roughly $140 million in price synergies from rationalization of duplicative operations and different prices.” And it expects “greater than $60 million in income synergies from pairing the corporate’s financing shoppers with Redfin actual property brokers, and from driving shoppers working with Redfin brokers to Rocket’s mortgage, title, and servicing choices.”

In different phrases, Rocket Firms seems to be making a strategic transfer to develop its market share by integrating Redfin’s buyer funnel with its mortgage enterprise and construct a powerhouse in residential actual property, making a one-stop store for homebuyers.

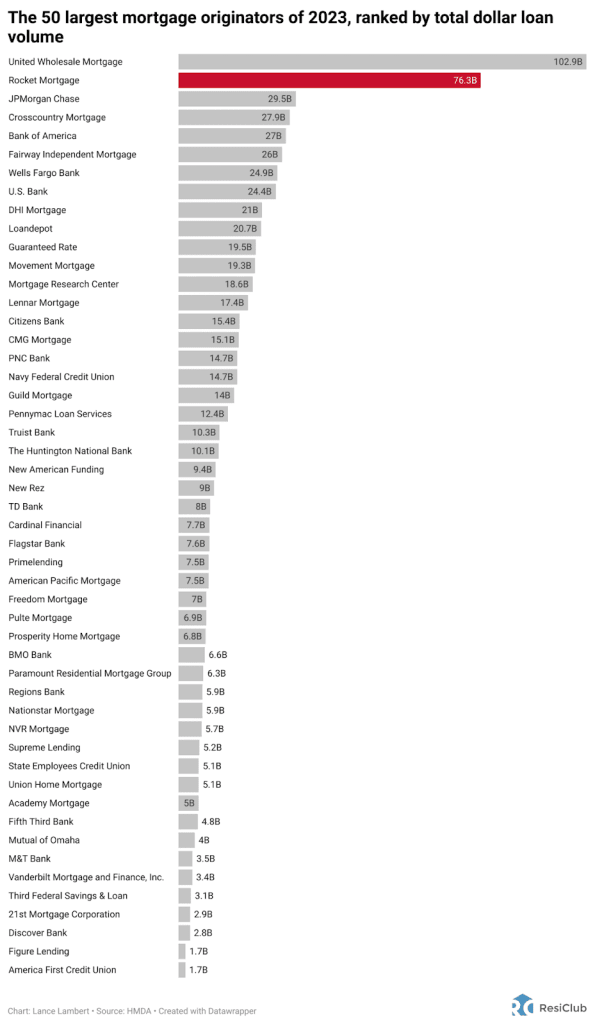

“Whereas Rocket Mortgage elevated its buy mortgage market share by 8% from 2023 to 2024, it nonetheless pales compared to crosstown rival UWM [United Wholesale Mortgage],” Colin Robertson, the founding father of The Truth About Mortgage, tells ResiClub. “Their tie-up with Redfin offers them the potential to seize 1 in 6 buy loans going ahead, which might see their market share quadruple from 4% to 16%+.”

The Rocket Firms’ proposed acquisition of Redfin comes throughout a chronic housing transaction downturn—marked by a pointy drop in current residence gross sales and refinancing—triggered by the 2022 mortgage price shock and strained affordability. The stoop has led to business upheaval, enterprise failures, and a wave of mergers.

Whereas each of those companies have been affected by the stoop, Redfin, particularly, has taken it on the chin.

At its peak in the course of the Pandemic Housing Increase, Rocket Firms had a $55.6 billion market capitalization—in comparison with its $26.6 billion market capitalization at enterprise shut at present. Whereas at its peak in the course of the Pandemic Housing Increase, Redfin had a $10 billion market capitalization—nicely above its $1.2 billion market capitalization at present.

Since mortgage charges spiked in 2022, Redfin has faced a continuous wave of layoffs, with 1,362 layoffs in 2022, 201 in 2023, 82 in 2024, and almost 500 already introduced in 2025.

Back in October 2022, Redfin CEO Glenn Kelman advised me that shuttering their iBuyer unit amid a then correcting market out West was inflicting Redfin to promote at huge losses. Kelman defined it like this: “We’re sitting on $350 million price of houses on the market that we purchased with our personal cash, or worse purchased with borrowed cash. And what we all the time advised buyers is that we might defend our stability sheet by appearing shortly. We don’t have hope as a method. We instantly began marking down issues… When the shiitake mushrooms hit the fan, [investors] wish to get out first. The way in which to do this is to determine the place the bottom sale is, and be 2% beneath that. And if it doesn’t promote within the first weekend, transfer it down [again].”

In November 2023, Kelman advised me that issues had been nonetheless slumped for the enterprise, including that current residence gross sales had been “principally useless as a doornail, so it couldn’t be worse.”

In August 2024, Kelman put Redfin’s scenario bluntly, telling analysts that the Plan B if mortgage charges didn’t come down was to “drink our personal urine or our opponents’ blood, keep within the foxhole.”

Click here to view an interactive model of the chart beneath.

“Once I took a glance one thing like 50% of Houses.com’s visitors is paid,” Amanda Orson, CEO and founding father of Galleon, tells ResiClub. “And that paid demo doesn’t depend their extraordinary advert spend on TV adverts. It’s simply not a sticky website. Redfin then again spends little or no and generates an absolute truckload of natural visitors. For now. That benefit isn’t everlasting, in fact. I can’t consider one other firm for whom the acquisition of Redfin would get a greater yield for its highest and greatest use than Rocket.”

Huge image: If the advantages of the Redfin acquisition come to fruition, it couldn’t solely cement Rocket Firms as the highest participant within the mortgage house (at the moment No. 2 by whole greenback mortgage quantity) but additionally additional lay the groundwork for the corporate to pursue its broader actual property ambitions—and even perhaps problem Zillow, which is working to construct a housing “Tremendous App.”